Gold maintains a moderate positive tone after soft US inflation

- Gold clings to moderate gains on Friday after softer-than-expected US PCE inflation figures.

- The US Dollar Index has extended its reversal from two-year highs following the release.

- XAU/USD remains under pressure, limited below $2,605

Gold (XAU/USD) is trading with a moderate positive tone on Friday following the sharp sell-off earlier this week. Cooler-than-expected US Personal Consumption Expenditures (PCE) Price Index data on Friday has increased selling pressure on the US Dollar, although the precious metal is struggling to put a significant distance from the one-month lows hit this week.

PCE Inflation has increased 0.1% in November, against expectations of a 0.2% increment. The yearly rate accelerated to 2.4% from the previous month's 2.3% reading, still below the 2.5% anticipated by the market consensus. Likewise, the Core PCE eased to 0.1% from 0.3% in October while the yearly inflation remained steady at 2,8% against market expectations of an uptick to 2.9%.

On Thursday, an upward revision to the third quarter’s US Gross Domestic Product (GDP), and the lower-than-expected Jobless claims have endorsed the Federal Reserve’s (Fed) hawkish stance for 2025.

Higher US yields, strong USD keep Gold recovery subdued

- XAU/USD is trading higher for the second consecutive day but lacks upside momentum, with traders reluctant to sell the US Dollar ahead of a key inflation report to be published at 13:30 GMT.

- US Treasury yields are steady above the 4.50% mark after having rallied 40 basis points over the last two weeks. This acts as a headwind for Gold as it is a non-interest-paying asset.

- Data released on Thursday showed that the US economy grew at a 3.1% annualized pace in the third quarter, significantly improving from the already healthy 2.8% advance previously estimated.

- Likewise, weekly Jobless Claims declined to 220K on the week ending December 13 from the previous week's 242K reading, beating expectations of a slower decline to 230K.

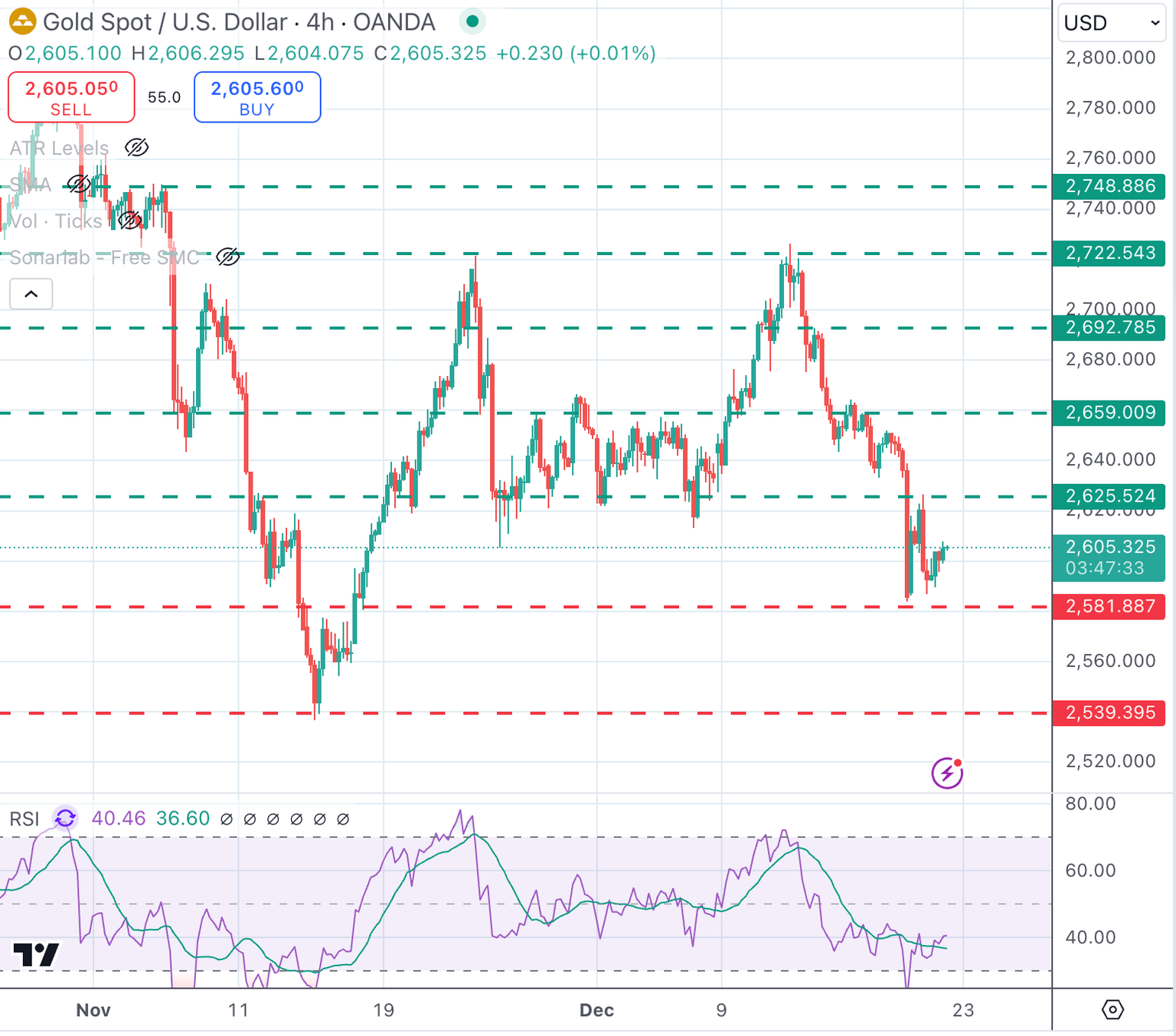

Technical analysis: XAU/USD maintains a negative trend below $2,625

Gold is going through a corrective recovery from heavily oversold levels. The broader trend, however, remains bearish. The pair is struggling to find acceptance above $2,600 and the Relative Strength Index (RSI) in the 4-hour chart remains flat at levels below the 50 threshold, highlighting the bearish momentum.

Immediate resistance is at the $2,605 intra-day high, with the key resistance area to challenge the bearish trend at the $2,625-$2,630 area (November 28, December 2 lows). On the downside, supports are at Wednesday’s low at around $2,580, ahead of November’s trough at $2,540.

XAU/USD 4-Hour Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.