Gold trades just above major trendline after release of US inflation

- Gold has found support from a major trendline and paused its short-term downtrend.

- Gold had been selling off in November amid expectations of interest rates staying elevated in the US.

- US CPI inflation data for October came out in line with excpectations and had little impact on Gold price.

Gold (XAU/USD) trades just above $2,600 on Wednesday after the precious metal’s November sell-off to seven-week lows found technical support at a major trendline. Gold takes a breather as markets digest the release of key inflation data from the US, which showed the US Consumer Price Index (CPI) rising in line with expectations in October.

US headline CPI rose by 2.6% YoY from 2.4% in the previous month of September, in line with expectations. MoM headline CPI increased by 0.2% from 0.2% previously and the same expected.

US Core CPI, meanwhile, rose by 3.3% in October, from the same in the previous month and 3.3% forecast. On month it rose by 0.3% from the same previously and expected.

The US Federal Reserve (Fed) had been on course to slash interest rates because of declining inflation and concerns about a weakening labor market – and this drove Gold price to record highs in October, however, that all changed with the election of Donald Trump to the White House. Trump’s radical protectionism and “free market” economic policies are likely to drive inflation back up, according to experts, keeping interest rates high – a negative for Gold.

Gold ETF outflows, a factor in the recent decline

Gold price’s decline in November was partly driven by large outflows from US Exchange Traded Funds (ETF). These allow traders to purchase stocks in Gold without investors having to own bullion themselves. Gold ETFs shed around $809 million (12 tonnes) net in early November, driven by North American outflows and partially offset by Asian inflows, according to the World Gold Council (WGC) data.

Demand for Gold is also expected to decline in China, the world’s largest consumer of the yellow metal, amid an economic slowdown that is expected to accelerate as the US imposes higher tariffs on Chinese imports.

Gold is also falling due to competition from alternative assets such as Bitcoin (BTC), which is trading in the high $80,000s, close to all-time highs, because of expectations the Trump administration will relax crypto regulation.

US stocks are also rising as investors anticipate lower corporation tax and looser regulations, boosting company profits, and this might also be diverting funds away from the precious metal.

Gold generally rises as a result of investors seeking safety amid a rise in geopolitical risks. One such risk factor has been the Russia-Ukraine war, which Trump boasted he could bring an end to “in one day – 24 hours.” Still, this has not been the case in reality. Trump is said to have warned Russian President Vladimir Putin “not to escalate in Ukraine” in a telephone call. However, Putin does not appear to have heeded his advice, given reports of Russian casualties continuing to rise.

Another geopolitical hotspot is the Middle East, where the possibility of peace now looks less likely given Trump’s appointment of Former Arkansas Governor Mike Huckabee as Ambassador to Israel. Huckabee is a known Zionist and supporter of Israeli Prime Minister Benjamin Netanyahu. He has said he does not support a two-state solution to the Israeli-Palestinian problem and sees the West Bank as belonging to Israel. His appointment will probably embolden Israel and bring further bloodshed to the region. If tensions rise, it could drive safe-haven flows to Gold.

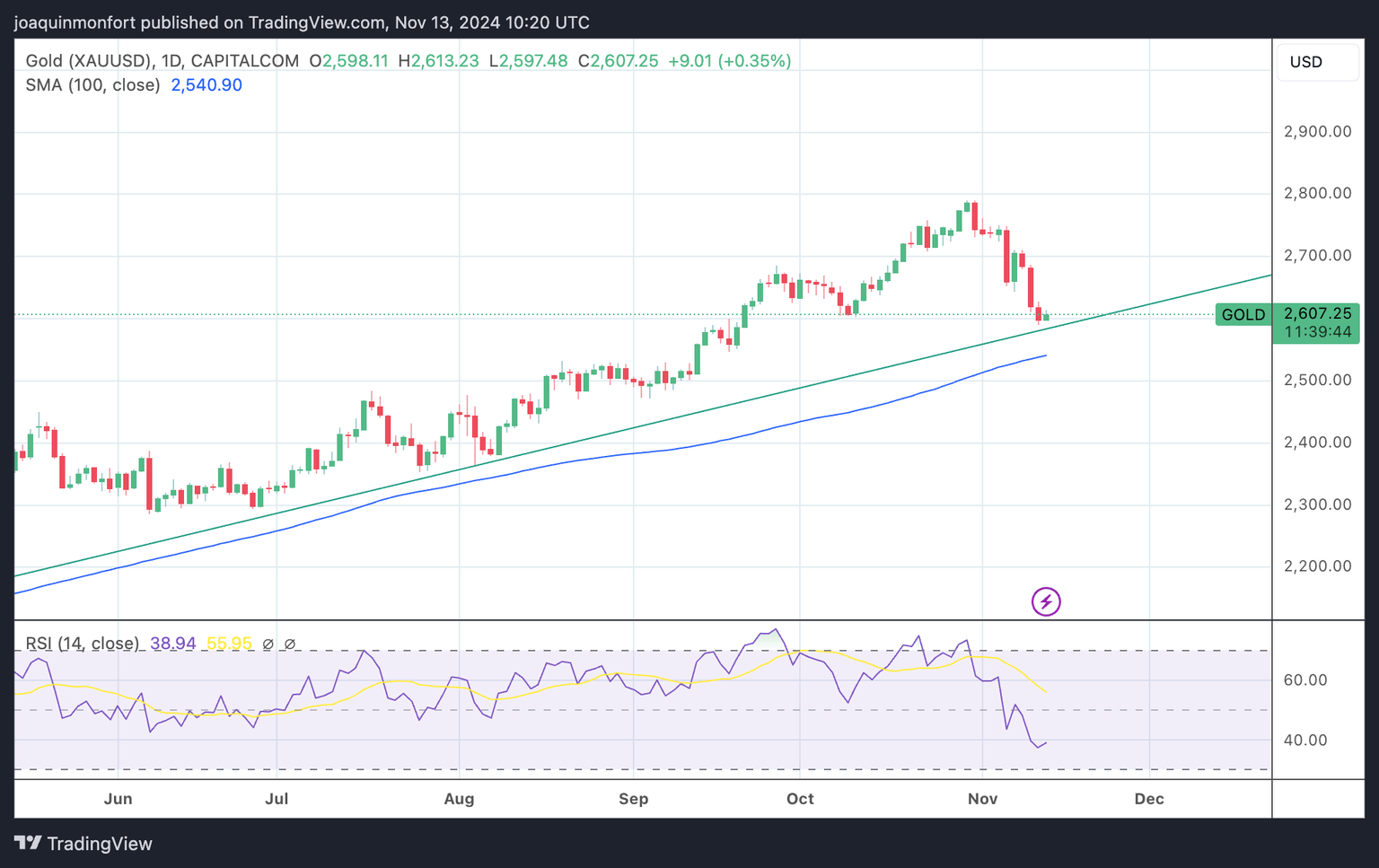

Technical Analysis: XAU/USD pauses at major trendline

According to technical analysis, the precious metal is now in a short-term downtrend, and, given it is a principle of technical analysis that “the trend is your friend,” the odds favor a continuation lower. However, Gold bounces off support from a major trendline for its long-term uptrend at around the $2,600 mark.

XAU/USD Daily Chart

A decisive break below the major trendline would confirm an extension of the short-term downtrend, probably to the next target at $2,540, the 100-day SMA and August highs.

A decisive break would be one accompanied by a longer-than-average red candle that pierced well below the trendline and closed near its low, or three red candles that broke clearly below the trendline.

However, the precious metal remains in an uptrend on a medium and long-term basis, giving the material risk of a reversal higher in line with these broader up cycles.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.