Gold maintains the upward pressure above $2,660, focus on China

- The increasing uncertainty in the Middle East and China’s purchases support Gold’s recovery.

- The US Dollar hesitates as strong US labour data did not curb hopes of further Fed interest-rate cuts next week.

- XAU/USD extends gains beyond the critical $2,665 price zone, needs to confirm channel breakout.

Gold price (XAU/USD) nudges higher on Monday’s early European session, favoured by its safe-aven status amid the increasing uncertainty in the Middle East after the fall of the Bashar al-Assad regime in Syria.

Beyond that, The People’s Bank of China (PBoC) announced over the weekend that it resumed Gold purchases in November after a six-month pause, which is giving an additional boost to the precious metal.

Data from the US released on Friday revealed that the country’s labour market remains solid, but the increasing unemployment rate confirmed expectations that the Federal Reserve (Fed) would cut rates by 25 bps next week. This, and a mild risk appetite, are keeping US Dollar upside attempts limited.

Daily digest market movers: Fed easing, geopolitical concerns and China boost Gold

- China’s Gold reserves increased by 160,000 ounces to 72.96 million ounces in November from 72.80 million ounces in November. This has boosted expectations of further Gold appreciation and is likely to underpin demand for the precious metal.

- On Friday, Nonfarm Payrolls (NFP) data showed that the US economy added 227,000 new jobs in November, beating expectations of a 200,000 increase.

- The Unemployment rate, however, ticked up to 4.2% from 4.1% in the previous month, which kept hopes of a Fed rate cut in December intact.

- The CME Group’s Fed Watch shows an 87% chance of a quarter-point rate cut by the Fed next week, up from less than 70% last week.

- The Benchmark 10-year Treasury yields are ticking up on Monday after losing about 20 basis points in the last two weeks. This has offset the positive impact of the Trump trade and is adding pressure on the US Dollar.

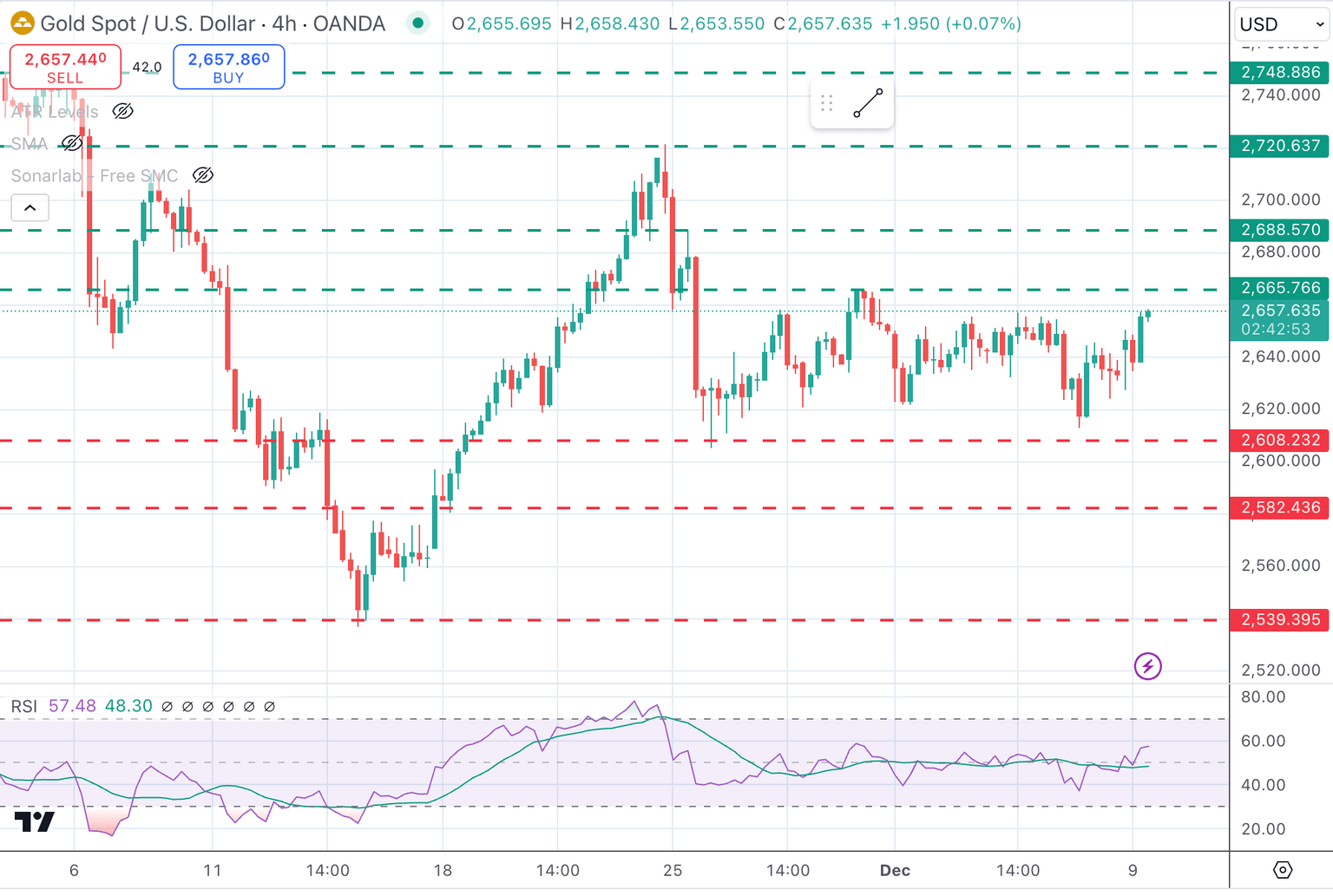

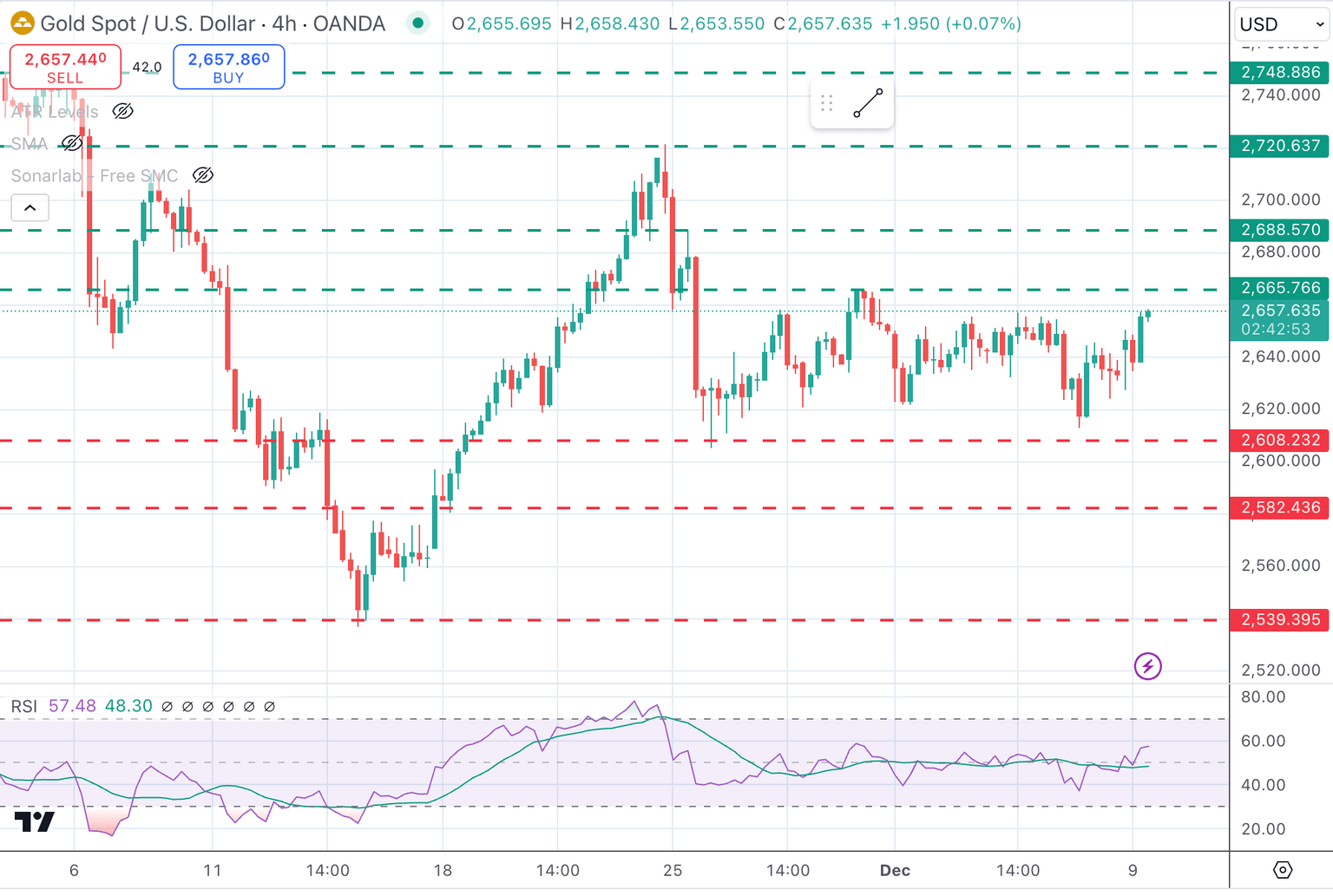

Technical analysis: XAU/USD defies the channel top at $2,665

Gold is showing an increasing bullish momentum on Monday as the positive trend from last week's lows gathers steam. With fundamentals in its favour, the pair is currently battling to confirm a bullish breakout of the top of the last two weeks’ channel at $2,665, trading a couple of $ above it.

Above here, the next target would be the $2,690 intra-day level, and the November 24 high, at $2,720. On the downside, the bottom of the mentioned channel is at $2,620. Below here, the next support is the November 25 low, at $2,605.

Gold 4-hour Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.