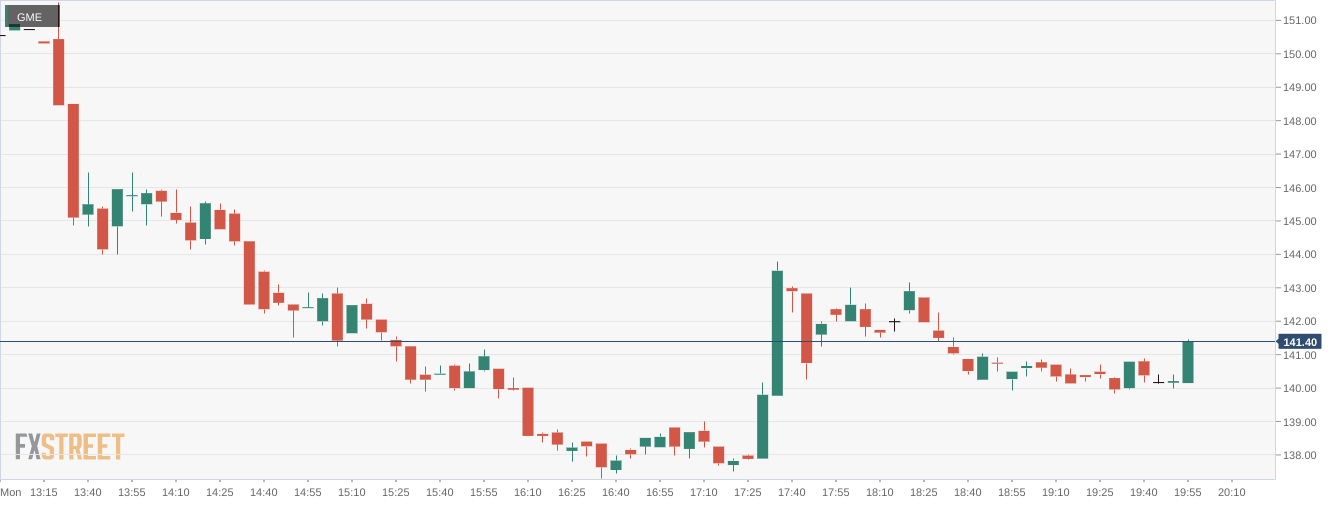

GME Stock Price: GameStop Corp sinks as markets pull back to start the week

- NYSE:GME fell by 6.17% during Monday’s trading session.

- Stock split momentum has faded but could pick up as other splits happen.

- Recent insider buying could be a positive sign for GameStop.

NYSE:GME kicked the week off on the back foot following the Easter long weekend, as market volatility continued to affect the major averages. On Monday, shares of GME dropped by 6.17% and closed the trading session at $141.46. It was another bleak start to the week as broader markets failed to find direction amidst growing concerns over more interest rate hikes by the Federal Reserve. This week also kicks off the first quarter earnings season for companies, and the true economic impact of the Russia-Ukraine war will be realized. On Monday, the Dow Jones dipped by 39 basis points, the S&P 500 fell by 0.02%, and the NASDAQ inched lower by 0.14%.

Stay up to speed with hot stocks' news!

It seems the stock split announcement for GameStop has lost its luster for investors. Considering the company will be voting on the decision at the annual shareholders meeting, which has yet to be decided, investors are likely weighing the risk reward of holding the volatile stock. Last year’s meeting took place in June, so it could be a while until we hear any more details on the proposed split. GameStop could see some sympathy reaction when larger companies like Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA) carry out their respective splits later this year.

GME stock forecast

There has been some notable insider buying as recently as the end of March for GameStop shares. Chairman Ryan Cohen and Director Larry Cheng bought 100,000 and 4,000 shares respectively. The old adage might ring true here: insiders sell the stock for a number of reasons but only buy the stock for one reason. Time will tell if Cohen and Cheng’s investments pay off.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet