GME Stock News: GameStop Corp climbs higher and starts the week on the right foot

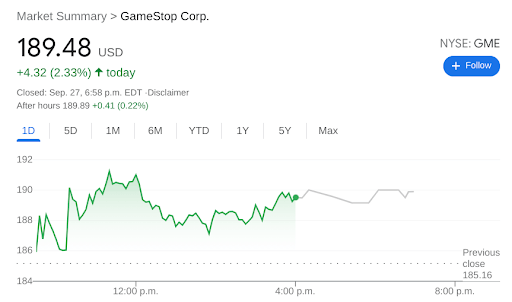

- NYSE:GME gained 2.33% during Monday’s session.

- The SEC is increasing its investigations into the GameStop squeeze.

- GameStop is approaching a decision point for the stock.

NYSE:GME is still dealing with the after effects of the short squeeze event from the beginning of the year as the SEC gets deeper into its investigations. Shares of GameStop gained 2.33% on Monday and closed the trading day at $189.48. It was a mixed day for both the broader markets and the meme stock sector, as the major indices were looking for direction for most of the session. Shares of ContextLogic (NASDAQ:WISH), Vinco Ventures (NASDAQ:BBIG), and Sundial Growers (NASDAQ:SNDL) were trading higher, while AMC (NYSE:AMC) and Greenidge Generation (NASDAQ:GREE) closed the day below water.

Stay up to speed with hot stocks' news!

The SEC investigation into the meme stock short squeezes from January and June continued as the government agency charged two traders for wash trading. Both individuals were able to make a profit off of market manipulation, and were investigated by the SEC Market Abuse Unit. Investors will recall that Roaring Kitty AKA Keith Gill was investigated earlier in the year, and news has just recently broke that Michael Burry who was the inspiration for the movie the Big Short has also been subpoenaed by the SEC for his involvement in GameStop. Needless to say, the ongoing saga is still far from being concluded.

GME stock forecast

Technically speaking, GameStop is fast approaching a decision point on its charts. The stock is currently trading below the key short-term levels of the 8-day and 21-day exponential moving averages, which is generally a bearish sign. Still, because of the volatility with GameStop, it is also trading above its 200-day moving average which is usually a bullish sign. Any further breakdown could see the stock break resistance at $189.00, while a bounce off that resistance could see shares return to around the $210.00 range.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet