Pound Sterling Price News and Forecast: GBP/USD could extend uptrend once it clears 1.3490-1.3500

GBP/USD Forecast: Pound Sterling could extend uptrend once it clears 1.3490-1.3500

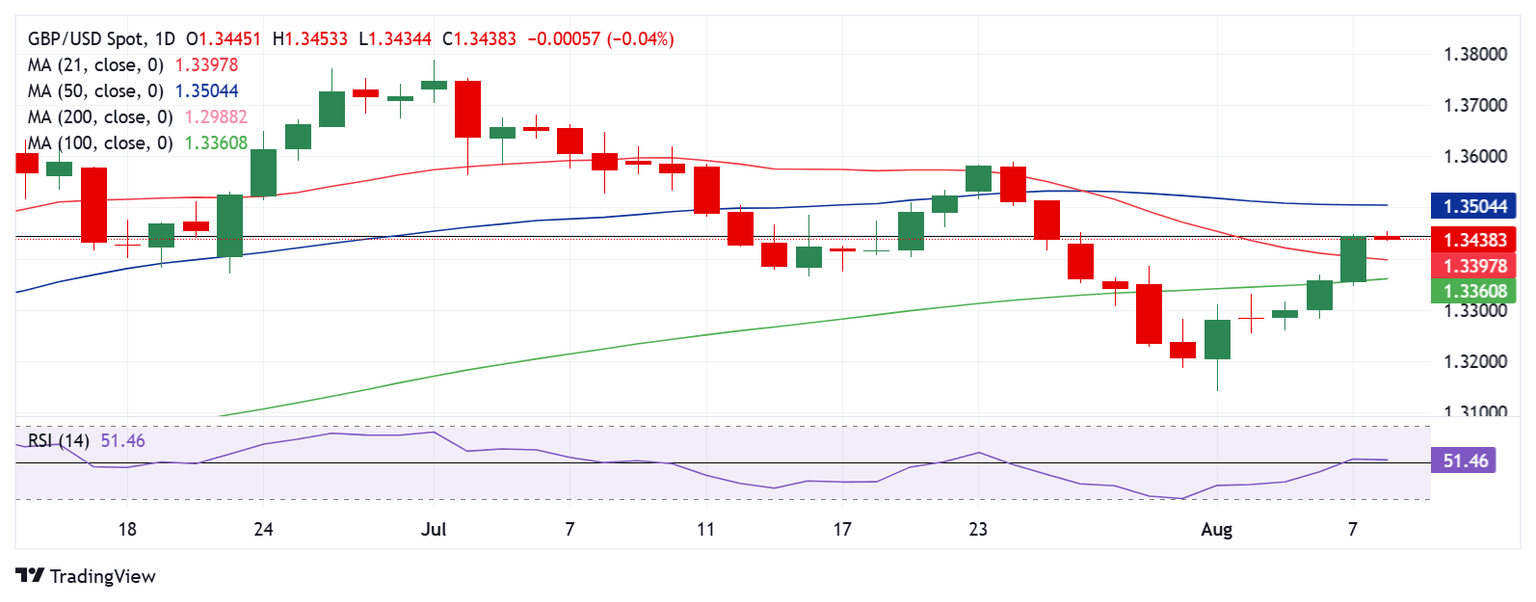

GBP/USD moves sideways above 1.3450 after gaining more than 1% in the previous week. The pair's technical outlook points to overbought conditions in the near term.

GBP/USD gathered bullish momentum in the second half of the previous week as Pound Sterling benefited from the Bank of England (BoE) hawkish rate cut. Speaking on the policy outlook, BoE Chief Economist Huw Pill said on Friday that there is a risk of a spill-over into more persistent inflation. Read more...

GBP/USD Weekly Outlook: Pound Sterling buyers return in tandem with BoE’s hawkishness

The Pound Sterling (GBP) gradually recovered ground against the US Dollar (USD), lifting GBP/USD from three-month lows to ten-day highs near 1.3500.

The GBP/USD pair received a double-booster shot in the past week, which helped it to stage a decent comeback, recording its best weekly performance since late June. The July American labor data disappointment and a slowdown in the services sector intensified concerns over US economic prospects, doubling down on expectations that the Fed will lower interest rates in September. Read more...

Author

FXStreet Team

FXStreet