GBP/USD Technical Analysis: Slow lift from 1.2500 sees bears positioned for further downside

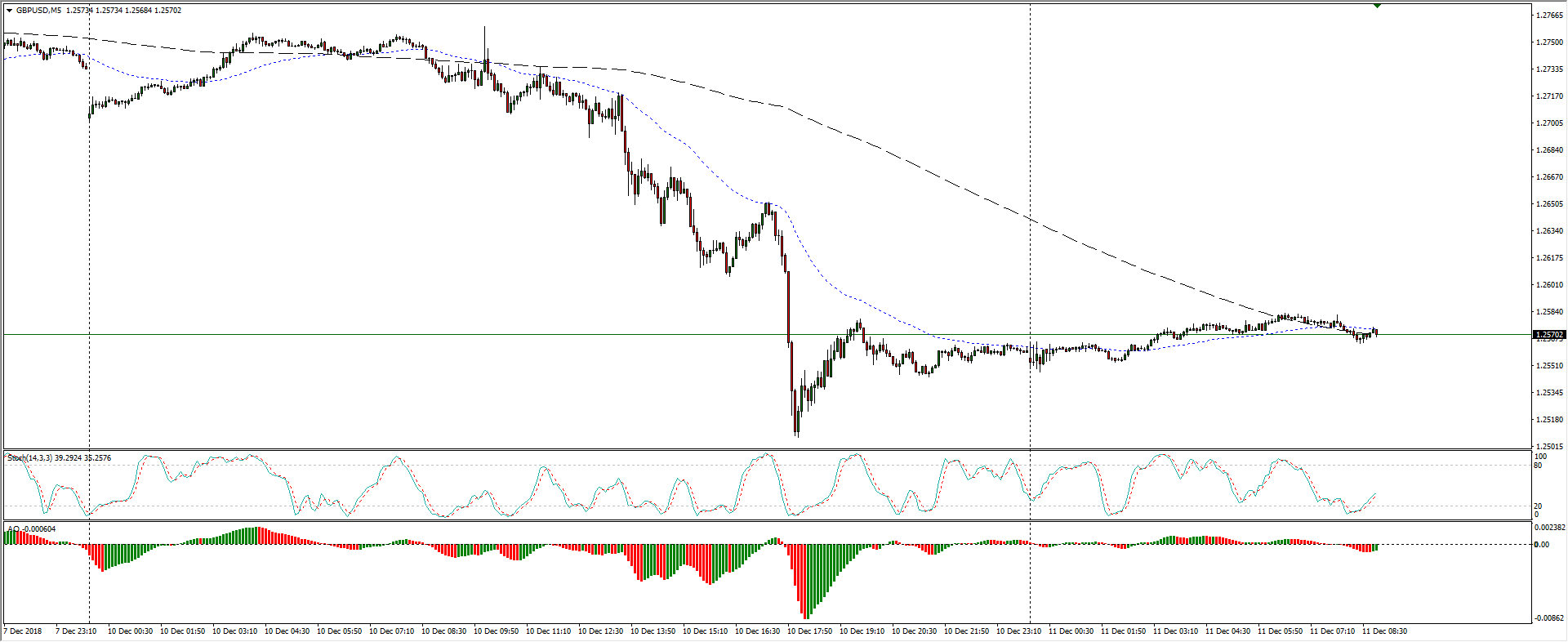

- GBP/USD remains trapped just above 1.2570, and a cautious recovery from Monday's bottom at the 1.2500 handle sees the Cable mixing with the 200-period moving average, implying the pair has lost momentum for the time being.

GBP/USD, 5-Minute

- This week's decline sees the Cable knocking down into a new support/resistance zone, and the 1.2700 key barrier that provided support in the near-term will now be a ceiling for any bullish pushes.

GBP/USD, 30-Minute

- The Cable has accelerated losses that were clearly telegraphed on the 4-hour candlesticks, and now the concern will be a bullish correction caused by profit-taking that could set up a re-test of key resistance at 1.2700 for a reload on short positions.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.257

Today Daily change: 11 pips

Today Daily change %: 0.0876%

Today Daily Open: 1.2559

Trends:

Previous Daily SMA20: 1.2792

Previous Daily SMA50: 1.2922

Previous Daily SMA100: 1.2953

Previous Daily SMA200: 1.3281

Levels:

Previous Daily High: 1.276

Previous Daily Low: 1.2507

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2604

Previous Daily Fibonacci 61.8%: 1.2663

Previous Daily Pivot Point S1: 1.2457

Previous Daily Pivot Point S2: 1.2355

Previous Daily Pivot Point S3: 1.2204

Previous Daily Pivot Point R1: 1.2711

Previous Daily Pivot Point R2: 1.2862

Previous Daily Pivot Point R3: 1.2964

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.