GBP/USD Technical Analysis: Near-term bullish correction capped near 1.2600

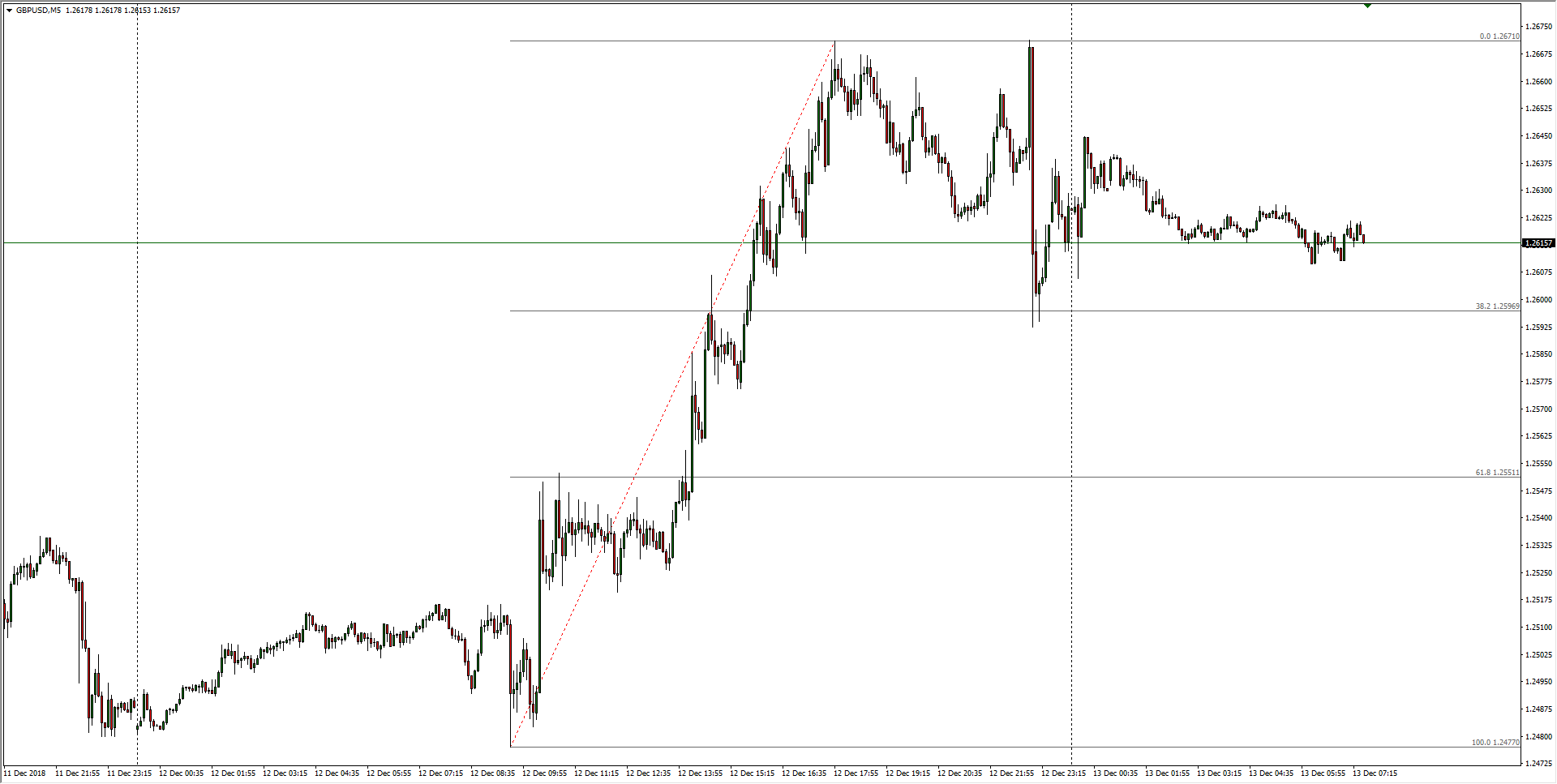

- The Sterling is already drifting back into intraday support from the 38.2% Fibo level just shy of 1.2600 as GBP/USD eases away from Wednesday's peak reached in a run-up from 1.2477.

GBP/USD, 5-Minute

- In the near-term, the Cable could be geared for another step lower after failing to recover beyond the 61.8% Fibo retracement of the last swing high at 1.2685.

GBP/USD, 30-Minute

- A significant line in the sand has been drawn at the 1.2700 level, which could see any further bull moves rejected flat-out as the Cable grinds into a new sideways pattern.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2617

Today Daily change: -54 pips

Today Daily change %: -0.426%

Today Daily Open: 1.2671

Trends:

Previous Daily SMA20: 1.2752

Previous Daily SMA50: 1.2907

Previous Daily SMA100: 1.2941

Previous Daily SMA200: 1.3269

Levels:

Previous Daily High: 1.2672

Previous Daily Low: 1.2477

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2598

Previous Daily Fibonacci 61.8%: 1.2551

Previous Daily Pivot Point S1: 1.2541

Previous Daily Pivot Point S2: 1.2411

Previous Daily Pivot Point S3: 1.2346

Previous Daily Pivot Point R1: 1.2736

Previous Daily Pivot Point R2: 1.2802

Previous Daily Pivot Point R3: 1.2932

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.