GBP/USD rallies and hovers near 1.3400 amid US Dollar weakness

- UK Retail Sales improve and BoE seen less dovish, boosting Sterling demand.

- US Dollar pressured by risk-on mood and Fed entering pre-meeting blackout.

- Traders brace for key UK housing data and heavy US economic calendar this week.

The Pound Sterling begins the week positively set to end April strong, is up 0.65% as the Greenback continues to weaken and risk appetite improves. At the time of writing, the GBP/USD trades near 1.3400 after bouncing off daily lows of 1.3279.

GBP/USD surges as traders favor Sterling on stronger UK outlook and fading Fed hawkishness

Wall Street trades with gains, a headwind for the appetite for haven assets like the US Dollar. A scarce economic docket in the US and Federal Reserve officials entering the blackout period ahead of the May meeting keep traders leaning toward the release of UK data. The CBI in the UK revealed that Retail Sales in April came negatively yet improved from -41 in March to -8, its highest reading since October.

Cable has been boosted by expectations that the Bank of England (BoE) wouldn’t be as dovish as expected. Interest Rate probabilities show that market participants estimate 87 basis points of easing toward the year’s end. Across the pond, the Fed is expected to reduce rates by 88 bps, suggesting that further GBP/USD is seen as investors remain concerned about US trade policies and the recent US Dollar weakness.

Barclays analysts remain bullish on the Sterling, particularly against the euro. "The UK's greater resilience to direct tariffs than the eurozone implies smaller demand damage, thereby offsetting the drag from a more-limited fiscal space," they said.

This week, the UK economic docket will feature Housing Pricing data. Conversely, in the US, traders are eyeing GDP figures for Q1 2025, the Fed’s preferred inflation gauge, the Core PCE, the ISM Manufacturing PMI, and Nonfarm Payrolls data in April.

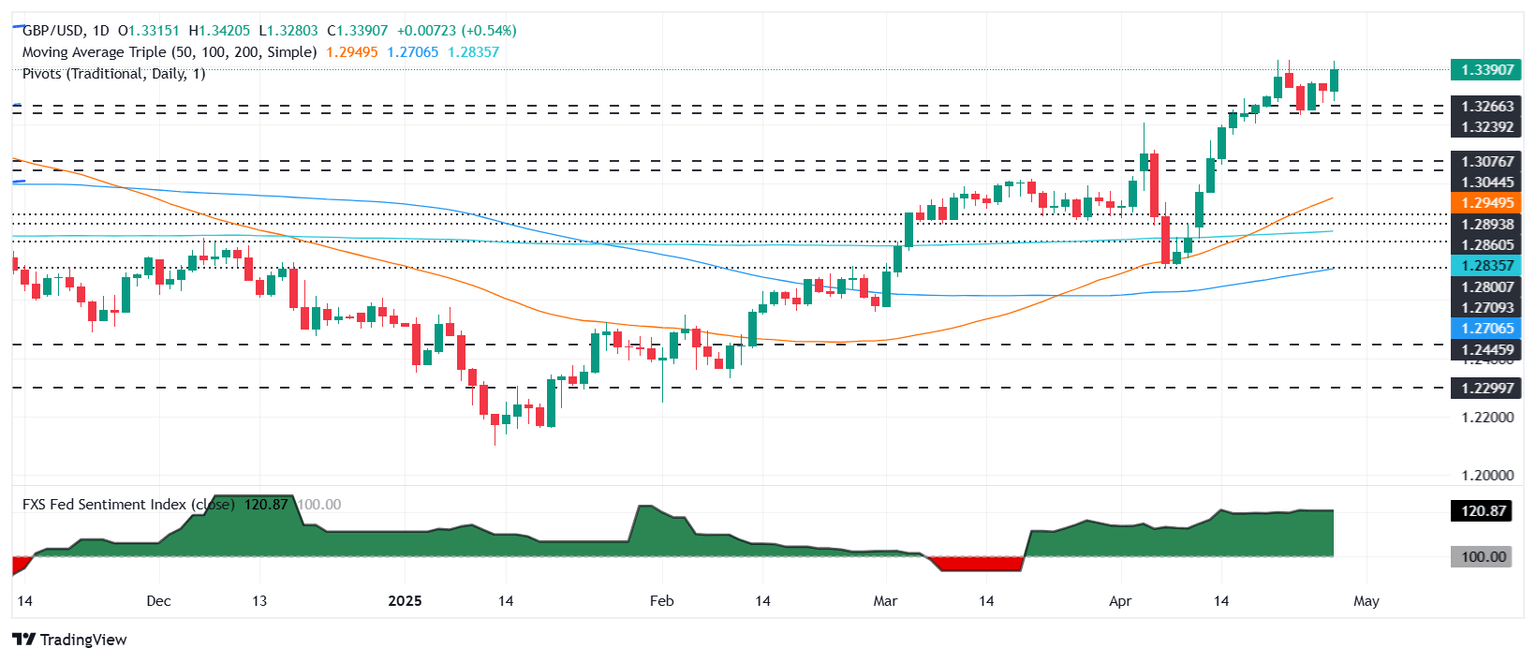

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains upward biased, even though buyers had failed to clear the year-to-date (YTD) high of 1.3423 decisively. A breach of the latter will expose the 1.3450, ahead of challenging 1.3500. On the flip side, if the pair slips below 1.3400, the next support would be 1.3350, followed by the 50-day Simple Moving Average (SMA) at 1.3273.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.15% | -0.56% | -0.61% | -0.17% | -0.24% | -0.13% | -0.49% | |

| EUR | 0.15% | -0.47% | -0.45% | -0.03% | -0.18% | 0.00% | -0.35% | |

| GBP | 0.56% | 0.47% | 0.00% | 0.46% | 0.27% | 0.48% | 0.13% | |

| JPY | 0.61% | 0.45% | 0.00% | 0.47% | 0.40% | -0.92% | 0.38% | |

| CAD | 0.17% | 0.03% | -0.46% | -0.47% | -0.20% | 0.04% | -0.31% | |

| AUD | 0.24% | 0.18% | -0.27% | -0.40% | 0.20% | 0.21% | -0.16% | |

| NZD | 0.13% | 0.00% | -0.48% | 0.92% | -0.04% | -0.21% | -0.36% | |

| CHF | 0.49% | 0.35% | -0.13% | -0.38% | 0.31% | 0.16% | 0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.