GBP/USD Price Forecast: Stumbles on soft UK data, bears target 1.2600

- GBP/USD remains under pressure, testing significant support levels after crossing below the 200-day SMA.

- Further downside may see the pair target 1.2600 and potentially extend to May's low of 1.2445.

- Recovery above 1.2700 could challenge resistance at 1.2817, with RSI indicating potential consolidation ahead.

The Pound Sterling extends its agony and printing losses for the sixth straight day against the Greenback. Soft UK GDP coupled with robust US Retail Sales figures boosted the US Dollar and weighed on GBP/USD, which trades at 1.2636, down 0.22%.

GBP/USD Price Forecast: Technical outlook

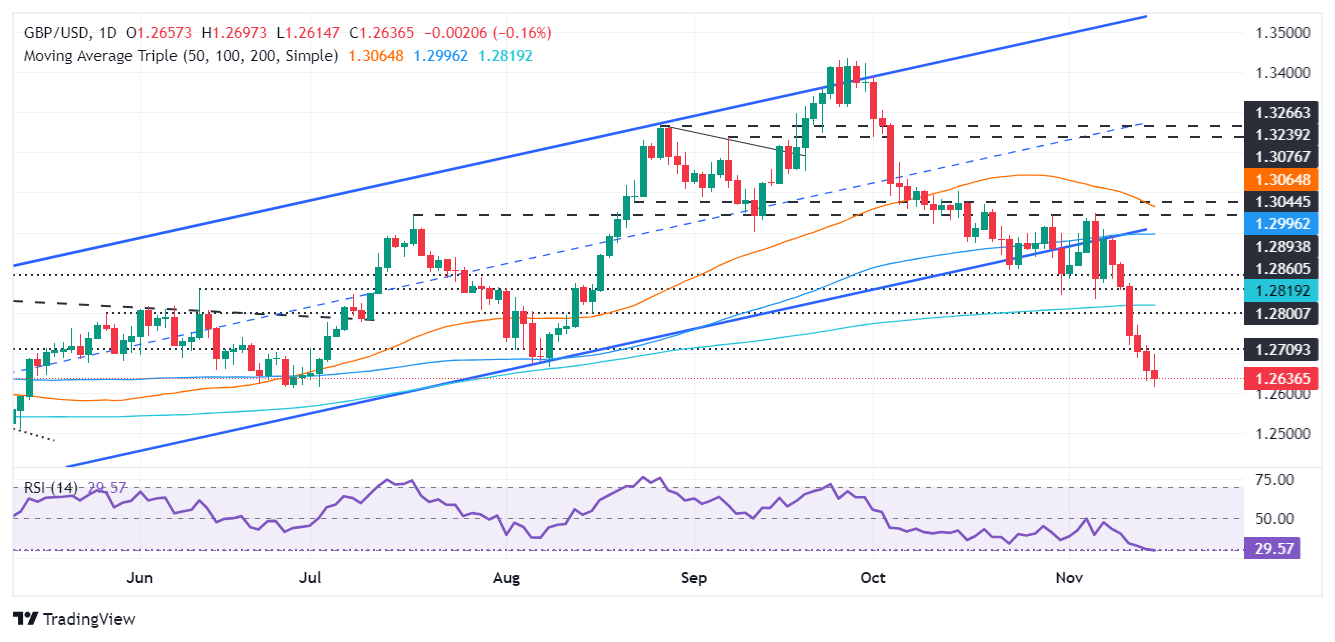

The GBP/USD is bearish-biased once it falls below the 200-day Simple Moving Average (SMA). A daily close below the latest intermediate support at 1.2664, the August 8 swing low, would pave the way for further downside. The following key support level would be the 1.2600 figure, followed by the latest cycle low at 1.2445 on May 9, followed by the year-to-date (YTD) low at 1.2299.

Conversely, if GBP/USD recovers and rises above 1.2700, the next resistance would be the 200-day SMA at 1.2817. Once surpassed, the next resistance would be the 1.2900 mark.

Oscillators, such as the Relative Strength Index (RSI), suggest the pair might consolidate. The RSI is nearby oversold conditions and has begun to shift flat.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | 0.16% | -0.98% | 0.11% | -0.22% | -0.35% | -0.35% | |

| EUR | 0.25% | 0.40% | -0.75% | 0.36% | 0.03% | -0.10% | -0.10% | |

| GBP | -0.16% | -0.40% | -1.15% | -0.03% | -0.37% | -0.50% | -0.50% | |

| JPY | 0.98% | 0.75% | 1.15% | 1.10% | 0.75% | 0.61% | 0.62% | |

| CAD | -0.11% | -0.36% | 0.03% | -1.10% | -0.35% | -0.47% | -0.47% | |

| AUD | 0.22% | -0.03% | 0.37% | -0.75% | 0.35% | -0.14% | -0.15% | |

| NZD | 0.35% | 0.10% | 0.50% | -0.61% | 0.47% | 0.14% | -0.01% | |

| CHF | 0.35% | 0.10% | 0.50% | -0.62% | 0.47% | 0.15% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.