GBP/USD Price Forecast: Rises on weak US Dollar, eyes 1.3100

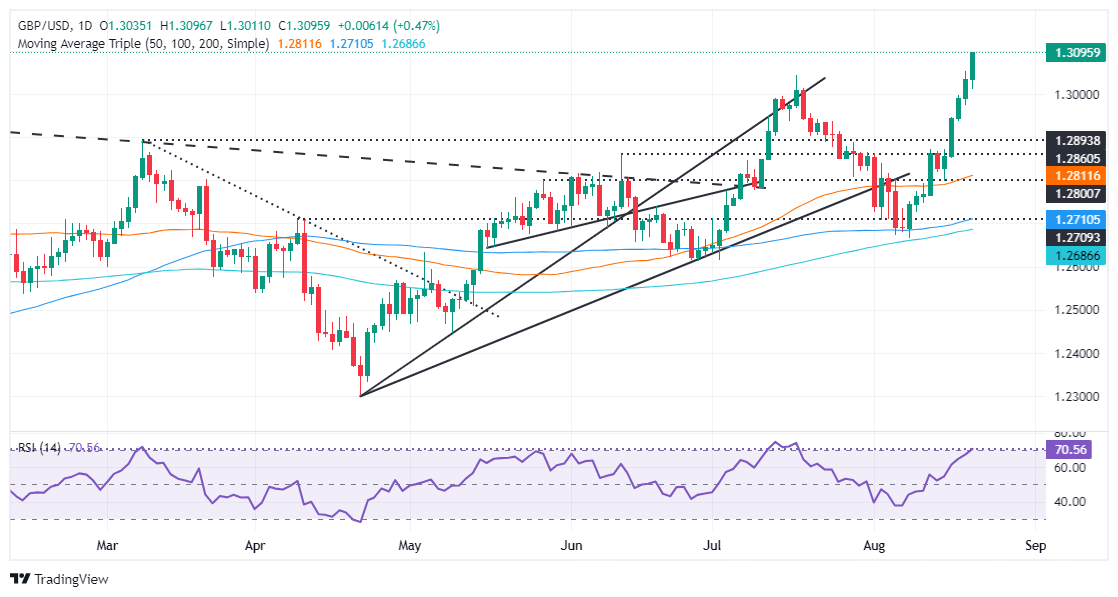

- GBP/USD extends its uptrend after bouncing off the 50-DMA at 1.2809, with RSI indicating strong bullish momentum.

- A break above 1.3100 targets the 2023 peak at 1.3142, with further gains possible toward 1.3200.

- If the pair retreats, support lies at the July 17 high of 1.3044, followed by the psychological 1.3000 level and August 13 high at 1.2872.

The GBP/USD advanced steadily for the fifth straight day and is eyeing the 1.3100 figure after data from the US Bureau of Labor Statistics (BLS) revealed that the US economy added 800K fewer Americans to the workforce. At the time of writing, the pair trades at 1.308 and gains 0.42%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend remains intact after bouncing off the 50-day moving average (DMA) at 1.2809 on August 15. The Relative Strength Index (RSI) shows momentum favoring buyers, though the pair could consolidate soon as the RSI approaches overbought levels.

If GBP/USD climbs above 1.3100, the next stop would be the t 2023 peak at 1.3142. On further strength, the next stop would be 1.3200.

Conversely, if GBP/USD retreats below the July 17 high of 1.3044, that would pave the way for a pullback. The psychological 1.3000 figure would be the next support, followed by the August 13 high at 1.2872.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.46% | -0.16% | -0.20% | 0.02% | -0.12% | -0.40% | |

| EUR | 0.21% | -0.26% | 0.03% | 0.00% | 0.26% | 0.08% | -0.19% | |

| GBP | 0.46% | 0.26% | 0.32% | 0.29% | 0.49% | 0.35% | 0.09% | |

| JPY | 0.16% | -0.03% | -0.32% | -0.04% | 0.20% | 0.00% | -0.22% | |

| CAD | 0.20% | -0.01% | -0.29% | 0.04% | 0.24% | 0.06% | -0.21% | |

| AUD | -0.02% | -0.26% | -0.49% | -0.20% | -0.24% | -0.18% | -0.41% | |

| NZD | 0.12% | -0.08% | -0.35% | -0.00% | -0.06% | 0.18% | -0.25% | |

| CHF | 0.40% | 0.19% | -0.09% | 0.22% | 0.21% | 0.41% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.