GBP/USD Price Analysis: Stumbles below 1.2100 on buoyant US Dollar

- The Pound Sterling drops below 1.2000, set to finish the week with gains of more than 1.50%.

- GBP/USD: Failure to hold above 1.2100 exacerbated a fall toward the November 24 low of 1.2049.

- GBP/USD Price Analysis: A break below 1.2000 will exacerbate a fall towards 1.1800.

The GBP/USD hovers below 1.2100 amid a subdued trading session on low volume conditions spurred by the US Thanksgiving holiday, with the US equity market set to close on Friday, around 13:00 ET. Broad US Dollar (USD) strength spurred by a risk-off impulse caused a retracement on the GBP/USD. At the time of writing, the GBP/USD is trading at 1.2079, registering a minuscule loss of 0.27%.

GBP/USD Price Analysis: Technical outlook

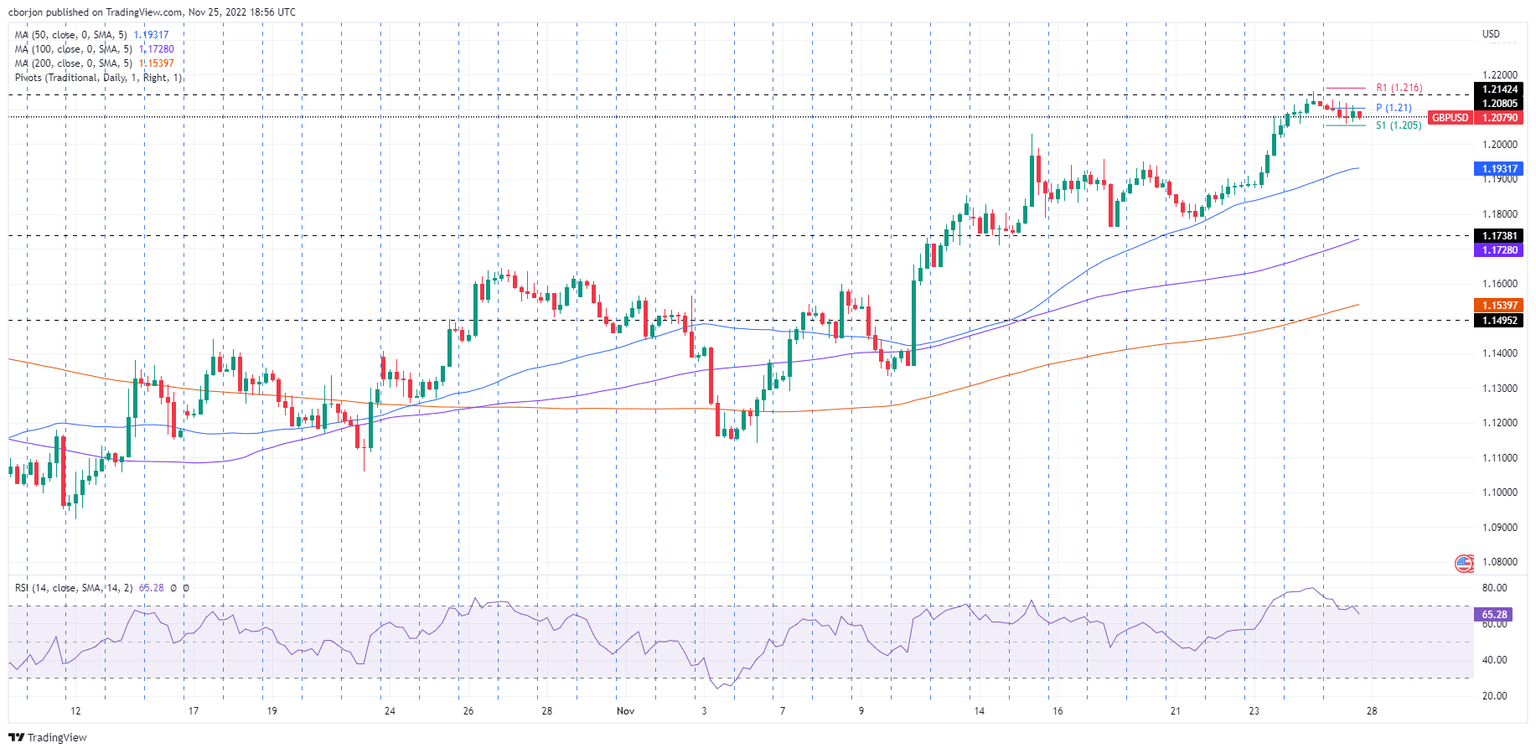

From a daily chart perspective, the GBP/USD remains neutral-upward biased, though lacking the force to break above the 200-day Exponential Moving Average (EMA) around 1.2181. November’s monthly high of around 1.2153 was shy of piercing the latter. Therefore, the GBP/USD would be subject to selling pressure, opening the door for further downside.

The GBP/USD 4-hour chart suggests that the major appears to be topping around the 1.2150 area in the near term, failing to break above the August 17 daily high of 1.2142, exacerbating a drop below 1.2100. Also, the Relative Strength Index (RSI) exiting from overbought conditions after peaking around 1.2150, which could mean two things: traders booking profits after a fall towards multi-decade lows around 1.0300 towards 1.2000, and also some US Dollar (USD) short covering.

Therefore, the GBP/USD path of least resistance is downwards. GBP/USD first support would be the S1 daily pivot point at 1.2050. Break below will expose the 1.2000 figure, followed by the 50-Exponential Moving Average (EMA) at around 1.1931.

GBP/USD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.