GBP/USD Price Analysis: Rebounds from key support near 1.4100

- GBP/USD picks up bids amid choppy US dollar trading.

- The cable is defending key support around 1.4095 on the 4H chart.

- RSI points higher within the bearish territory.

GBP/USD is off the weekly lows near the 1.4100 level, having stalled its three-day bearish momentum on Thursday.

The sentiment around the cable remains undermined by Dominic Cummings’, the UK PM Boris Johnson’s former top aide, severe allegations on the government’s handling of the covid pandemic.

Additionally, renewed US dollar’s bullish momentum amid tapering talks adds to the downside pressure on the major.

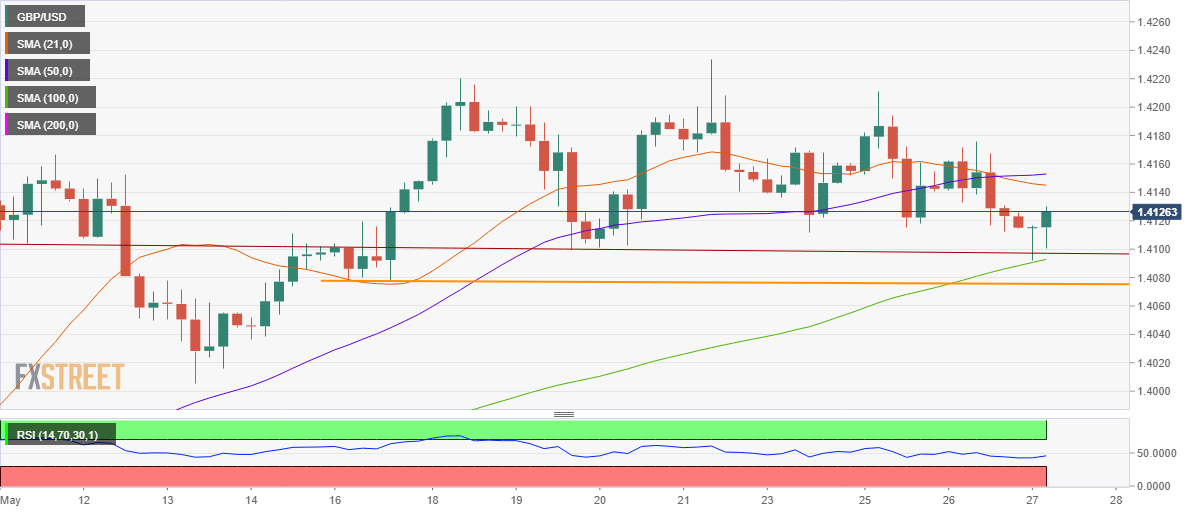

From a near-term technical perspective, the spot is defending critical support near the 1.4095 region, which is the confluence of the horizontal trendline support and upward-sloping 100-simple moving average (SMA).

GBP/USD four-hour chart

However, for the recovery to gather traction, the bulls need to seek a decisive break above powerful resistance around 1.4150, where the 21 and 50-SMA hover.

Alternatively, a four-hourly closing below the abovementioned crucial support could expose the next horizontal (orange) trendline support at 1.4075.

The Relative Strength Index (RSI) is edging higher to probe the midline, currently at 45.48, suggesting the latest uptick seen in the spot.

GBP/USD additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.