GBP/USD Price Analysis: Plummets and shift bearish, dives below 1.2500

- GBP/USD falls sharply, influenced by a move towards safer assets and a strengthening US Dollar.

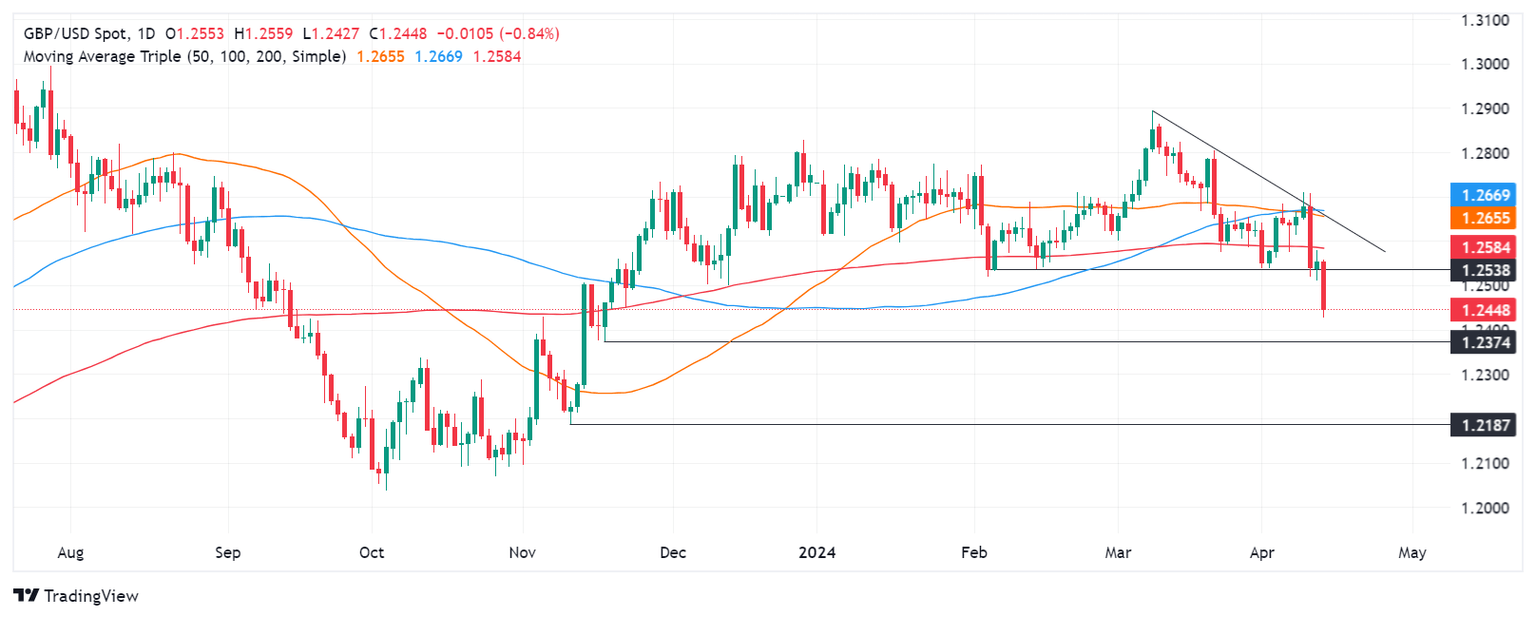

- Technical analysis indicates a shift to bearish territory after dropping below the 200-day moving average.

- Recovery targets include reclaiming 1.2500, with resistance at the 200-day DMA.

The British Pound plunged against the US Dollar late in the North American session, down 0.74%, and trades at 1.2445 after hitting a daily high of 1.2559. Risk aversion triggered a flight to safety, a headwind for the Pound Sterling even though UK GDP figures were solid.

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD shifted bearish as it achieved a successive series of lower highs and lows while breaching key support levels. On its way south, the pair cleared the 200-day moving average (DMA) at 1.2584, which opened the door to a tumble below 1.2500.

For a bearish continuation, the GBP/USD needs to clear the 1.2400 mark. A breach of the latter will expose the November 17, 2023, low of 1.2374, followed by the 1.2300 mark.

On the other hand, if buyers lift the GBP/USD past the 1.2500, that could pave the way for further gains. The next resistance would be the 200-day moving average (DMA) at 1.2584, ahead of 1.2600.

As the GBP/USD dropped below key support levels and achieved

GBP/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.