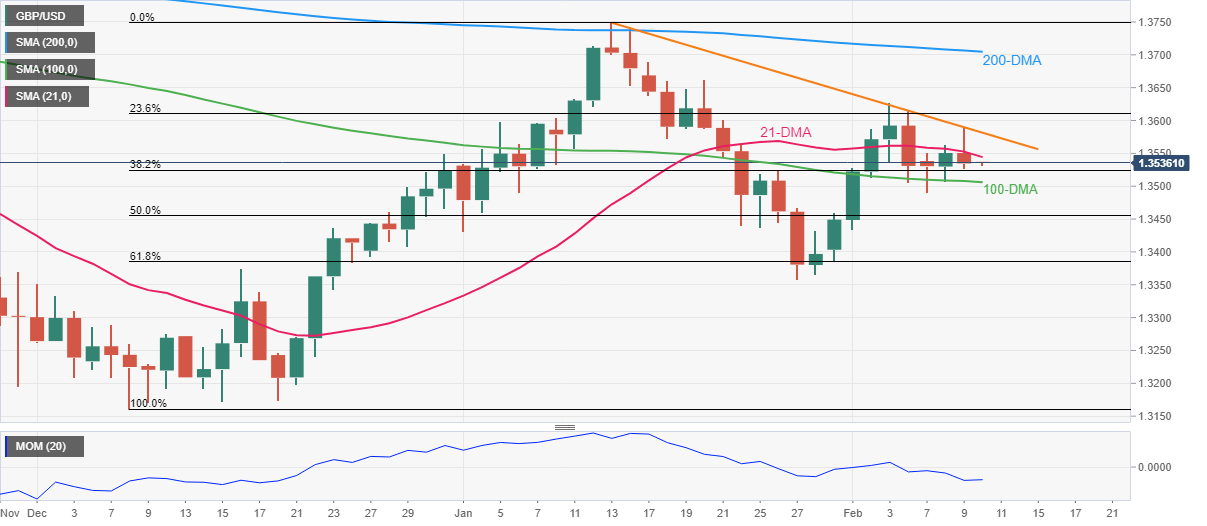

GBP/USD Price Analysis: Keeps pullback from monthly resistance above 1.3500

- GBP/USD struggles between 21-DMA and 100-DMA after easing from monthly resistance line.

- Downbeat Momentum line keeps sellers hopeful to test the key Fibonacci retracement levels.

- Buyers remain cautious til prices stay below 200-DMA.

GBP/USD seesaws around 1.3535-40 during Thursday’s Asian session, following a pullback from a one-month-old descending resistance line the previous day.

In doing so, the cable pair stays within the weekly range between the 21-DMA and 100-DMA. However, the recently downbeat Momentum line favors sellers.

That said, a clear downside break of the 100-DMA level near 1.3500 becomes necessary for the GBP/USD sellers to take entries.

Following that, the 50% and 61.8% Fibonacci retracement of December-January run-up, respectively around 1.3450 and 1.3385, will be in focus.

Also acting as a downside filter is the previous monthly low around 1.3355.

On the contrary, the 21-DMA and aforementioned resistance line, close to 1.3545 and 1.3585 in that order, guard the GBP/USD pair’s short-term upside.

Following that, the recent swing high near 1.3630 may offer an intermediate halt before fueling prices towards the 200-DMA level surrounding 1.3705.

GBP/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.