GBP/USD Price Analysis: Holds above the 1.2800 mark, eyes on the 1.2850 level

- GBP/USD remains on the defensive above the 1.2800 mark on Monday.

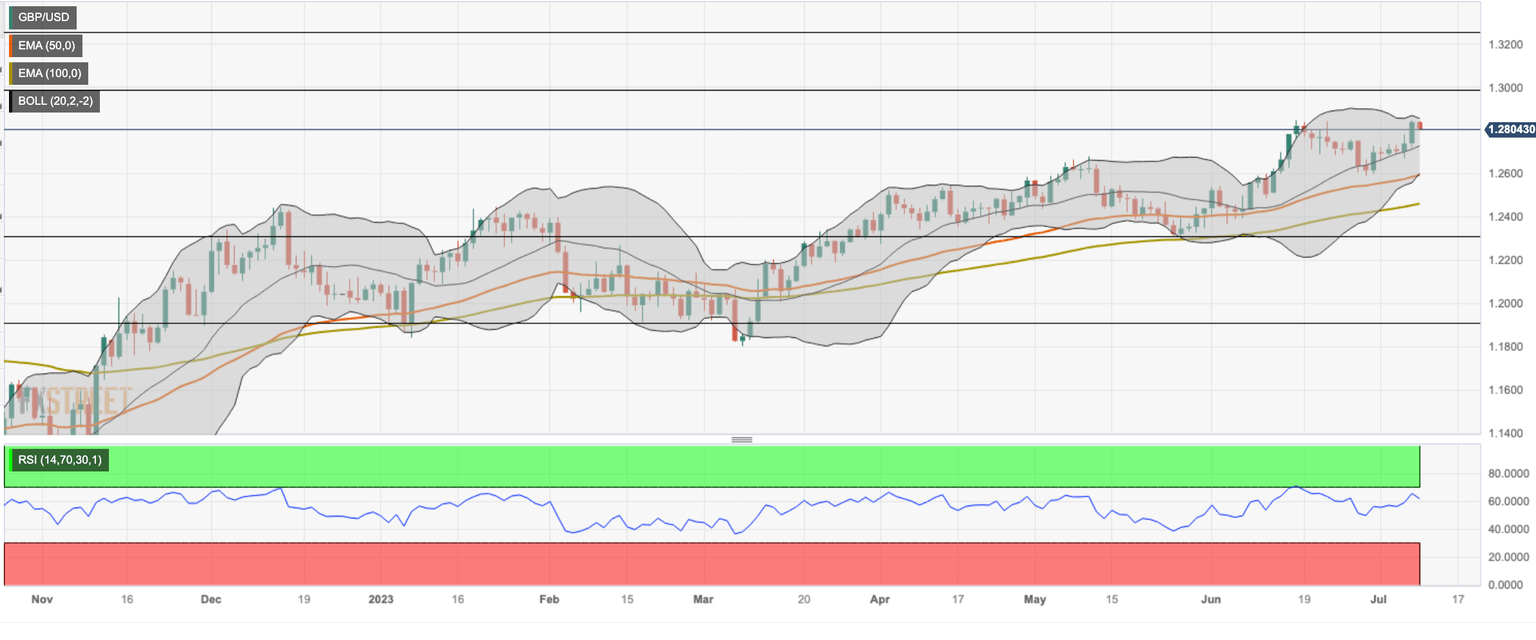

- GBP/USD holds above the 50-, 100-day Exponential Moving Averages (EMA).

- The immediate resistance level is at the 1.2850 mark while the 1.2730 area is an initial support level.

The GBP/USD pair struggles to capitalize on Friday's upward move and remains above the 1.2800 area during early European hours on Monday. The major pair currently trades on the defensive at 1.2801, up to 0.35% on the day.

From a technical perspective, the path of least resistance for the GBP/USD is to the upside as the pair holds above the 50- and 100-day Exponential Moving Averages (EMA) on the daily chart. Additionally, the Relative Strength Index (RSI) stands at 61.70, portraying the bullish territory for the pair.

GBP/USD met the immediate resistance level at 1.2850 region, highlighting the upper boundary of the Bollinger Band.

The next barrier is seen at 1.2975, the horizontal line and a low of April 13. A break above the latter will see a rally to 1.3248, a high of March 23.

On the downside, the 1.2730 is seen as an initial support level, representing the midline of Bollinger Band.

The breach of the latter would drag the pair toward the next contention at 1.2600. This level is a confluence of a psychological round mark, the lower limit of Bollinger Bands, and the 50-day EMAe. A decisive break below the key demand area will see a drop to 1.2462, the 100-day EMA.

GBP/USD: Daily chart

Author

FXStreet Team

FXStreet