GBP/USD Price Analysis: Extends losses and approaches 1.2600

- GBP/USD remains heavy as BoE delivers ‘dovish’ hold.

- UK Retail Sales crushed estimates, but PMIs were softer.

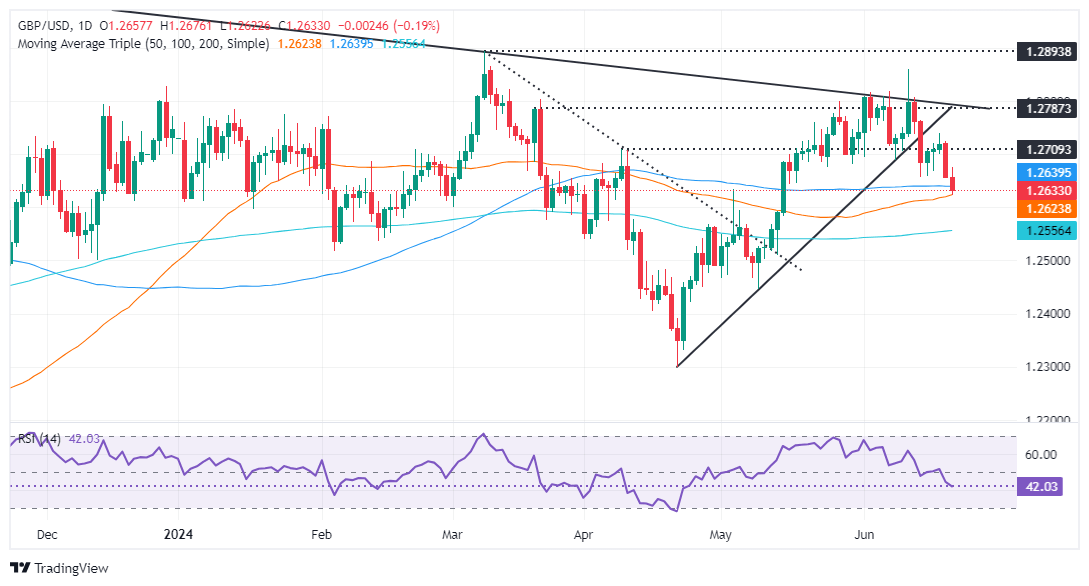

- Tested 50-DMA, bounced but remains above 100-DMA, sitting at 1.2638.

The Pound Sterling prolonged its agony and fell for the second straight day after the Bank of England’s decision to hold rates unchanged, signaling that the beginning of the easing cycle is coming. Additionally, mixed UK economic data, with Retail Sales exceeding estimates but flash PMIs softening, hints the economy might be slowing. The GBP/USD trades at 1.2636, down 0.16%.

GBP/USD Price Analysis: Technical outlook

After diving to its lowest level since May 15 at 1.2621, the GBP/USD trimmed some of its earlier losses yet remains beneath its opening price. Momentum favors sellers, with the Relative Strength Index (RSI) aiming downwards and below its 50-neutral line.

That said, a daily close below the May 3 high turned support at 1.2634 would pave the way to test 1.2600. A breach of the latter will expose the 200-day moving average (DMA) at 1.2552. Conversely, further upside would be seen once buyers lift the exchange rate above 1.2700.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.19% | 0.32% | 0.09% | 0.23% | 0.10% | 0.25% | |

| EUR | -0.14% | 0.05% | 0.22% | -0.04% | 0.12% | -0.02% | 0.10% | |

| GBP | -0.19% | -0.05% | 0.14% | -0.11% | 0.05% | -0.10% | 0.07% | |

| JPY | -0.32% | -0.22% | -0.14% | -0.24% | -0.09% | -0.23% | -0.04% | |

| CAD | -0.09% | 0.04% | 0.11% | 0.24% | 0.13% | -0.00% | 0.17% | |

| AUD | -0.23% | -0.12% | -0.05% | 0.09% | -0.13% | -0.16% | 0.03% | |

| NZD | -0.10% | 0.02% | 0.10% | 0.23% | 0.00% | 0.16% | 0.16% | |

| CHF | -0.25% | -0.10% | -0.07% | 0.04% | -0.17% | -0.03% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.