GBP/USD Price Analysis: Defends downside near 1.2340 as BoE to raise rates further

- GBP/USD has shown some recovery from 1.2340 as the USD Index is struggling in refreshing the day’s high above 104.33.

- The BoE is expected to raise interest rates further considering the fact that United Kingdom inflation is not decelerating as expected.

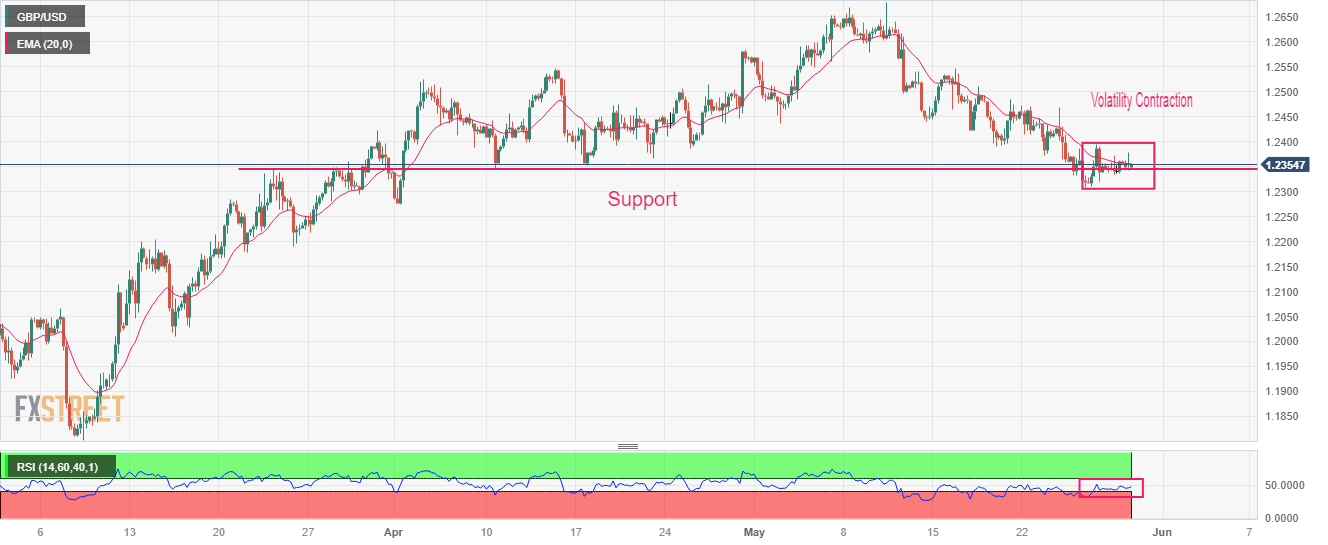

- GBP/USD is showing a volatility contraction pattern after dropping to near the horizontal support at 1.2344.

The GBP/USD pair has rebounded after defending its downside near the crucial support around 1.2340 in the early European session. The Cable has shown recovery as the US Dollar index (DXY) has faced pressure while attempting to refresh its day’s high above 104.33. More upside in the USD Index seems possible as it has not shown signs of bearish reversal yet.

S&P500 futures are showing choppy moves after Asia as investors are anticipating wild movements on New York opening after an extended weekend. The overall market mood is cautious as investors are anticipating that the Federal Reserve (Fed) will not pause the policy-tightening spell in June.

The Pound Sterling has hogged the limelight as the Bank of England (BoE) is expected to raise interest rates further considering the fact that United Kingdom inflation is not decelerating as expected.

GBP/USD is showing a volatility contraction pattern after dropping to near the horizontal support plotted from March 23 high at 1.2344. The Cable is expected to deliver wider ticks and witness heavy volume after an explosion in the volatility contraction pattern.

It is highly likely that a mean-reversion move to near the 50-period Exponential Moving Average (EMA) at 1.2390 would trigger the downside bias.

For the time being, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates a loss in the downside momentum. However, the downside bias is not ruled out yet.

Should the asset decline below May 25 low at 1.2308, US Dollar bulls will get strengthened further and will drag the Cable toward April 03 low at 1.2275, followed by March 14 high at 1.2204.

On the flip side, a recovery move above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 and 26 April 2022 high at 1.2772.

GBP/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.