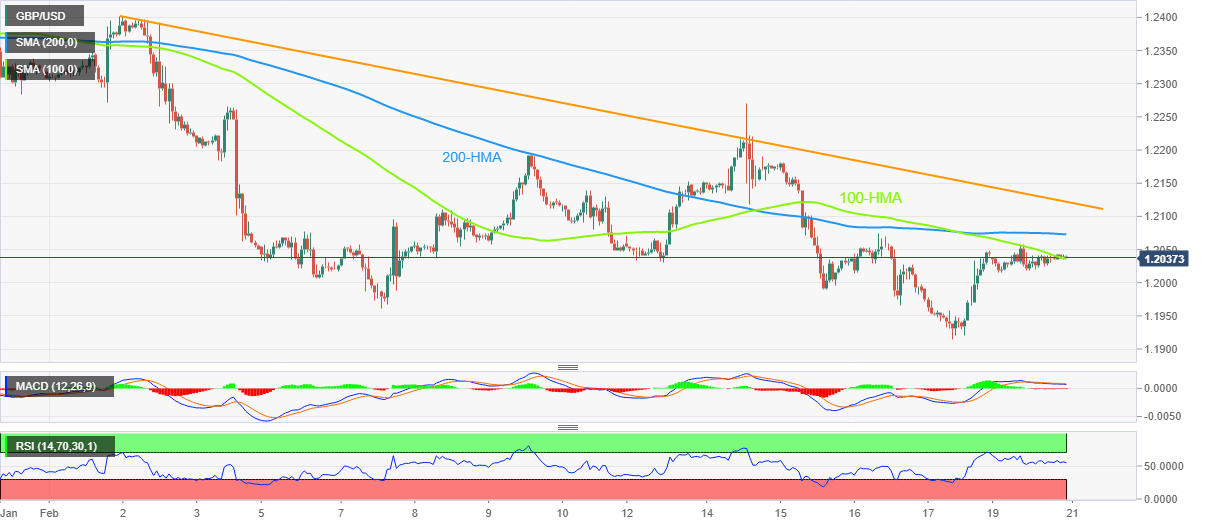

GBP/USD Price Analysis: Clings to 100-HMA above 1.2000 with eyes on UK PMI

- GBP/USD struggles for clear directions after tepid week-start, fails to extend Friday’s bounce off multi-day low.

- Sluggish oscillators, key HMAs challenge bulls ahead of 13-day-old resistance line.

- Bears need sustained trading below 1.1920-15 to retake control.

GBP/USD remains sidelined near 1.2040 during the early hours of Tuesday’s Asian session, extending Monday’s inaction.

In doing so, the Cable pair seesaws around the 100-Hour Moving Average (HMA) amid the trader’s cautious mood ahead of the first readings of the UK Purchasing Managers Indexes (PMI) for February.

Not only the 100-HMA level surrounding 1.2040 but the 200-HMA level surrounding 1.2075 also challenges the GBP/USD pair buyers.

Following that, a downward-sloping resistance line from February 02, close to 1.2125 at the latest, will be important to watch as a break of which could convince GBP/USD buyers to challenge the monthly high surrounding the 1.2400 threshold. During the run-up, the previous weekly high near 1.2270 may act as an intermediate halt.

Meanwhile, the 1.2000 psychological maget precedes the 1.1960 support to restrict short-term GBP/USD downside.

However, the recent low near 1.1920-15 joins an upward-sloping support line from mid-November 2022 to act as a tough nut to crack for the GBP/USD bears to conquer.

To sum up, GBP/USD remains tight-lipped ahead of the key UK data. However, the sluggish oscillators and multiple hurdles to the north keep sellers hopeful.

GBP/USD: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.