GBP/USD pinned near 1.2800 as markets head into 2024

- GBP/USD rose 0.8% bottom-to-top on Wednesday as markets lean into rate cut bets.

- Markets are anticipating an accelerated rate cut cycle from the Federal Reserve as soon as March.

- Thin data on the economic calendar this week, Thursday’s US Initial Jobless Claims in focus.

The GBP/USD climbed higher on Wednesday as broad-market risk appetite pushed the US Dollar (USD) into the floorboards, bolstering the Pound Sterling (GBP). The GBP/USD climbed over three-quarters of a percent from Wednesday’s low bids near 1.2700 to pin into the 1.2800 handle heading into the Thursday market session.

UK data is nearly absent from the economic data docket this week, with low-tier Nationwide Housing Prices for October being the only data representation for the GBP, slated for Friday.

US Initial Jobless Claims will be the key data focus this week, with markets expecting a slight increase from 205K to 210K new jobless benefits seekers for the week ending December 22 versus the 205K from the week before.

Broad-market risk appetite continues to surge higher as investors lean into bets that the Federal Reserve will be pushed into an increased rate cut cycle, with many market participants betting on rate cuts to begin as soon as March. The Fed’s rate stance pivot pinned investor hopes on an accelerated pace of rate cuts, and multiple attempts from Fed officials to throw water on red-hot market expectations have had little effect.

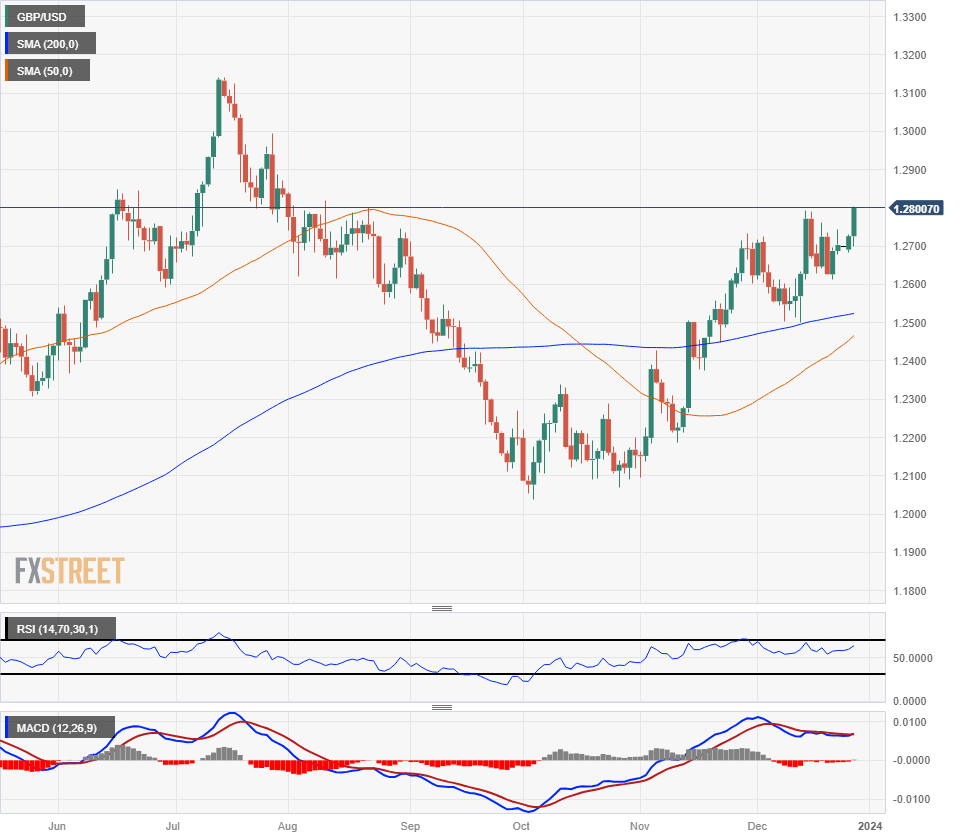

GBP/USD Technical Outlook

The GBP/USD hit a 19-week high on Wednesday, and the pair is on pace to close in the green for eight of the past nine trading weeks. The pair rallied off of the 50-hour Simple Moving Average (SMA) as intraday action pins firmly into risk-on, sending the GBP into the ceiling near the 1.2800 handle.

The GBP/USD continues to lift on the back of US Dollar weakness than any particular GBP strength, climbing over 6% from October’s bottom bids near 1.2040.

The 200-day SMA is providing long-term technical support from 1.2525, and the next immediate challenge for GBP/USD bulls, or Dollar bears in general, will be to muscle the pair back over the 1.3000 major handle.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.