GBP/USD chalks in seventh straight winning day on Fed rate cut hopes

- GBP/USD vaulted over 1.3200 on broad-market Greenback weakness.

- Fed gave a head nod to impending rate cuts, sending risk appetite into the ceiling.

- Coming up next week: UK Monday holiday, US GDP and PCE inflation.

GBP/USD found a Fed-fueled surge on Friday, climbing roughly a full percent through the day’s trading and closing the week with a seventh consecutive bullish daily candle as the US Dollar slumps across the board.

Forecasting the Coming Week: Recession concerns take over Fed’s easing

According to the CME’s FedWatch Tool, rate markets are pricing in roughly three-to-one odds of a double cut on September 18, with the rest of the rate board still committed to a single quarter-point cut. Bets of a 50 bps opening rate trim in September rose after Fed Chairman Jerome Powell, while speaking at the Jackson Hole Economic Symposium on Friday, openly admitted that the time has finally come for the US central bank to begin pushing reference rates down.

Up ahead: UK bankers take a break, US PCE inflation figures loom

Coming up next week, Cable traders will want to keep an eye out for the UK’s upcoming bank holiday on Monday. Throughout the rest of the week, UK economic data releases remain limited, though money markets will be paying extra-close attention to upcoming US Gross Domestic Product (GDP) growth and Personal Consumption Expenditure (PCE) inflation figures slated for later next week.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.49% | -2.07% | -2.24% | -1.27% | -1.85% | -3.05% | -2.04% | |

| EUR | 1.49% | -0.65% | -0.73% | 0.24% | -0.45% | -1.74% | -0.58% | |

| GBP | 2.07% | 0.65% | -0.29% | 0.81% | 0.14% | -1.08% | 0.08% | |

| JPY | 2.24% | 0.73% | 0.29% | 0.95% | 0.37% | -0.68% | 0.08% | |

| CAD | 1.27% | -0.24% | -0.81% | -0.95% | -0.62% | -1.72% | -0.82% | |

| AUD | 1.85% | 0.45% | -0.14% | -0.37% | 0.62% | -1.10% | -0.10% | |

| NZD | 3.05% | 1.74% | 1.08% | 0.68% | 1.72% | 1.10% | 1.12% | |

| CHF | 2.04% | 0.58% | -0.08% | -0.08% | 0.82% | 0.10% | -1.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

GBP/USD price forecast

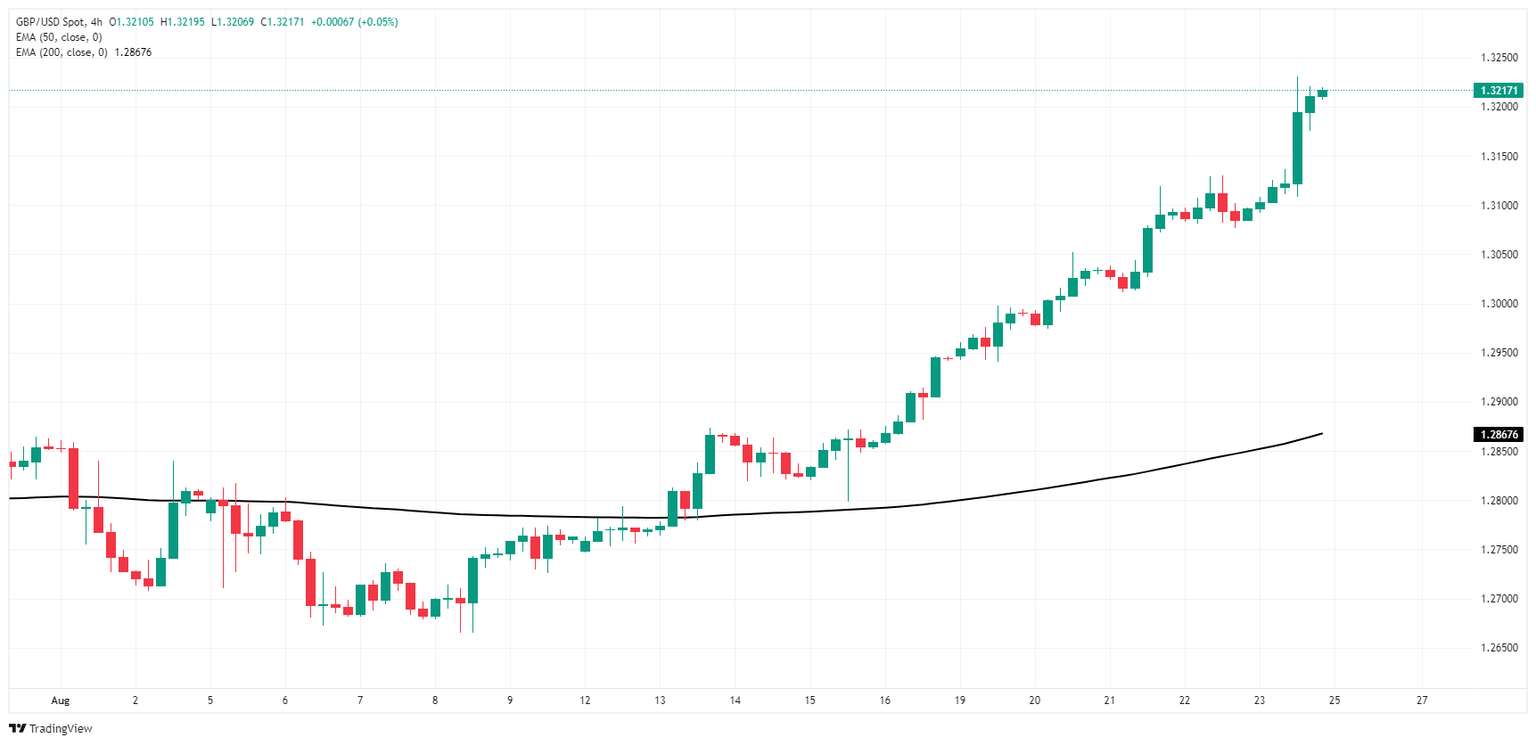

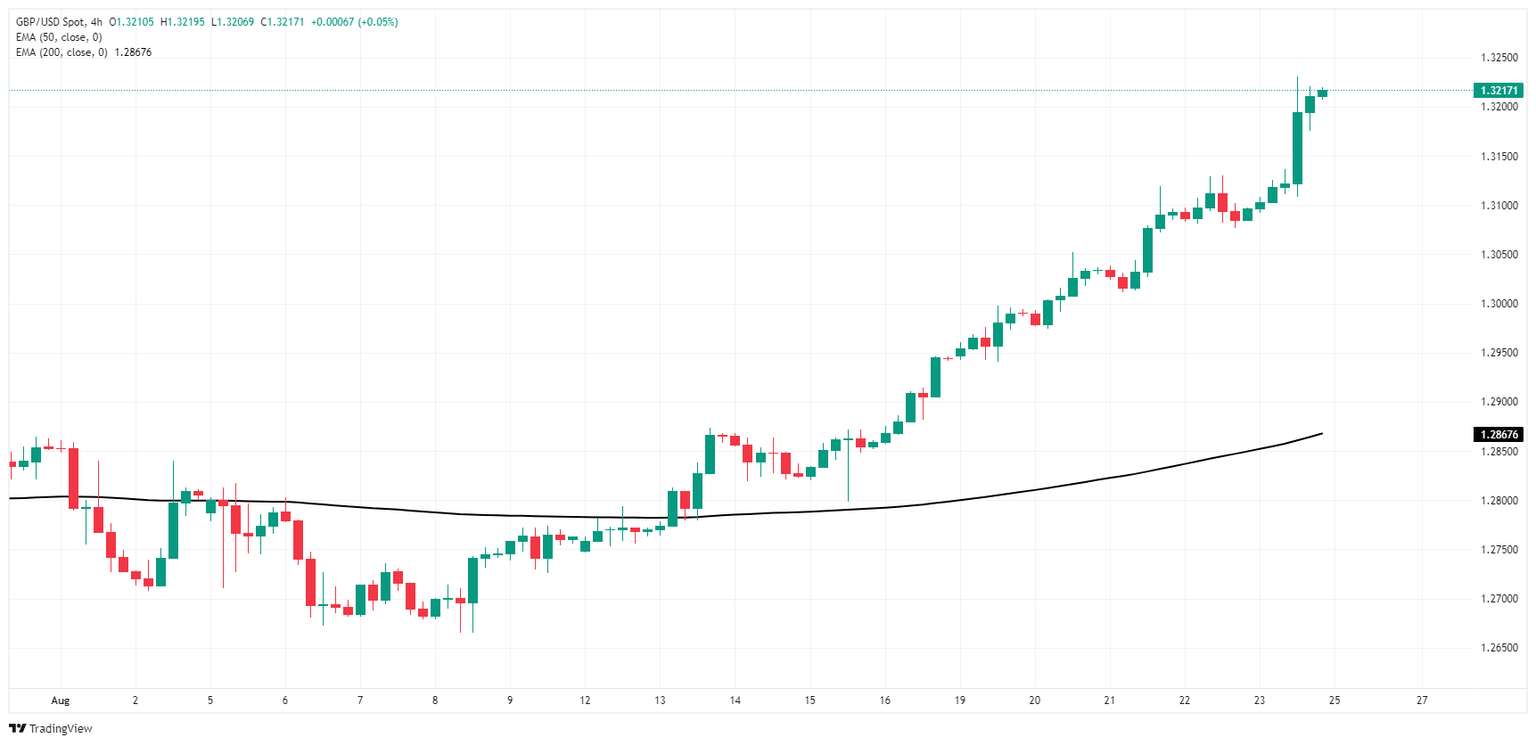

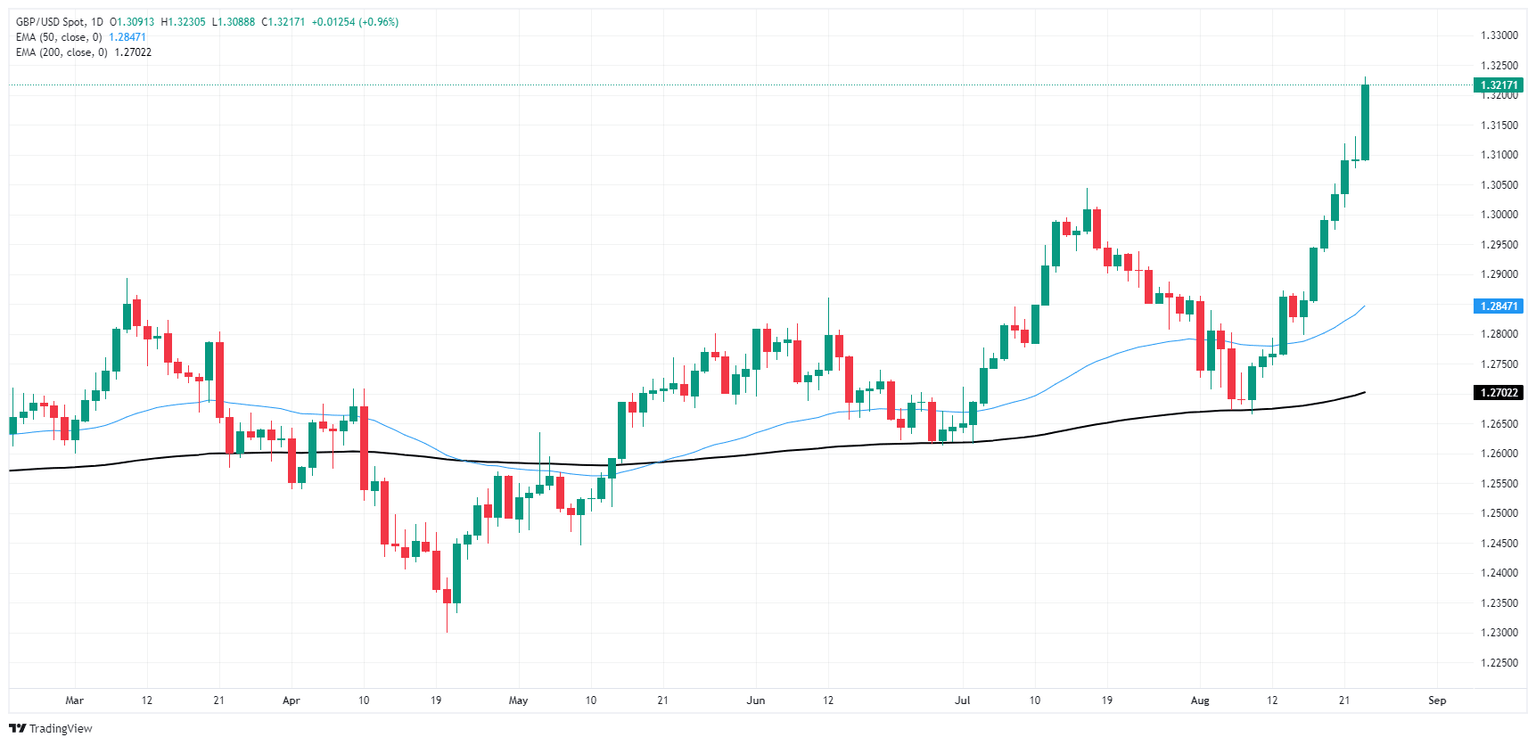

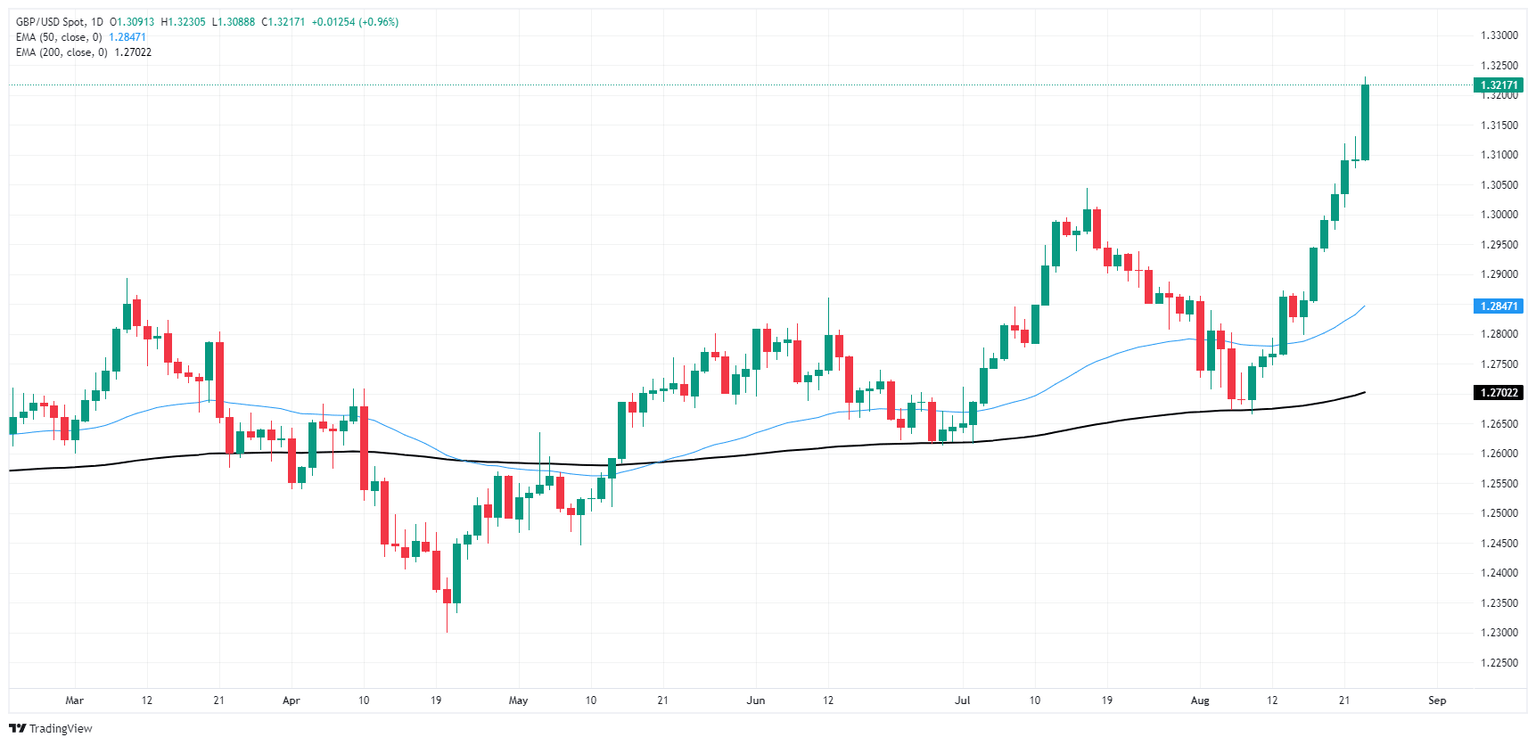

Cable chart action was notably one-sided this week, with GBP/USD climbing steadily from Monday’s opening bids near 1.2950. The pair climbed over 2.1% this week in a firm march up the chart paper, extending a recovery bid from August’s early swing low to 1.2665.

GBP/USD knocked into a fresh 29-month high on Friday, and the pair is up an impressive 28% since hitting all-time lows in 3Q 2022. Cable’s current bull run has yet to show signs of exhaustion, and the pair has closed in the green for all but one of the last 11 consecutive trading days, marking a dizzying run up the chart.

GBP/USD 4-hour chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.