GBP/JPY Technical Analysis: Drifting lower as Yen bidders step up

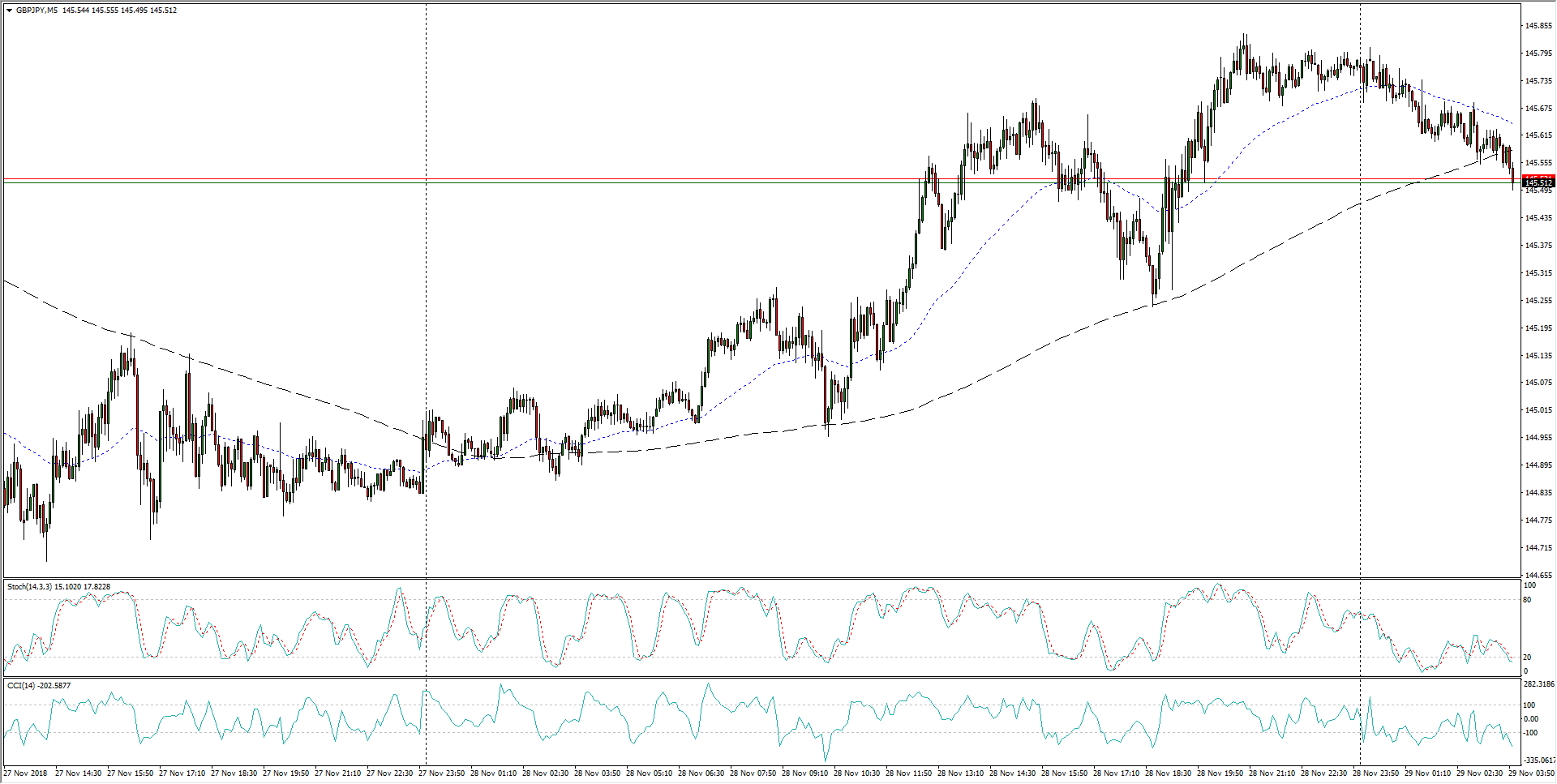

- GBP/JPY peering over the edge as shortside action into 145.50 eats away at Wednesday's gains.

- A break of support from the 200-period moving average in the overnight session could see a bearish move extend its legs.

GBP/JPY, 5-Minute

- The past two weeks have been rough on the Guppy, caught in a rough sideways pattern.

- Swings higher have been met with hard selling, separating periods of rough chop, but the GBP/JPY may be making gains off of higher lows from November 20th's bottom.

GBP/JPY, 30-Minute

- The GBP/JPY is making a run higher on the 4-Hour candles, but heavy resistance from the 200-period moving average waits just above at the 146.00 handle.

GBP/JPY, 4-Hour

GBP/JPY

Overview:

Today Last Price: 145.59

Today Daily change: -16 pips

Today Daily change %: -0.110%

Today Daily Open: 145.75

Trends:

Previous Daily SMA20: 146.3

Previous Daily SMA50: 146.78

Previous Daily SMA100: 145.72

Previous Daily SMA200: 147.01

Levels:

Previous Daily High: 145.84

Previous Daily Low: 144.83

Previous Weekly High: 145.96

Previous Weekly Low: 144.01

Previous Monthly High: 149.52

Previous Monthly Low: 142.78

Previous Daily Fibonacci 38.2%: 145.46

Previous Daily Fibonacci 61.8%: 145.22

Previous Daily Pivot Point S1: 145.11

Previous Daily Pivot Point S2: 144.46

Previous Daily Pivot Point S3: 144.09

Previous Daily Pivot Point R1: 146.12

Previous Daily Pivot Point R2: 146.49

Previous Daily Pivot Point R3: 147.13

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.