GBP/JPY Price Forecast: Stalls below 200-day SMA as bulls struggle for momentum

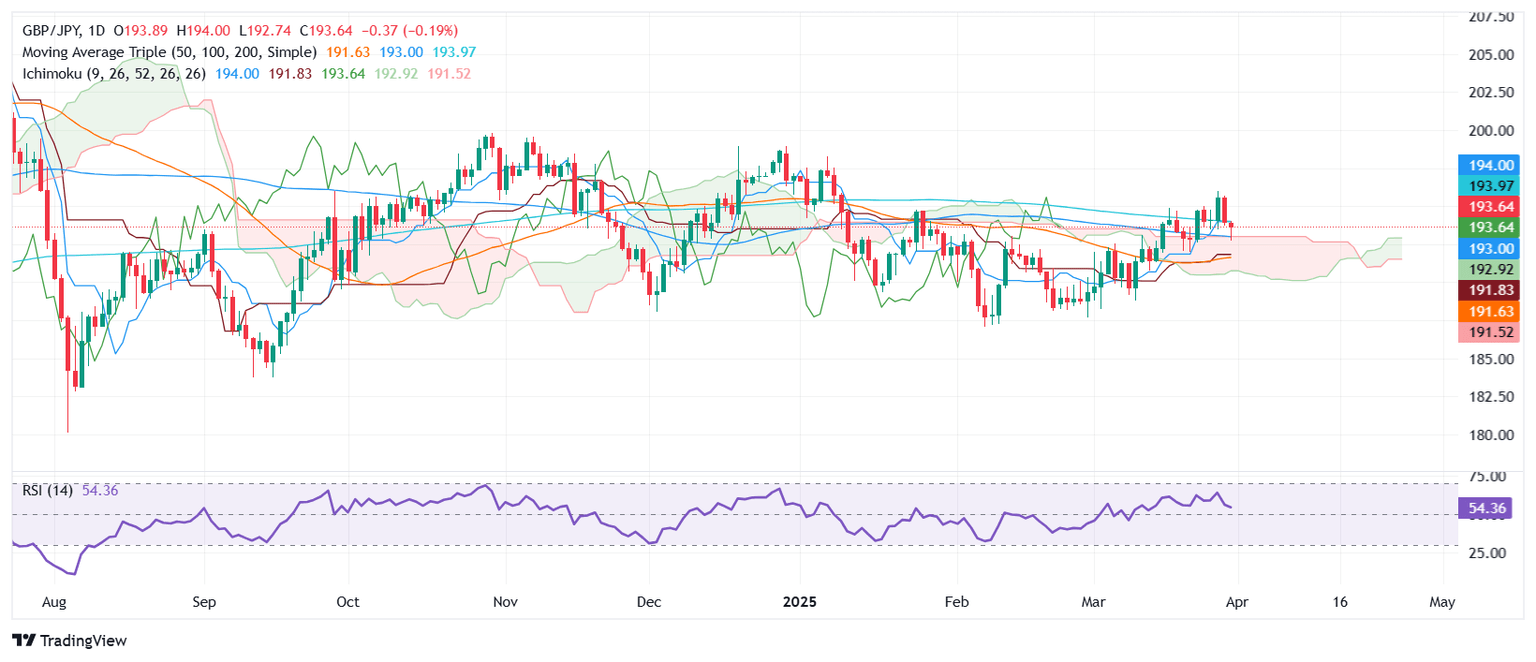

- GBP/JPY consolidates in tight 192.70–193.98 range, hovering just below 200-day SMA at 193.91.

- Bullish bias intact above Kumo, but buyers must clear 194.00 and 195.71 to resume upward trajectory.

- A drop below 192.89/193.00 could expose 191.81 Kijun-sen and 50-day SMA at 191.63.

The GBP/JPY begins Tuesday’s Asian session mostly unchanged, trading at 193.63, below the 200-day Simple Moving Average (SMA) at 193.91, as it consolidates on top and below of the latter. The cross pair remains steady within the 192.70 – 193.98 range, with buyers unable to extend its gains.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is neutral to upward biased, with buyers' lack of strength to push prices above the 200-day SMA, so they would shift the bias to bullish. Even though price action is above the Ichimoku Cloud (Kumo), bulls must clear 194.00 alongside the March 28 peak of 195.71, so the uptrend could resume.

Key resistance levels lie above the latter, like 196.00 and the January 7 daily high of 198.24. On the flip side, if GBP/JPY tumbles below the confluence of the top of the Kumo and the 100-day SMA around 192.89/193.00, this could exacerbate a retest of 191.81, where the Kijun-sen lies, followed by the 50-day SMA at 191.63.

GBP/JPY Price Chart – Daily

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | -0.02% | -0.06% | 0.01% | 0.03% | 0.08% | -0.03% | |

| EUR | 0.07% | -0.00% | 0.00% | 0.04% | 0.05% | 0.08% | -0.01% | |

| GBP | 0.02% | 0.00% | -0.04% | 0.03% | 0.04% | 0.08% | -0.01% | |

| JPY | 0.06% | 0.00% | 0.04% | 0.08% | 0.08% | 0.10% | 0.03% | |

| CAD | -0.01% | -0.04% | -0.03% | -0.08% | 0.00% | 0.05% | -0.05% | |

| AUD | -0.03% | -0.05% | -0.04% | -0.08% | -0.01% | 0.03% | -0.06% | |

| NZD | -0.08% | -0.08% | -0.08% | -0.10% | -0.05% | -0.03% | -0.09% | |

| CHF | 0.03% | 0.00% | 0.01% | -0.03% | 0.05% | 0.06% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.