GBP/JPY Price Forecast: Holds steady above 193.00 as the pair bottoms

- GBP/JPY bounces off 192.00 zone, reclaiming 193.00 amid improving risk sentiment.

- Buyers must clear 193.58 and 194.00 to unlock further upside toward 195.00.

- Failure to hold above 192.00 risks deeper pullback to 191.00 support zone.

The GBP/JPY registers modest gains as Friday’s Asian session begins, carrying on an upbeat mood as the pair gained over 0.23% on Thursday, bottoming at around the 192.00 area. At the time of writing, the cross-pair trades at 193.14 virtually unchanged.

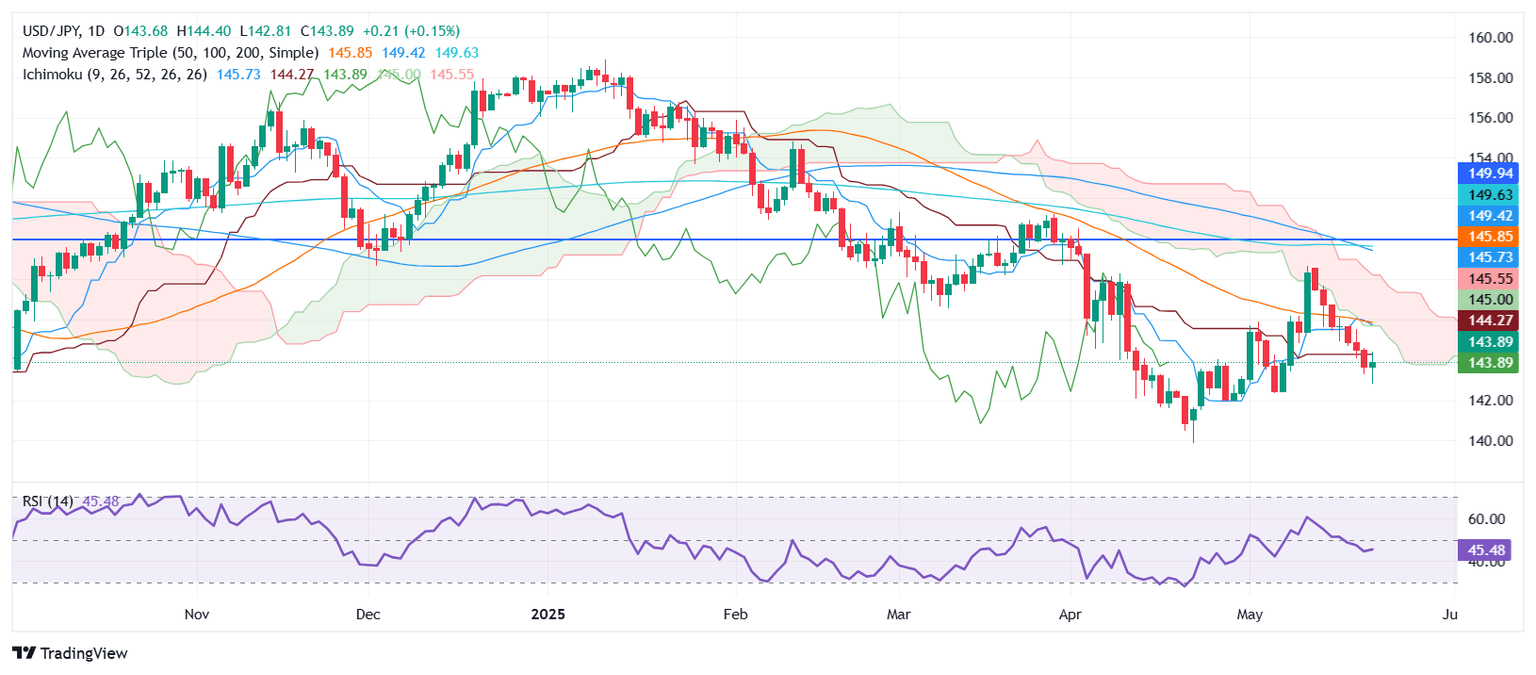

GBP/JPY Price Forecast: Technical outlook

From a daily chart perspective, the GBP/JPY remains trading sideways, though slightly tilted to the upside. On Friday, the pair cleared a confluence support zone composed of the 200-day Simple Moving Average (SMA) at 192.48 and the 20-day SMA at 192.74, but sellers failed to achieve a daily close below those levels, and buyers entered the market.

So far, the GBP/JPY has reclaimed the 193.00 figure. If buyers want to extend their gains, they must clear the May 22 high of 193.58 ahead of 194.00. Once done, traders could set their eyes on the Tenkan-sen at 194.33, followed by the 195.00 mark.

Conversely, if GBP/JPY falls below 192.00, key support levels will be exposed, as bulls’ lack of momentum will lower prices. The next support would be the 50—and 100-day SMA confluence at 191.71, followed by the 191.00 figure.

GBP/JPY Price Chart – Daily

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.87% | -1.02% | -0.96% | -0.82% | -0.08% | -0.25% | -0.98% | |

| EUR | 0.87% | -0.17% | -0.03% | 0.11% | 0.92% | 0.68% | -0.09% | |

| GBP | 1.02% | 0.17% | -0.15% | 0.28% | 1.09% | 0.86% | 0.08% | |

| JPY | 0.96% | 0.03% | 0.15% | 0.15% | 1.05% | 0.92% | 0.05% | |

| CAD | 0.82% | -0.11% | -0.28% | -0.15% | 0.75% | 0.57% | -0.20% | |

| AUD | 0.08% | -0.92% | -1.09% | -1.05% | -0.75% | -0.23% | -0.98% | |

| NZD | 0.25% | -0.68% | -0.86% | -0.92% | -0.57% | 0.23% | -0.77% | |

| CHF | 0.98% | 0.09% | -0.08% | -0.05% | 0.20% | 0.98% | 0.77% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.