GBP/JPY Price Analysis: Pound holds steady near 191.00 amid mixed technical landscape

- GBP/JPY trades near the 191.00 zone with little movement after Monday’s European session.

- Overall tone is neutral, with short-term signals diverging and long-term resistance capping upside.

- Support remains just below current levels, while resistance aligns near recent highs.

The GBP/JPY pair showed marginal movement on Monday, holding near the 191.00 zone following the European session. Price action remained flat within a narrow range, reflecting uncertainty in direction as momentum indicators deliver conflicting signals. While intraday buyers provided minor support, broader trend signals remain undecided.

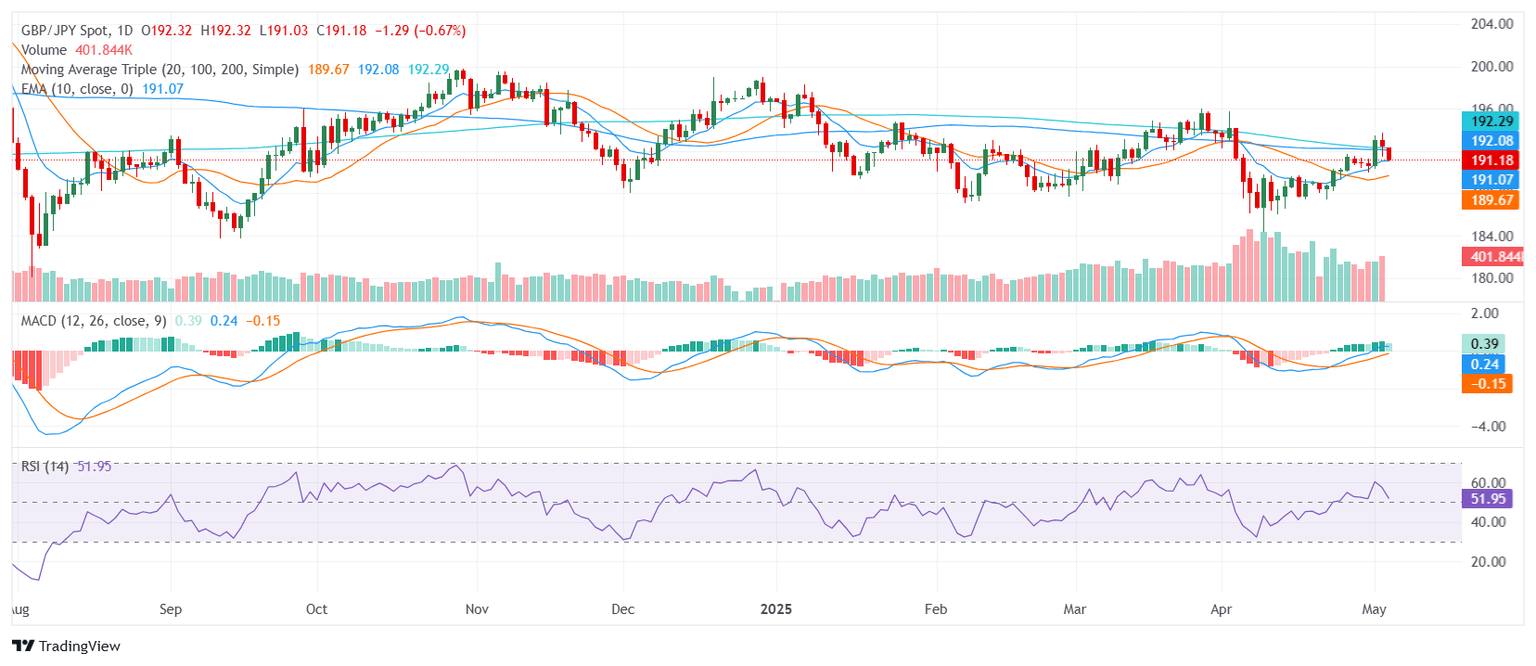

Technically, GBP/JPY is currently exhibiting a neutral outlook. The Relative Strength Index is flat near 52, confirming a lack of directional momentum. The Moving Average Convergence Divergence offers a mild buy signal, but this is countered by a bearish print from the Momentum indicator. The Awesome Oscillator adds to the indecision, staying neutral, while the Ichimoku Base Line also lacks a clear bias.

Trend indicators further illustrate the standoff. The 20-day Simple Moving Average, positioned below price, suggests some bullish undertone in the short term. However, the 100-day and 200-day SMAs — both above current levels — point downward, acting as broader resistance. Until those longer-term levels are breached, any upside may be capped.

Support is found at 191.07, 191.05, and 190.98. Resistance levels lie at 191.17, 191.70, and 191.98. A sustained move outside this tight band may be required to establish a clearer directional breakout in the coming sessions.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.