GBP/JPY Price Analysis: Holds steady around 191.00 amid thin liquidity conditions

- GBP/JPY hovers around 191.00, with trading subdued due to the Easter holiday.

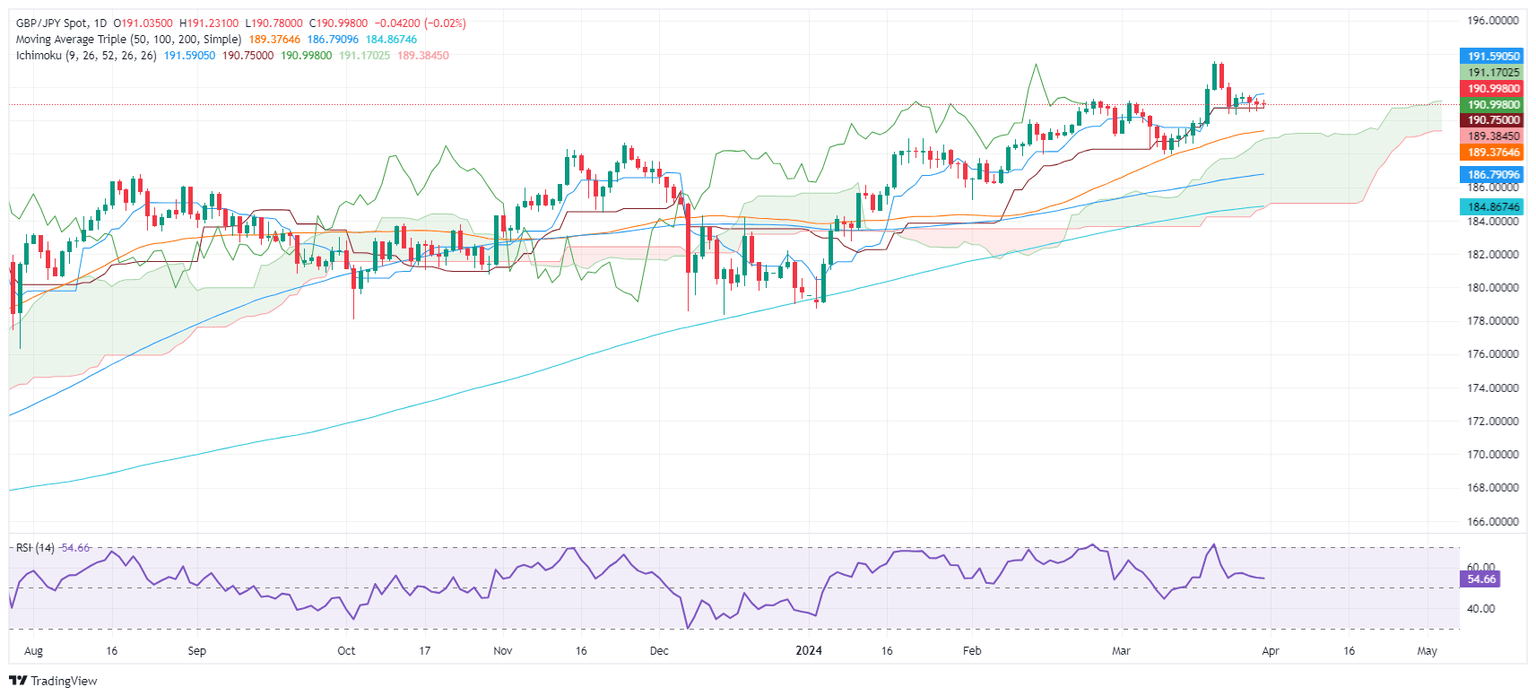

- Technical indicators show potential for movement, with key levels at 191.57 and 190.74, marking immediate targets.

- Future direction hinges on breaking 192.00 resistance or 190.00 support.

On Friday, the GBP/JPY remained steady at around 191.00, almost flat, as the financial markets remained closed in observance of the Easter holiday. In the meantime, Fed Chair Jerome Powell crossed the newswires, saying that monetary policy is well placed to react to a range of different data paths.

GBP/JPY Price Analysis: Technical outlook

The daily chart suggests the GBP/JPY is trading sideways, capped on the upside by the Tenkan-Sen at 191.57. Since the pair fell below the latter, the exchange rate has remained beneath the 191.40 area, which has opened the door for further downside.

A push below 191.00 could pave the way for a deeper pullback. The next support would be the Kijun Sen at 190.74, followed by the March 25 wing low of 190.33. A breach of the latter would expose the next support level at 190.00.

On the other hand, if GBP/JPY stays afloat and rallies above the Tenkan-Sen, that would open the door to challenge 192.00. Further gains are seen above that level, with the 193.00 mark, followed by the current year-to-date (YTD) high of 193.53.

GBP/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.