GBP/JPY Price Analysis: Holds steady above 151.50 confluence, awaits BoJ decision

- GBP/JPY was seen oscillating in a range just above mid-151.00s ahead of the BoJ decision.

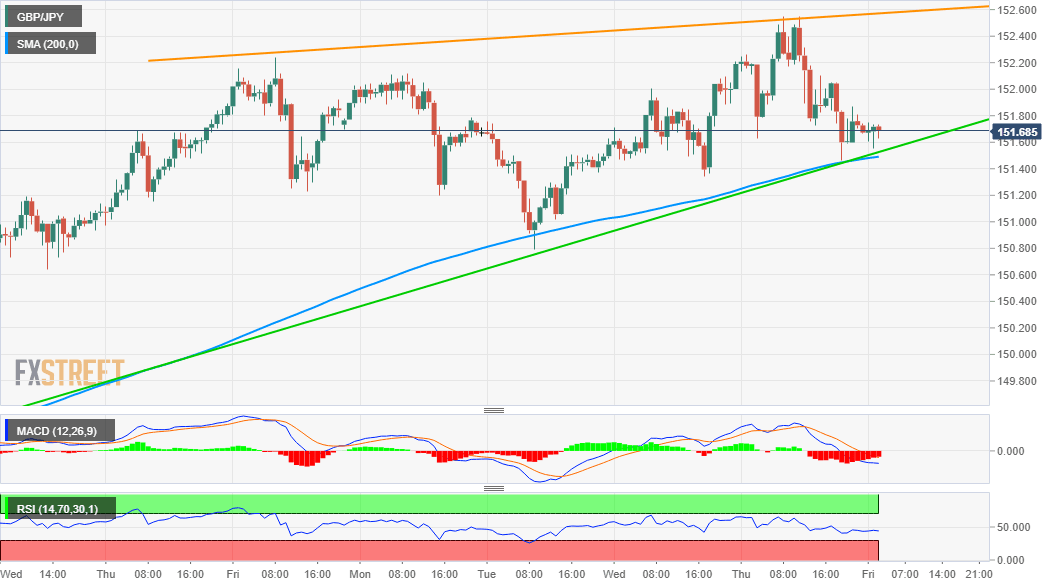

- The overnight pullback from multi-year tops could be seen as signs of bullish exhaustion.

- Bears now await a break below 200-hour SMA/ascending trend-line confluence support.

The GBP/JPY cross lacked any firm directional bias on Friday and remained confined in a narrow trading band, above mid-151.00s through the Asian session.

From a technical perspective, the overnight pullback from levels beyond mid-152.00s, or near three-year tops could be seen as the first sign of bullish exhaustion. Moreover, RSI (14) on the daily chart is still holding above the 70.00 mark, pointing to slightly overstretched conditions.

Despite the negative set-up, the GBP/JPY cross, so far, has managed to defend 200-hour SMA support. This coincides with a multi-week-old ascending trend-line and should now act as a key pivotal point for short-term traders as the focus remains on the critical BoJ policy decision.

A convincing break below will be seen as a fresh trigger for bearish traders and prompt some aggressive long-unwinding. The GBP/JP cross might then accelerate the corrective slide towards the 151.00 mark before eventually dropping to retest weekly swing lows, around the 150.80-75 region.

Some follow-through selling should pave the way for additional weakness towards the key 150.00 psychological mark. The latter marks a previous strong resistance breakpoint and should now act as a strong bass for the GBP/JPY cross, which if broken will negate any near-term positive bias.

On the flip side, immediate resistance is pegged at the 152.00 round-figure mark ahead of multi-year tops, around the 152.50-55 region. A sustained move beyond, though seems unlikely, should assist the GBP/JPY cross to reclaim the 153.00 mark for the first time since April 2018.

GBP/JPY 1-hopurly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.