GBP/JPY Price Analysis: Dives on safe-haven flows towards the Yen

- GBP/JPY dips 0.45% to 181.80, as rising Israel-Hamas conflict propels Yen’s safe-haven appeal.

- Technical outlook reveals potential bearish bias, with eyes on critical support and resistance levels.

- Short-term neutrality may pivot to bearishness or bullishness, contingent on geopolitical and economic updates.

The GBP/JPY recovery stalls on Monday, following developments during the weekend, as the conflict between Hamas and Israel escalated. Hence, the Japanese Yen (JPY) was favored on safe-haven status, stalled last week’s rally, with the pair trading at around 181.80, down 0.45%.

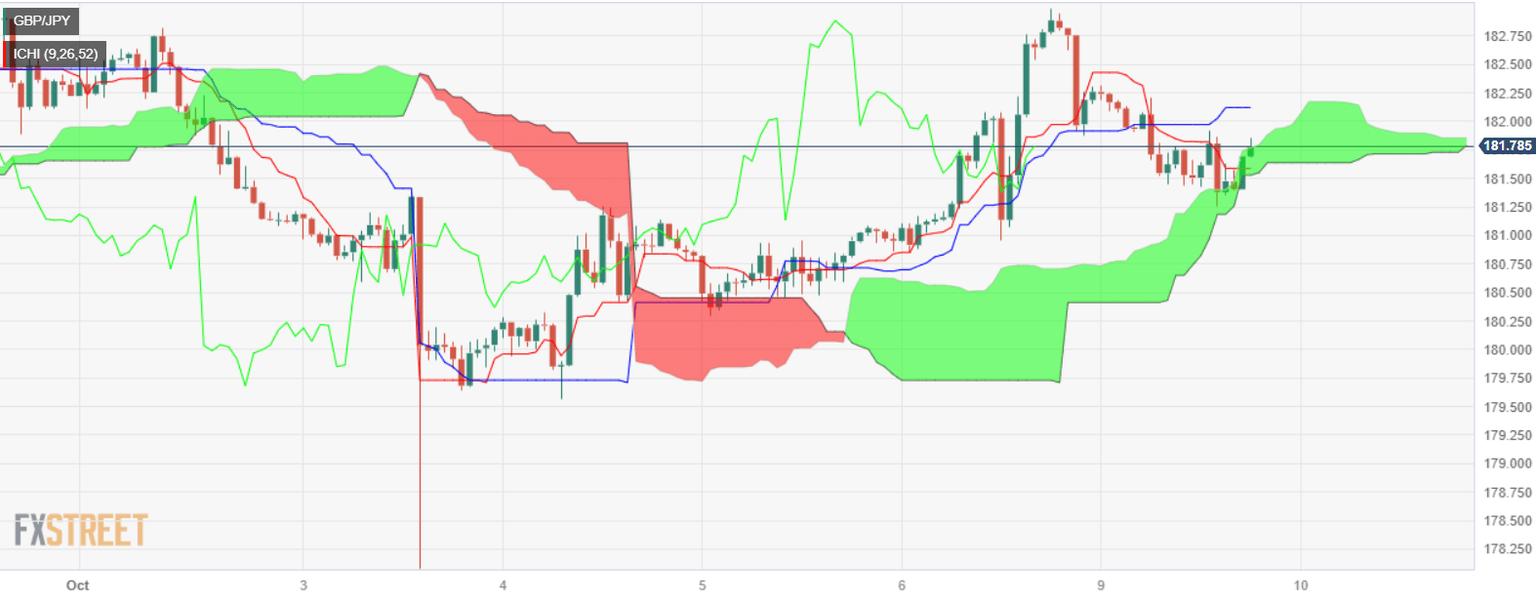

The daily chart portrays the cross as neutral to downward biased, hovering towards the bottom of the Ichimoku Cloud (Kumo), which, if broken, would confirm the bearish bias and open the door to test the October 3 daily low of 178.03. If that level is broken, that could pave the way towards the July 28 swing low of 176.30.

Short term, the GBP/JPY pair is neutral biased, about to break above the Kumo, which could pave the way to test the Kijun-Sen at 182.11. An extension of its gains past the latter would expose 183.00. On the other hand, if the GBP/JPY breaks below the Kumo, the next support would emerge on today’s daily low of 181.25. Once cleared, the next stop would be 181.00, followed by last Friday’s 180.84.

GBP/JPY Price Action – Hourly chart

GBP/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.