GBP/JPY Price Analysis: Climbs to YTD high above 184.00 amidst a soft JPY

- GBP/JPY reached a new YTD high above 184.00.

- A favorable technical setup, including the Ichimoku Cloud (Kumo) position and a Tenkan-Sen/Kijun-Sen crossover, supports a bullish outlook.

- If the GBP/JPY retraces below 183.00, it might witness an accelerated pullback towards technical support at 182.32 and 182.00, with Kumo’s top and the Kijun-Sen providing subsequent support levels.

Pound Sterling (GBP) extended its gains against the Japanese Yen (JPY) on Thursdays, as the latter weakened as inflation in the United States (US) decelerated, though it triggered a rally in the USD/JPY pair. Consequently, the GBP/JPY printed a new year-to-date (YTD) high of 184.24. At the time of writing, the GBP/JPY exchanges hands at 183.44, up 0.34%.

GBP/JPY Price Analysis: Technical outlook

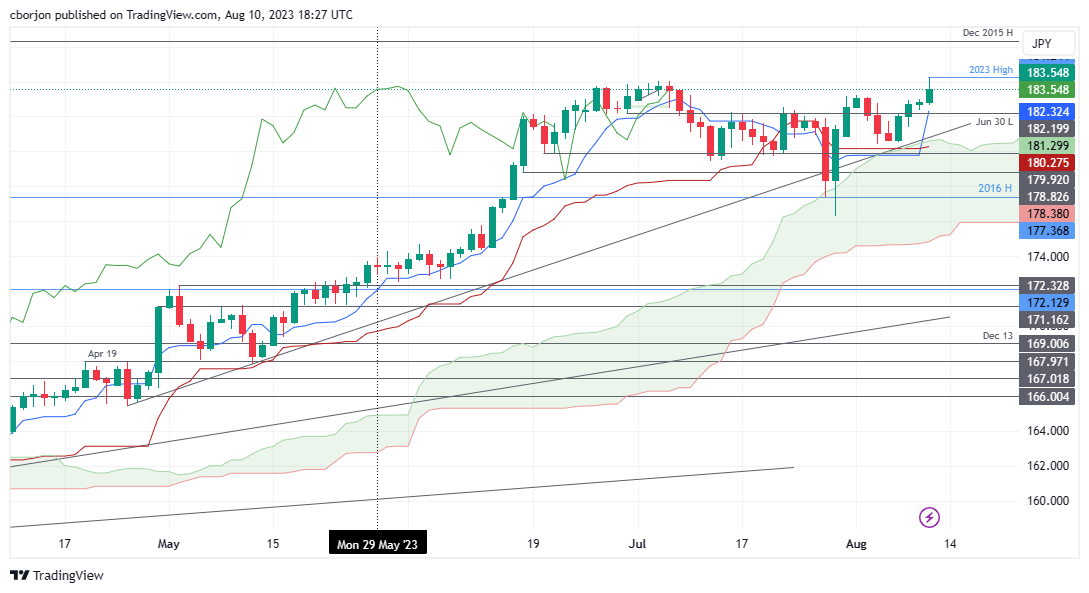

The GBP/JPY resumed its uptrend, despite dipping towards the 183.40s area as of writing, sponsored by several factors. The Ichimoku Cloud (Kumo) remains below the price action, while the crossover of the Tenkan-Sen above the Kijun-Sen, opened the door for further upside, as seen during Thursday’s session.

For the GBP/JPY to extend its uptrend toward the 185.00 figure, buyers must reclaim 184.00, followed by the YTD high of 184.24. Conversely, if GBP/JPY continues to edge lower and breaks below 183.00, that could exacerbate the pullback. Hence, the GBP/JPY first support would be the Tenkan-Sen at 182.32, followed by a support trendline at around 182.00. Break below will expose the Kumo’s top at 180.60/75, followed by the Kijun-Sen at 180.27.

GBP/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.