GBP/JPY Price Analysis: Again retreats from six-month-old resistance

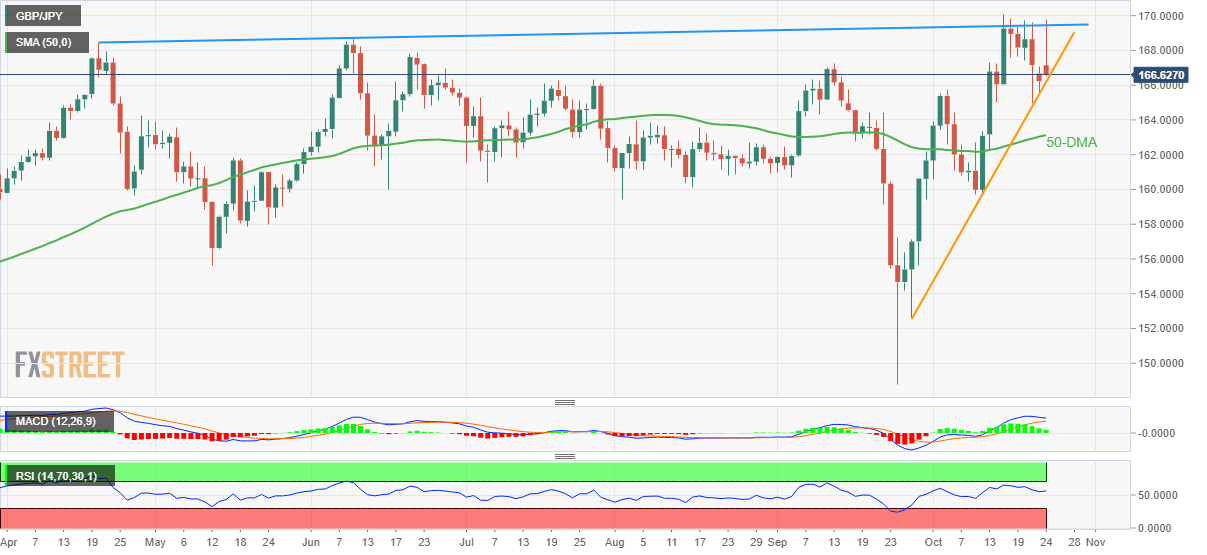

- GBP/JPY reverses the week-start rebound while taking a U-turn from a six-month-old resistance line.

- Oscillators, sustained trading beyond monthly support keeps buyers hopeful.

- 50-DMA adds to the downside filters, 175.00 could lure bulls during a strong run-up.

GBP/JPY takes offers to renew intraday low around 166.60, reversing the week-start run-up, as it drops towards one-month-old support during Monday’s Asian session. In doing so, the yen cross again reverses from the six-month-old upward-sloping resistance line.

However, bullish MACD signals and the steady RSI requires the GBP/JPY bears to remain cautious unless they break the aforementioned support line, around 166.20 by the press time, as well as conquer the 166.00 thresholds.

Following that, a downward trajectory towards the 50-DMA support of 163.10 becomes imminent.

Though, the 160.00 psychological magnet and the monthly low near 159.70 could challenge the GBP/JPY sellers afterward.

On the flip side, a daily closing beyond the ascending resistance line from April, around 169.85, as well as a successful break of the 170.00 round figure, becomes necessary for the GBP/JPY buyers.

In that case, a run-up toward the February 2016 high near 175.00 will be much more likely on the bull’s radar.

Overall, GBP/JPY remains on the buyer’s radar despite the latest pullback from the key resistance line. However, the odds of the short-term downside can't be ruled out.

GBP/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.