GBP/JPY looking for support from 181.40 as Sterling falls back, Yen gains

- GBP/JPY down 0.70% in Monday trading as Pound Sterling recedes.

- Risk aversion market flows are sending investors into safe havens.

- Market concerns about an economic slowdown continue to sap market confidence.

The GBP/JPY has declined 125 from Monday's peak near 182.25 as the Pound Sterling (GBP) swoons against the safer Japanese Yen (JPY). Broader market sentiment has soured to kick off the new trading week, and early gains are giving way to deepening red as Monday rounds the corner into Tuesday's Asia market session.

The Pound Sterling is broadly expected to suffer with an overly cautious Bank of England (BoE) at the helm; an unexpected rate hike pause from the UK's central bank, coupled with incredibly dovish language from various BoE officials, exposes the GBP to the downside unless inflation returns in a meaningfully-enough way to jumpstart the BoE's rate hike decision-making.

Traders hoping for inspiration from the economic calendar are in for a disappointing trading week, with little of note on the data docket for either currency.

Japan's Tankan Manufacturing Index & Outlook figures for the third quarter exceeded expectations on Monday. The Tankan Manufacturing Index printed at a solid 9, well above the forecast 6 and easily beating the previous print of 5.

The Tankan Manufacturing Outlook also beat the books, climbing from the previous 9 to print at a nice round 10, handily wiping out the market forecast of 5.

The only remaining notable data for the week will be Thursday's wage figures from Japan, due at 23:30 GMT.

GBP/JPY technical outlook

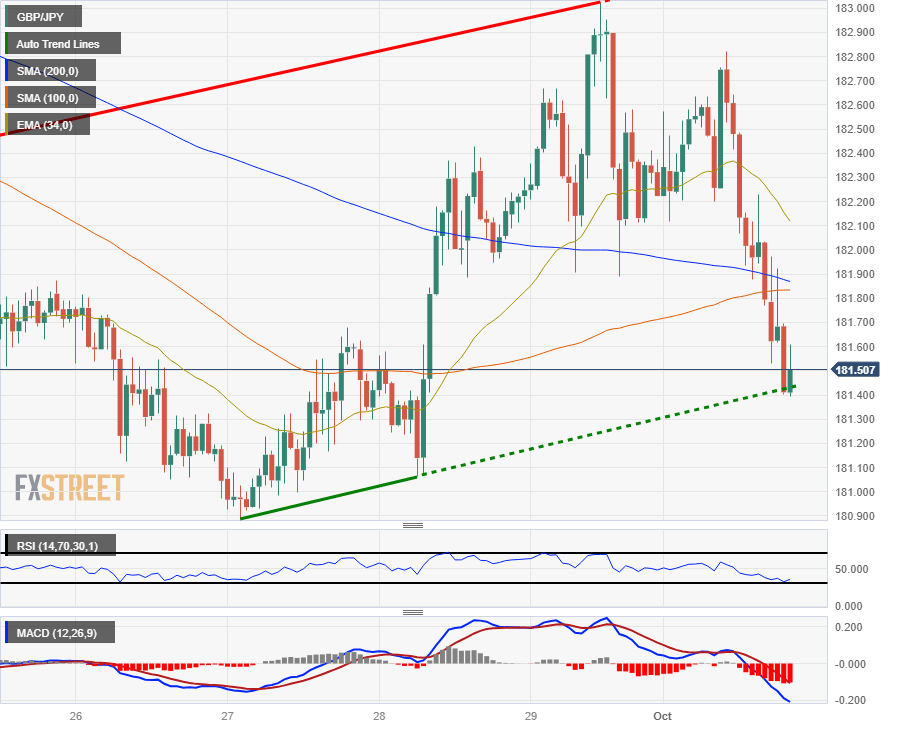

The Guppy's backslide from Friday's peak near 182.80 is seeing hourly candles bounce from a near-term raising trendline marked in from last week's swing low into 180.90, and bidders will be looking to gain enough momentum to make a break for the 200-hour Simple Moving Average (SMA) near 181.90.

The downside is starting to open up wide, and short-side pressure is mounting to take the GBP/JPY into September's lows near 180.80.

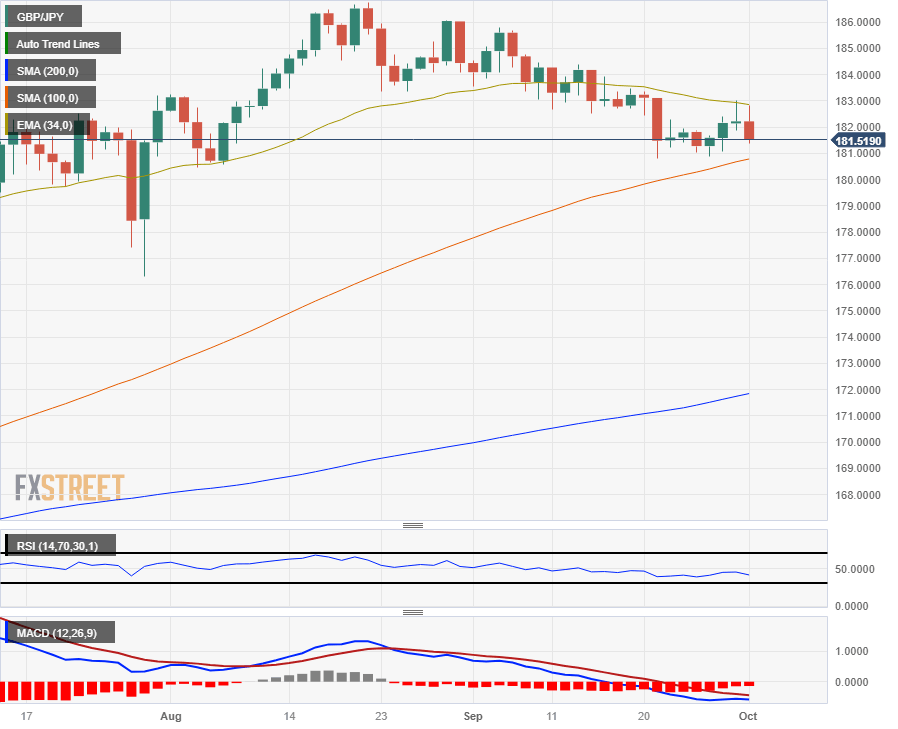

On the daily candlesticks, the GBP/JPY continues to lose its nerve, waffling from August's swing high above 186.00 to trade on the bearish side of the 34-day Exponential Moving Average (EMA) currently settling into the 183.00 handle.

With technical support coming from the 100-day SMA just south of the 181.00 handle, GBP traders will have their work cut out for them if they're going to halt a long-term decline to the 200-day SMA far below current price action at 172.00.

GBP/JPY hourly chart

GBP/JPY daily chart

GBP/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.