GBP/JPY breaks consolidation, dips into 181.30 after BoE balks on rate hikes

- The GBP/JPY skidded into the 181.00 handle after the BoE stepped back from an anticipated rate hike.

- Inflation might be falling faster than previously thought in the UK, rapidly cooling rate expectations.

- UK retail sales and PMI still in the pipe for Friday.

The GBP/JPY fell out of its recent trading range, colliding with the 181.00 major level before GBP bulls were able to catch a mild intraday relief rally to keep the Guppy trading into 181.30 heading into the end of Thursday trading.

BoE turns dovish on subsiding inflation

The United Kingdom's (UK) Consumer Price Index (CPI) figures on Tuesday came in below expectations, printing at 0.3% versus the expected 0.7%. The decline in headline inflation was enough to knock the UK's central bank back from a broadly expected rate hike as inflation appears to recede faster than previously expected.

The Bank of England (BoE) stepped back from the rate hike cycle, holding its benchmark interest rate at 5.25% versus the expected 25-basis-point hike to 5.5%.

The Bank of Japan (BoJ) is similarly expected to hold interest rates steady at -0.1% when the Japanese central bank meets on Friday.

Friday will also see Retail Sales and Purchasing Manager Index (PMI) figures for the UK. Retail Sales for August are expected to rebound from -1.2% to 0.5%, and Composite PMIs are expected to tick up slightly to 48.7 from 48.6.

The recent miss on CPI could see economic data for the UK come in below expectations, pushing the BoE further back on their rate expectations looking forward.

GBP/JPY technical outlook

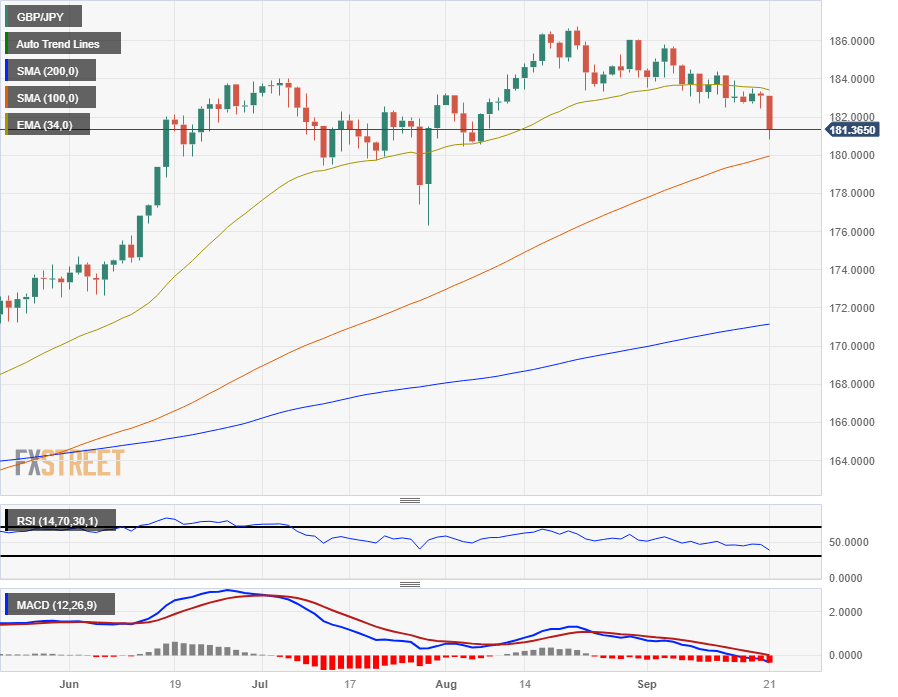

The GBP/JPY fell a full percentage point after the BoE blinked on rates, taking the Guppy down into the 181.00 region. GBP bulls were able to recover the pair into 181.30, but further downside remains on the cards if buyers can't push the pair back towards the 200-hour Simple Moving Average (SMA) near 183.25.

In the meantime, a pattern of lower highs remains intact from late August's peaks near 186.70.

On the daily candlesticks, the Guppy is set to challenge the 100-day SMA currently parked near 180.00, and a rebound into bullish momentum will need to remount the 186.00 level before extending further.

GBP/JPY daily chart

GBP/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.