GameStop Stock News and Forecast: GME stock falls to key support

- GME stock continues its slide lower.

- Ryan Cohan and equity backdrop continue to hinder GME stock.

- GME stock sees its next key support at $29.

GameStop (GME) stock continues to suffer from a combination of factors hindering its performance. By now we are all familiar with the Ryan Cohen RC Ventures scenario in Bed Bath & Beyond (BBBY). This has soured some investors' faith in his long-term plans for GameStop. We have outlined how being chairman of GameStop means the investment here is likely different, but the sentiment is powerful and hard to shift once established.

GameStop also will feel the effects now of higher rates being penciled in as investors reprice risk assets using a higher interest rate. Recall from our deep dive series how when calculating discounted cash flows to reach the terminal future value we discount back to the present value using the interest rate and the growth rate. A combination of higher interest rates and lower growth rates is a double blow to the DCF model, meaning equity valuations go lower. GME needs growth.

GameStop stock news

Needing growth is one thing, but getting it may prove difficult. Videogame sales are slowing, according to data out earlier this month. GME entered the NFT marketplace, which has also notably slowed. September 7 is when we get the next earnings report from GameStop, and it will be difficult for management to paint a bullish picture. Revenue growth has already reversed and is now in decline. Revenue from January 2022 to April 2022 went from $2.2 billion to $1.3 billion. Gross profit in the same period went from $378 million to $298 million. Analysts are expecting EPS of $-0.42 and revenue of $1.27 billion. Again if earnings come in line, revenue is flat, while costs are likely to increase due to inflation. Margin pressure is being felt across all industries.

GameStop stock forecast

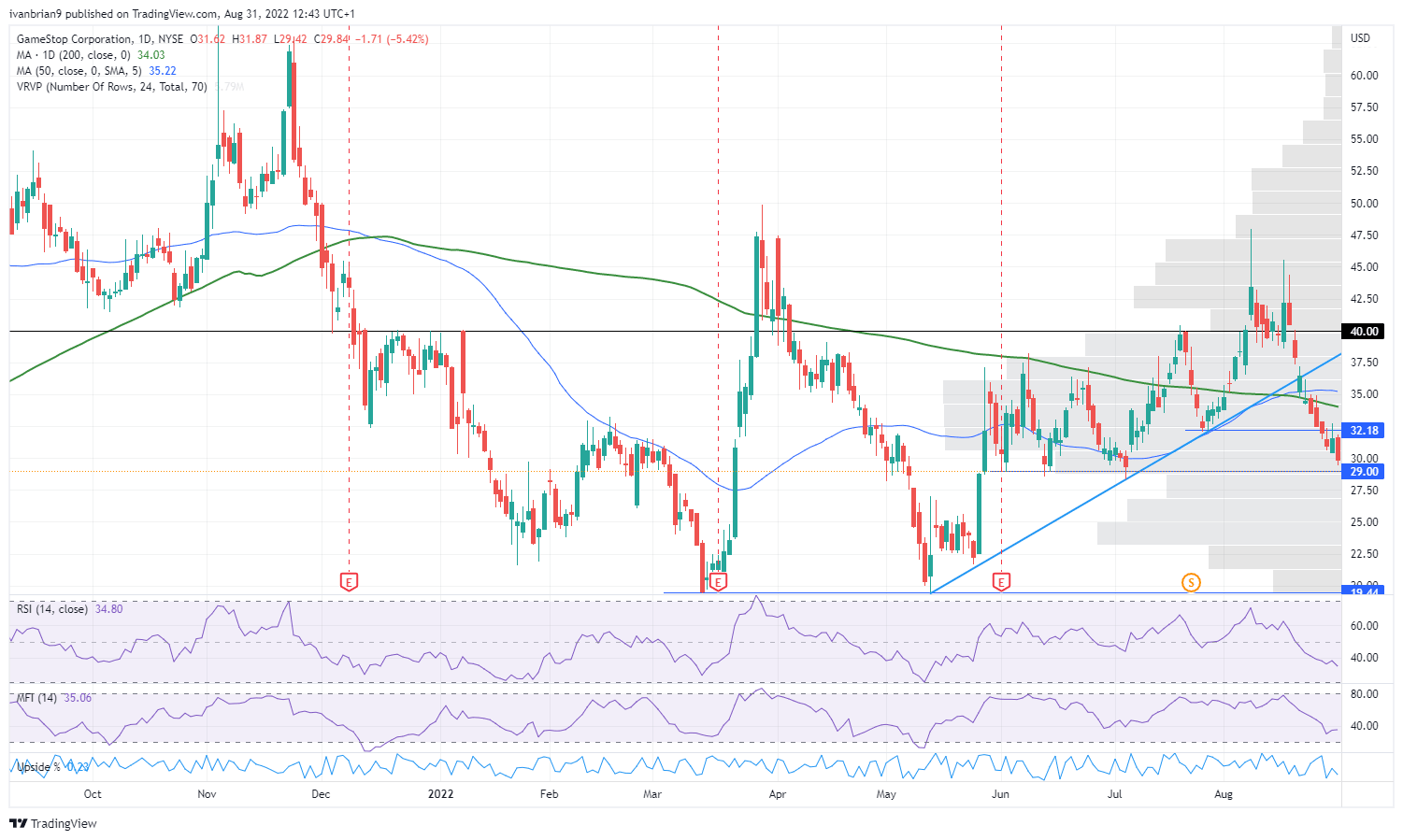

A near-perfect double top was accompanied by a bearish divergence from the Relative Strength Index (RSI) and the Money Flow Index (MFI). The stock has now broken the 200-day and 50-day moving averages and support at $32.18. That leaves $29 as the immediate target, and a break there will target $19.44.

GME daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.