GameStop (GME) Stock News and Forecast: GME loses more ground to break key support

- GME stock slides again on Thursday as risk is avoided.

- Jackson Hole could give clues as to future equity direction on Friday.

- GameStop (GME) breaks key support at $32.18.

GameStop (GME) stock lost more ground on Thursday as investors braced for a hawkish tilt from Fed Chair Powel at the Jackson Hole symposium on Friday. This would mark another supposed pivot after the dovish pivot only a few weeks ago. Confusion and uncertainty are detested by the market, and hence we are left scrambling for direction.

GameStop stock news

The hangover effect from BBBY and Ryan Cohen continues to weigh on GME stock, and why wouldn't it? GME shareholders have placed Cohen on a pedestal and anointed him as the savior of GameStop. Retail traders were naturally delighted then when RC Ventures took a stake in another meme stock favorite BBBY. The sudden sell-off last week in BBBY left many retail traders nursing serious losses though and made them rethink that honor given to Cohen.

This probably led to some retail selling of GameStop as perhaps confidence waned and or retail traders needed to sell GME to raise cash to cover BBBY losses. However, Cohen is chairman of GameStop, so the story looks a little more complex there with hopefully more of a longer term slant. There is still a lot of work to do to turn around GME. Video game sales are declining according to the latest data, and Sony was not exactly bullish on gaming with price rises for the PS5 due to cost pressures. Microsoft gaming results were also showing a decline in the latest earnings for the Xbox. Plenty of headwinds for GME are apparent then without some retail traders losing faith in Cohen.

GameStop stock forecast

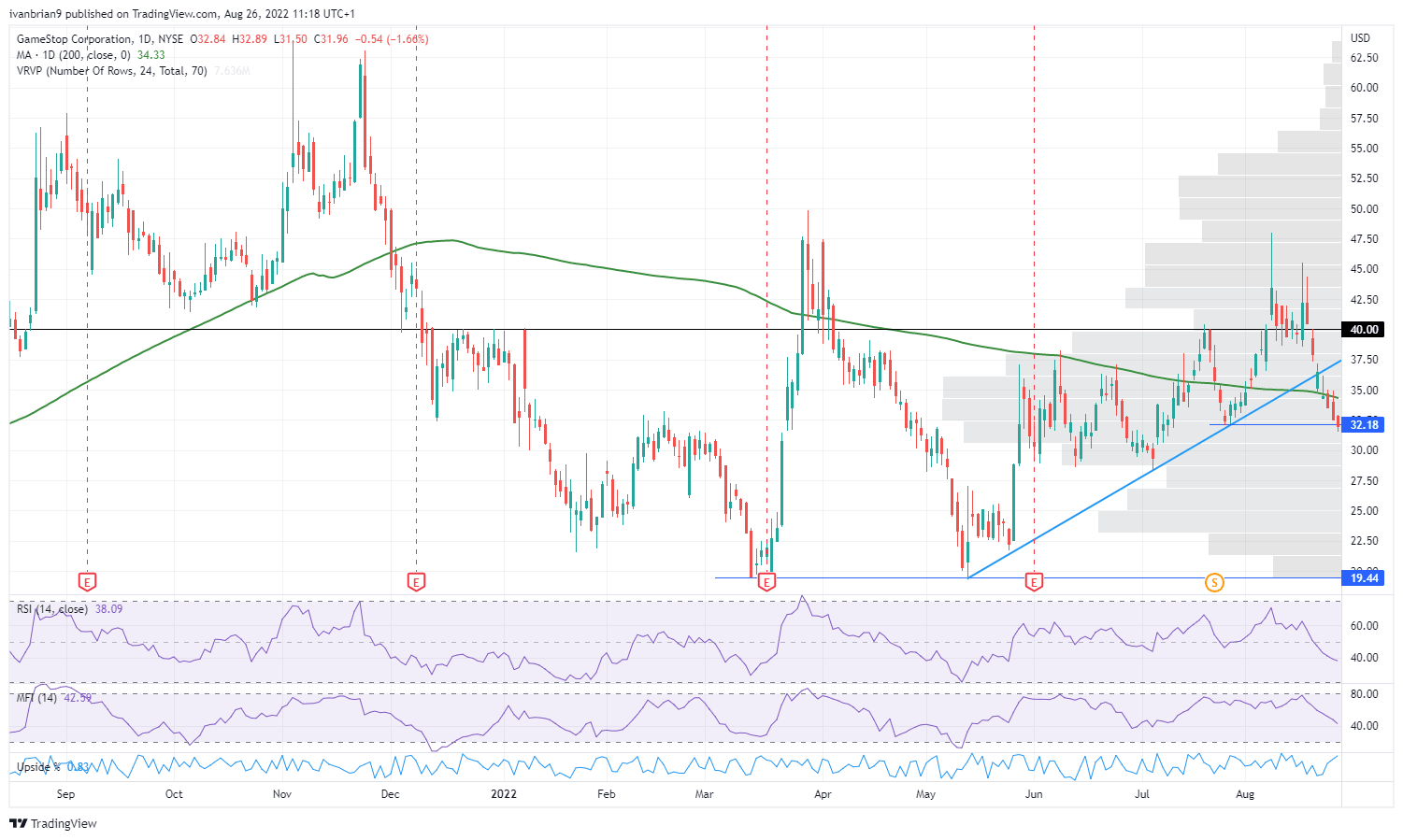

GME stock has broken support at $32.18 and the 200-day moving average. The meme stock rally is over, and so GME resumes a downtrend. The ultimate target is $19.44, but support at $29 is the immediate target. There has been high volume here, and below volume thins out, which could accelerate losses.

GME stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.