Futures on the rise: Nasdaq and S&P 500 set sights on key daily targets

With both indices pressing critical pivot levels, we outline our mid-term bias and intraday triggers—leaning bullish but waiting for price-action confirmation.

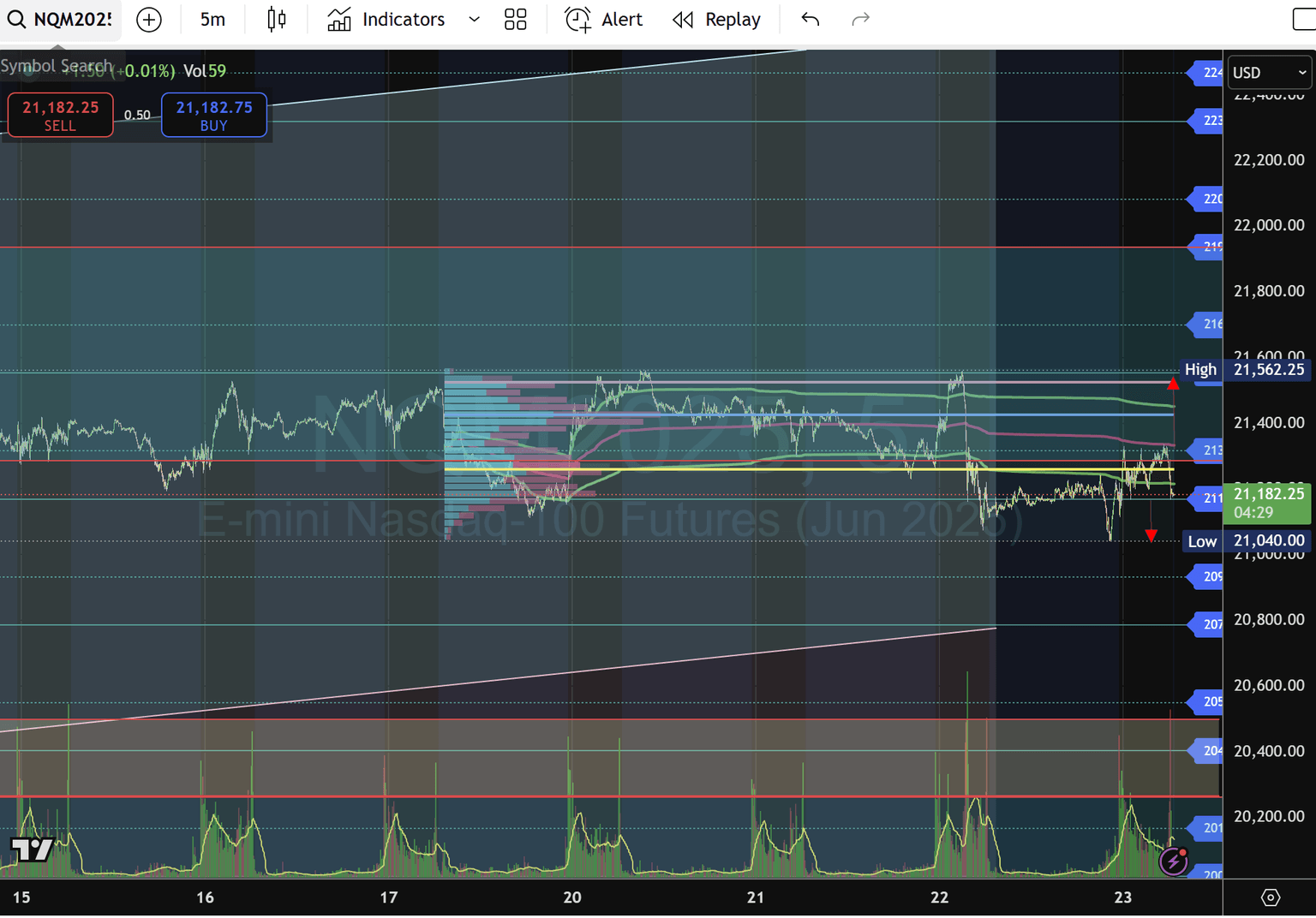

Weekly five-minute context

Nasdaq-100 Futures (NQM2025).

-

Mon: Sharp gap up from ~20,502 into the 21,100–21,200 area. Choppy rotation between 21,100 support and 21,315 resistance.

-

Tue–Wed: Buyers repeatedly defended 21,169; upside capped at 21,315–21,364 (POC). Value area formed ahead of today's open.

-

Thu: Brief dip below 21,169 on US open, swift recovery above 21,200, and held just under 21,315—setting the stage for a fresh breakout attempt.

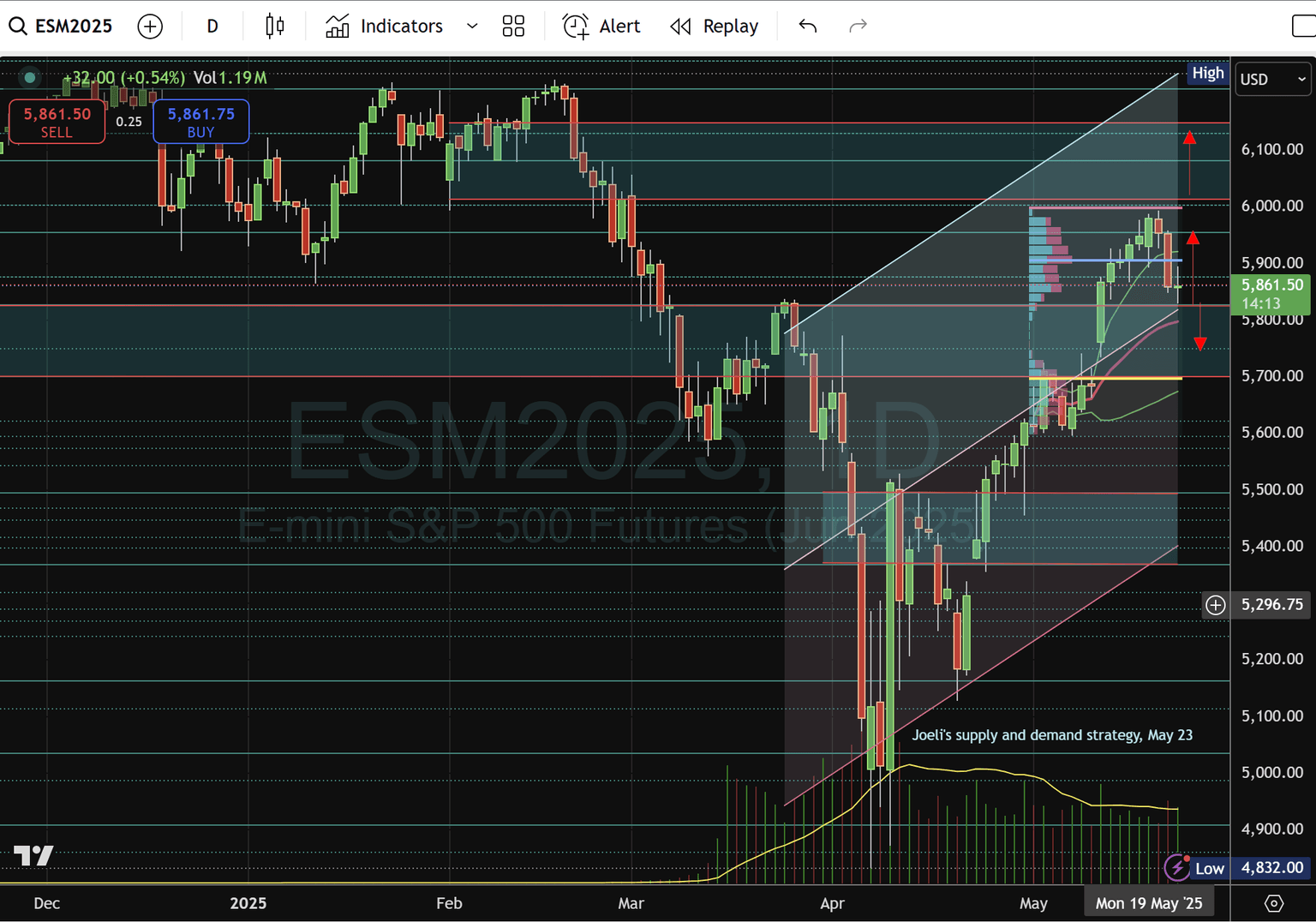

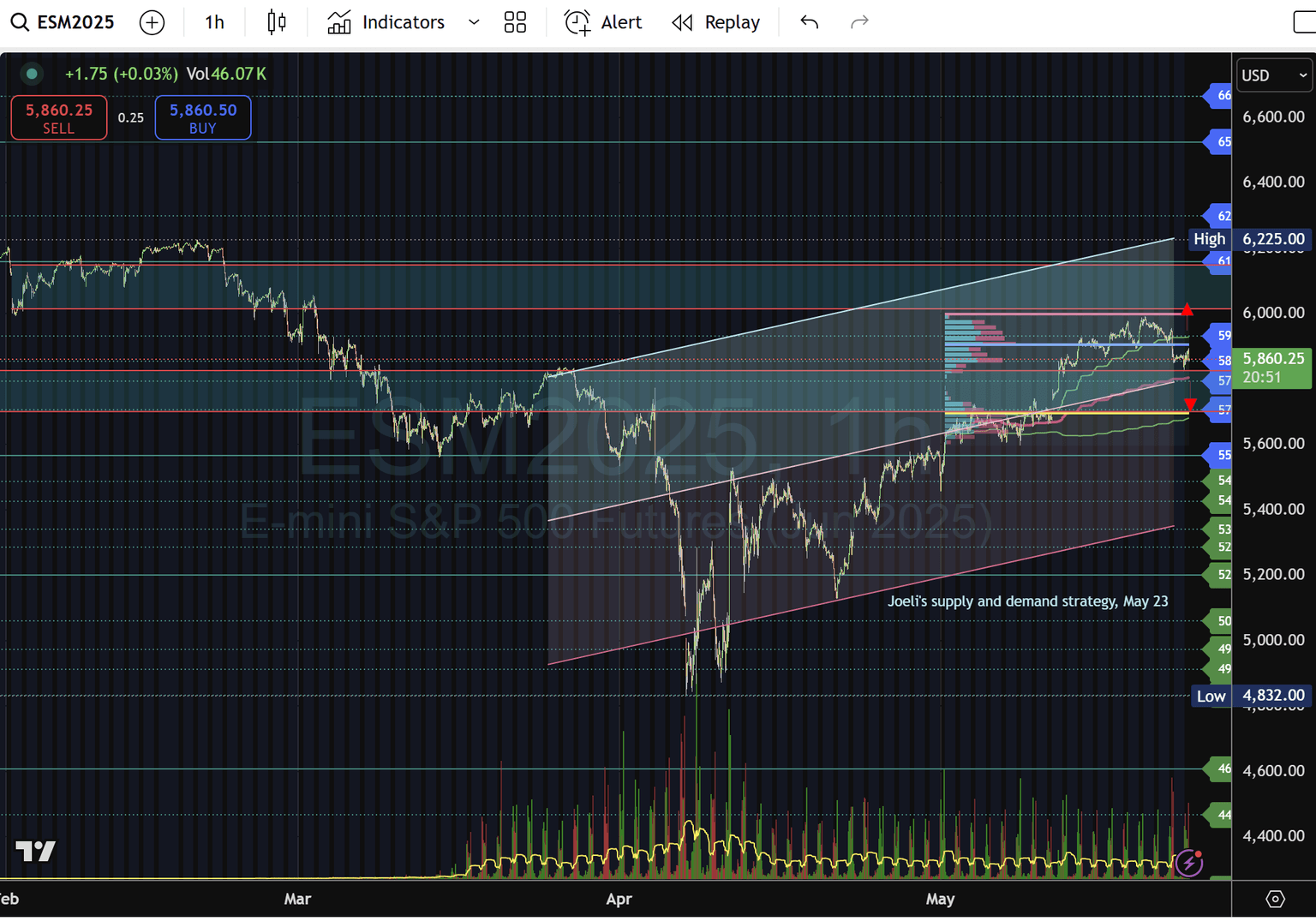

S&P 500 Futures (ESM2025)

-

Mon: Sold into the FVG demand zone 5,827–5,849, then rallied into 5,900–5,930.

-

Tue–Wed: Consolidation between 5,870 support and 5,904 resistance, anchored by VWAP (yellow) and POC (blue). Two tests of 5,870 were held.

-

Thu: Early break below 5,870 down to 5,828, then reclaimed into 5,904. Late session held above 5,870, priming today's retest of 5,904 pivots.

Mid-term summary

Nasdaq-100: Structure - Above daily VAL 21,100 (gap pivot). March-May demand intact. Bullish Scenario - Hold >21,100 → 21,497 → 21,743 → 22,140 → 22,385 / 22,782 supply. Bearish Scenario - Break <21,100 → 20,855 → 20,458 → 20,212. Loss risks Q1 lows near 19,600.

S&P 500: Structure - Respecting FVG demand 5,827–5,849; daily POC at 5,954. Bullish Scenario - Reclaim >5,876 → 5,954 → 6,000 → 6,000–6,208 supply. Bearish Scenario - Break <5,827 → 5,749–5,700. Failure below 5,700 risks a deeper pullback toward 5,650.

Overall Bias: Lean bullish toward daily targets—but only upon clean holds above each pivot. If pivots fail, bias shifts neutral-to-bearish.

Intraday play triggers

A. Nasdaq-100 Futures (NQM2025)

-

H1 Triggers:

-

Bullish: Hold >21,154 → ramp to 21,364 (POC) → 21,410 → 21,505 → 21,557 (VAH).

-

Bearish: Break <21,154 → drop to 21,014 → 20,905 → 20,751.

-

-

5-Minute Entries:

-

Long: 1-min close >21,315 → scale at 21,419 & 21,552; final run to 21,669–21,935.

-

Short: Close <21,169 → target 20,932 & 20,786; stop above 21,315.

-

B. S&P 500 futures (ESM2025)

-

H1 Triggers:

-

Bullish: Reclaim >5,854 → 5,932.50 (POC) → 5,979.75 → 6,023 (61.8% Fib).

-

Bearish: Break <5,854 → test FVG zone 5,792.50–5,706.25.

-

-

5-Minute Entries:

-

Long: 1-min close >5,904 → targets 5,931 → 5,960 → 5,994–6,000.

-

Short: Break <5,870 → target 5,828 → 5,814; stop above 5,904.

-

Execution and risk management

-

Confirmation: Wait for clean 1-minute closes beyond pivots before committing.

-

Stops: Place just beyond the opposing 5-min pivot (e.g., below 21,169 for NQ longs).

-

Sizing: Risk ≤ 1–1.5% of account per trade; move stop to breakeven after first target.

-

Watchlist: US data releases and Fed comments—adjust size during expected volatility spikes.

Remain patient—let price confirm key pivots before pulling the trigger. Always manage risk with a defined stop-loss and position sizing. This is not financial advice. Good luck!

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.