Freeport-McMoRan (FCX) should continue upside

Freeport-McMoRan Inc., (FCX) engages in the mining of minerals in North America, South America & Indonesia. It primarily explores for Copper, Gold, Molybdenum, Silver & other metals. It is based in Phoenix, Arizona, US, comes under Basic Materials sector & trades as “FCX” ticker at NYSE.

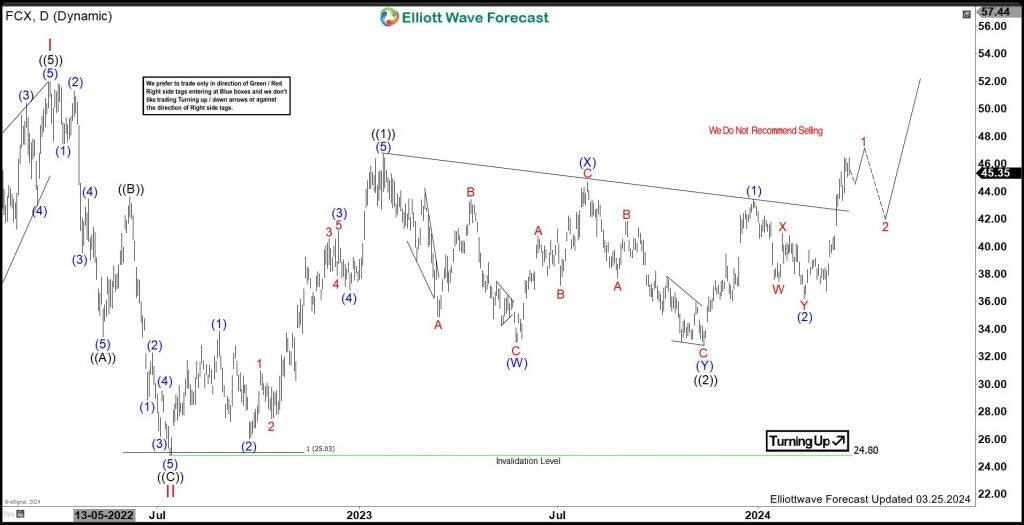

As showing in the previous article, FCX ended ((1)) of III at $46.73 high. It also ended ((2)) at $32.83 low & started reacting higher in ((3)), which confirms when it breaks above $46.73 high. It favors impulse upside in (3) of ((3)).

FCX – Elliott Wave latest weekly view

Since January-2016 low, it reacted higher in I as impulse sequence ended at $51.99 high in March-2022 peak. It ended II as 3 swing correction at $24.80 low as more than 0.5 Fibonacci retracement in July-2022. Above II low, it favored higher in ((1)) of III, which ended at $46.73 high. Within ((1)), it placed (1) at $33.89 high, (2) at $26.03 low, (3) at $41.16 high, (4) at $36.85 low & (5) at $46.73 high as ((1)). Below there, it ended ((2)) as double three correction at $32.83 low. Within ((2)), it placed (W) at $33.05 low, (X) at $44.70 high & (Y) at $32.83 low.

FCX – Elliott Wave latest daily view

Above ((2)) low, it favors upside in (3) of ((3)) & need to break above $46.73 high to confirm the next move higher. It placed (2) of ((3)) at $36.26 low & favors upside in 1 of (3), which expect one more push higher to finish it before correcting in 2. As long as it stays above $36.26 low, it expects rally to resume in (3) of ((3)) of III. Once it break above ((1)) high, it should extend up to $54.79- $68.36 area for ((3)) higher.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com