Fed: Implications of Warsh's nomination for Fed policy – BNY Markets

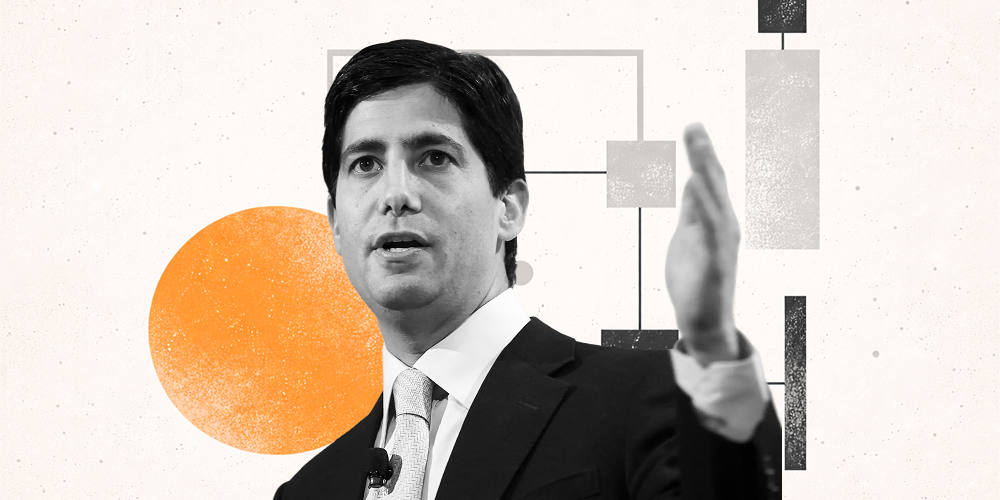

Kevin Warsh has been nominated by President Trump to be the next Fed chair, but his confirmation process may be complicated. Warsh's past as a hawk has shifted towards a more dovish stance in recent years. Analysts are closely watching how his leadership could affect the Federal Reserve's balance sheet and monetary policy, notes John Velis, Americas Macro Strategist at BNY Markets.

Impacts of Warsh's nomination

"Once confirmed, a process that may or may not be smooth sailing, Warsh will assume the Board of Governors seat currently held by Stephen Miran, himself a Trump appointee whose term formally expired on January 31 but will continue until Warsh is confirmed."

"Warsh has made himself clear on another aspect of monetary policy: the balance sheet. Calling it 'bloated,' he has advocated reducing its size."

"Reducing the size of the Fed’s System Open Market Account (SOMA) portfolio from its current 22% of GDP, or some $6.6tn, would again need to be endorsed by a majority of the Open Market Committee, similar to a change in rates."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.