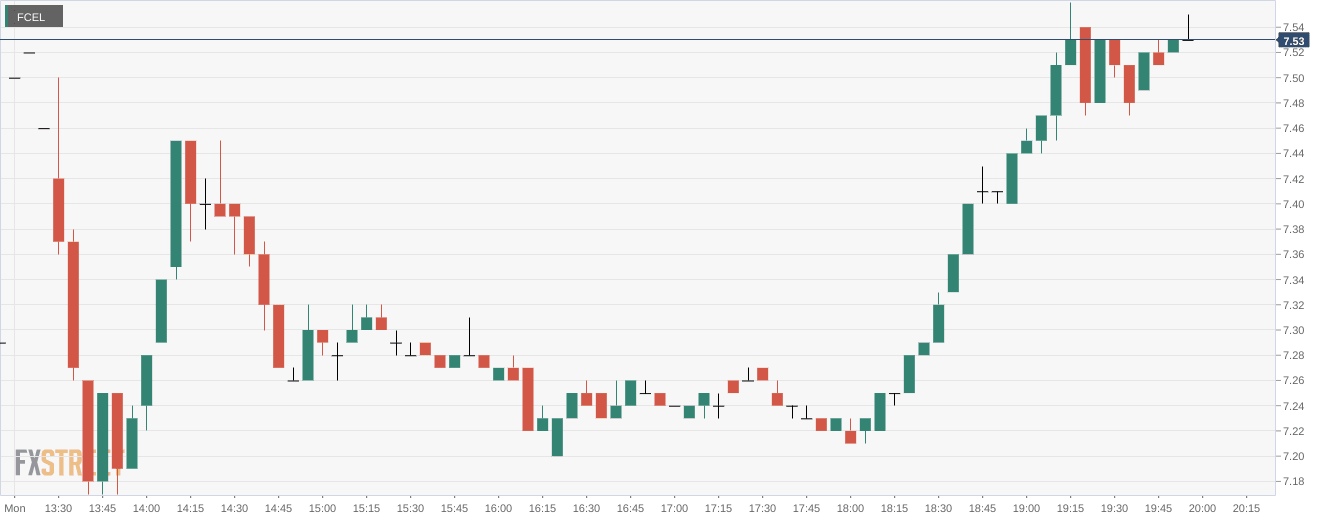

FCEL Stock News: FuelCell Energy rips higher into the close as a rival signs a massive partnership

- NASDAQ:FCEL gained 3.43% during Monday’s trading session.

- Bloom Energy signs a $4.5 billion new partnership with SK Group in South Korea.

- The alternative energy sector rebounded after Friday’s sell off.

NASDAQ:FCEL rose strongly into the close on Monday, as the NASDAQ paced the broader markets with a 0.9% gain as mega-cap tech stocks kicked off their earnings season. Shares of FCEL gained 3.43% and closed the session at $7.54. FuelCell Energy has been on the rise as of late, although shares are still down 1.43% during the past month. This can be seen in the fact that FCEL is currently trading above its 50-day moving average, but below its key 200-day moving average, indicating a longer-term downtrend for the hydrogen fuel cell manufacturer.

Stay up to speed with hot stocks' news!

FuelCell’s rival, Bloom Energy (NYSE:BE) skyrocketed on Monday and many stocks from the sector were riding higher in sympathy. Bloom announced that it has signed a massive $4.5 billion deal with South Korean energy conglomerate SK Group. The deal will see Bloom produce at least 500 megawatts of power by 2024, and builds upon a previous agreement between the two companies. The demand for alternative energy sources in the Asian markets is growing, so Bloom is positioning itself to be a major player as Asia moves towards carbon neutrality.

FCEL stock forecast

Most stocks in the alternative energy sector were flying on Monday. Stocks like FuelCell Energy and Plug Power (NASDAQ:PLUG) declined on no real news last Friday, as FuelCell tumbled by over 10%. Plug Power gained 6.67% on Monday, while Bloom Energy rebounded by an impressive 37.15% on the news of the previously mentioned deal with SK Group. It was a nice bounce back for a sector that has been beaten down so far in 2021.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet