EURUSD: The Euro reclaimed 0.9800 as Federal Reserve officials would tune subsequent rate hikes

- The Federal Reserve is laying the ground to shrink the size of upcoming interest rate hikes, weighed on the US Dollar.

- Falling US bond yields undermined the USD and boosted the EUR.

- The EURUSD is downward biased, though a break above 0.9900, could propel the EURUSD higher.

The US Dollar tumbled as traders braced for the weekend following a volatile session that initially witnessed the EURUSD hitting its daily lows of around 0.9704. Still, news that the Federal Reserve (Fed) officials will slow the rhythm of rate hikes lifted the Euro from its lows, propelling the EURUSD back above 0.9800. Therefore, the EURUSD is trading at 0.9856, up 0.17%.

Federal Reserve officials to adjust the pace of interest rates

In the New York session, the US Dollar was hit by news that Fed policymakers will discuss the size of subsequent interest rate increases to the Federal funds rate (FFR) at the November meeting. EUR buyers capitalized on the news, as the EURUSD recovered the 0.9800 figure. Later, San Francisco Fed President Mary Daly acknowledged what the article meant, commenting that even though rate hikes are needed and support a 75 bps increase for November, she added that it would not be 75 bps increases “forever.”

Echoing her comments was the St. Louis Fed President James Bullard, a voter in the Federal Reserve Open Market Committee (FOMC) in 2022. Bullard noted that the Fed had moved rates to a “higher level of the policy rate” and added that once you reached a “right level,” it might just need some tweaks based on incoming data. Traders should remember that the United States is struggling with inflation above 8% YoY in headline inflation, while the core Consumer Price Index (CPI) for September jumped by 6.6% YoY.

US bond yields fall on Fed pivot speculations, props the EUR

Consequently, US bonds rallied, a headwind for US Treasury yields, which dropped from around weekly highs, weighing on the US Dollar and underpinning the Euro. The US 10-year Treasury bond yield trimmed its earlier gains and stood at around 4.218% after reaching a YTD high of 4.338%, levels last seen in 2007.

Japanese authorities intervene in the FX markets

Meanwhile, in the middle of the North American session, the Bank of Japan (BoJ), and the Japanese Ministry of Finance (MoF) intervened in the FX market, selling US Dollars and propelling the yen, which increased volatility in the markets and undermined the greenback. The EURUSD pair dived toward its daily lows before rallying sharply toward the daily high at 0.9869.

In the next week, the macroeconomic calendar in Europe will feature France and German Flash Services PMI, the German IFO Business Climate, alongside the European Central Bank (ECB) Monetary Policy decision, with expectations of a 75 bps rate hike by the ECB. The US economic docket will feature Flash Manufacturing PMIs, the CB Consumer Confidence, the Gross Domestic Product (GDP) for Q3, and the Federal’s Reserve favorite gauge of inflation, the core PCE.

EURUSD Price Forecast

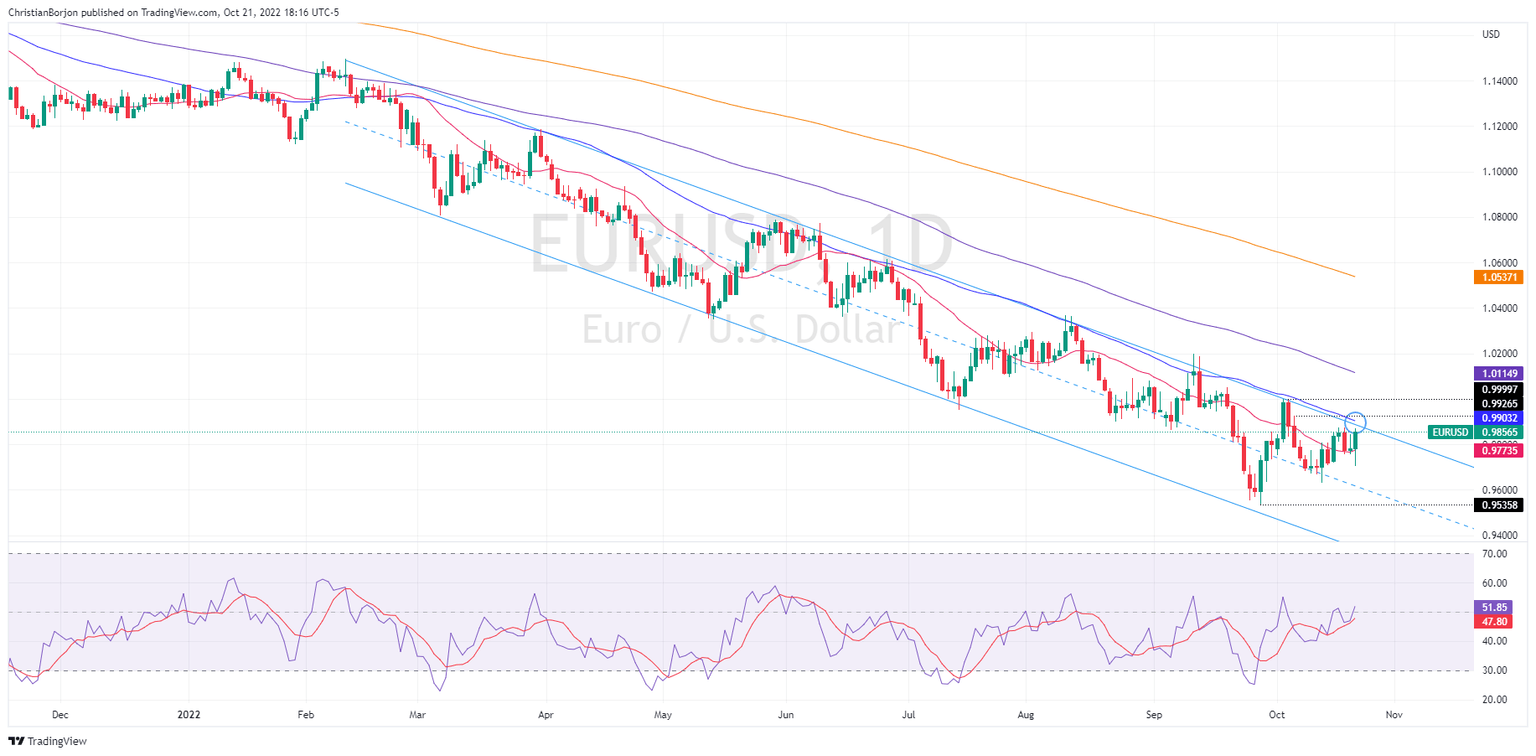

The EURUSD pair remains neutral-to-downward biased, despite reclaiming the 0.9800 figure and the 20-day Exponential Moving Average (EMA). Friday’s rally stalled due to low liquidity conditions, but also on the confluence of a top-trendline of a descending channel drawn in the daily chart and the 50-day EMA around 0.9903. The Relative Strength Index (RSI) turned bullish after crossing its midline, which would likely suggest an upside correction, but the EURUSD will need to clear 0.9903 to lay the ground for a parity retest.

On the flip side, if the EURUSD struggles at 0.9900, that will weigh on the Shared currency, sending the EURUSD diving toward the 20-day EMA at 0.9773, which, once cleared, could pave the way to October 13 daily low at 0.9631, and the YTD low at 0.9535.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.