Euro clings to daily gains above the 1.0900 yardstick

- Euro regains composure and advances past 1.0900 vs. the US Dollar.

- Stocks in Europe trade mostly with gains on Friday.

- EUR/USD manages to trespass the 1.0900 region to 4-day highs.

- US jobs report showed mixed readings during last month.

- ECB’s Christine Lagarde speaks later in the day.

The Euro (EUR) manages to regain some shine and advances to fresh multi-day highs north of 1.0900 the figure vs. the U.S. Dollar (USD) on Friday, allowing some breathing space in EUR/USD while keeping the optimism well in place in the second half of the week.

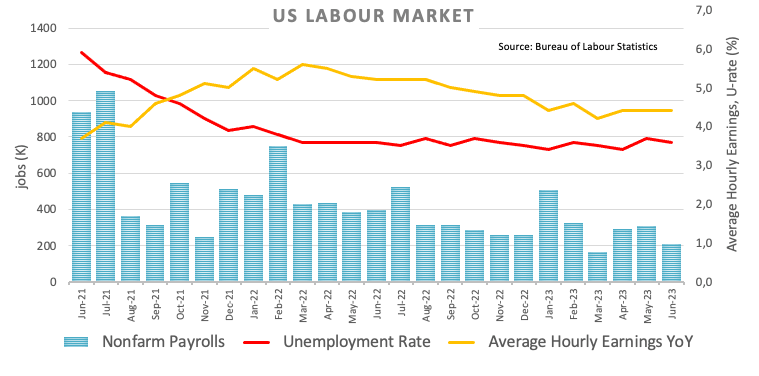

Instead, the USD Index (DXY) now slips back well south of the 103.00 support after mixed figures from the US Nonfarm Payrolls for the month of June. The corrective move in the US Dollar comes amidst the downtick in the short end of the curve vs. further gains in the belly and the long end of the curve, all against the backdrop of steady speculation of further tightening by the Fed as soon as at the July gathering.

Meanwhile, the debate continues around the potential future moves by the Federal Reserve and European Central Bank (ECB) to normalize monetary policy, as concerns grow about slowing growth on both sides of the Atlantic.

Recent strong U.S. economic data, reflecting a tight labor market and resilient economy, has reinforced expectations the Fed will likely hike rates by a quarter point at its July meeting.

Back at the ECB, Vicepresident Luis De Guindos said that their job was not yet done and mentioned that while underlying price pressures continued to be strong, most indicators had started to display some signs of softening. He noted that services had become an important driver of inflation and emphasized that the evolution of core inflation would be crucial for future ECB policy decisions. De Guindos also pointed out that it was uncertain what would happen to rates in September.

In the domestic data space, Industrial Production in Germany contracted 0.2% MoM in May, while Retail Sales in Italy expanded 0.7% also in May vs. the previous month.

Across the Atlantic, Nonfarm Payrolls showed the US economy added 209K jobs in June, while the Unemployment Rate eased to 3.6% in the same period. In addition, Average Hourly Earnings - a proxy for wage inflation - rose 0.4% MoM and 4.4% from a year earlier, and the Participation Rate held steady at 62.6%.

Daily digest market movers: Euro attempts to consolidate the breakout of 1.0900

- The EUR regains composure and breaks above the 1.0900 yardstick.

- Germany’s Industrial Production surprised to the downside.

- US jobs report came in a tad below expectations in June.

- Investors continue to price in a 25 bps hike by the Fed in July.

- ECB's De Guidos said the September meeting remains an open question.

- ECB’s Lagarde speaks later in the session.

Technical Analysis: Euro continues to target the June peak

While EUR/USD looks to extend the surpass of the 1.0900 hurdle, the loss of the weekly low at 1.0833 (July 6) could open the door to a test of the interim 100-day SMA at 1.0826. The breakdown of the latter should meet the next contention area not before the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

On the other hand, occasional bullish attempts should clear the 1.0900 region to expose a potential move to the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1180, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0618.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.