Euro whipsaws following US jobs data

- The EUR/USD jumps before pulling back to previous levels following the US NFP release.

- The US Dollar reacted lower after the data release to bounce up later on.

- The political turmoil in France might limit the Euro's upside attempts.

The EUR/USD pierced the top of the last three weeks’ trading range on Friday as the outcome of the US Nonfarm Pauyrrolls report triggered some risk appetite, although the immediate reaction was quickly reversed

US employment increased above expectations in November with wage inflation steady. The unemployment rate, however, has ticked higher, which keeps hopes of a December rate cut alive.

The political turmoil in France is likely to loom large for the common currency. A questioned Macron has taken the responsibility of replacing the Prime minister who will have to convince a strongly divided parliament to manage a ballooning public deficit. This is likely to keep Euro rallies limited.

Daily digest market movers: Euro crawls higher despite strong US data, France woes

- US Nonfarm employment increased by 227,000 in November. This reading beats the market consensus of a 200,000 increment adding to evidence that the US economy is outperforming its peers.

- Wage growth has remained steady at 4%, against market expectations of a decline to 3.9%. The jobless rate, on the other hand, has increased to 4.2% from 4.1% which contributed to maintaining hopes of a December cut intact.

- According to the CME Group’s Fed Watch Tool, futures markets are pricing more than 90% chances of a 25 bps cut after the December 18 meeting, up from less than 70% before the data release.

- Data from Thursday showed that US Weekly Jobless Claims increased by 224K, accelerating from the upwardly revised 215K seen a week earlier. This, together with the weaker-than-expected ADP report on Wednesday, has cast some doubts about the strength of Friday’s Payrolls report.

- Fed Chairman Jerome Powell stated earlier this week that the US economy is stronger than what central bank policymakers had expected when they started cutting rates. The Fed chief reiterated the cautious approach to monetary easing and said that interest rate cuts will be gradual.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

USD EUR GBP JPY CAD AUD NZD CHF USD 0.05% -0.05% 0.33% 0.10% 0.48% 0.66% -0.08% EUR -0.05% -0.10% 0.29% 0.05% 0.42% 0.61% -0.14% GBP 0.05% 0.10% 0.35% 0.15% 0.52% 0.70% -0.04% JPY -0.33% -0.29% -0.35% -0.22% 0.15% 0.32% -0.41% CAD -0.10% -0.05% -0.15% 0.22% 0.37% 0.56% -0.19% AUD -0.48% -0.42% -0.52% -0.15% -0.37% 0.18% -0.58% NZD -0.66% -0.61% -0.70% -0.32% -0.56% -0.18% -0.75% CHF 0.08% 0.14% 0.04% 0.41% 0.19% 0.58% 0.75% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote)

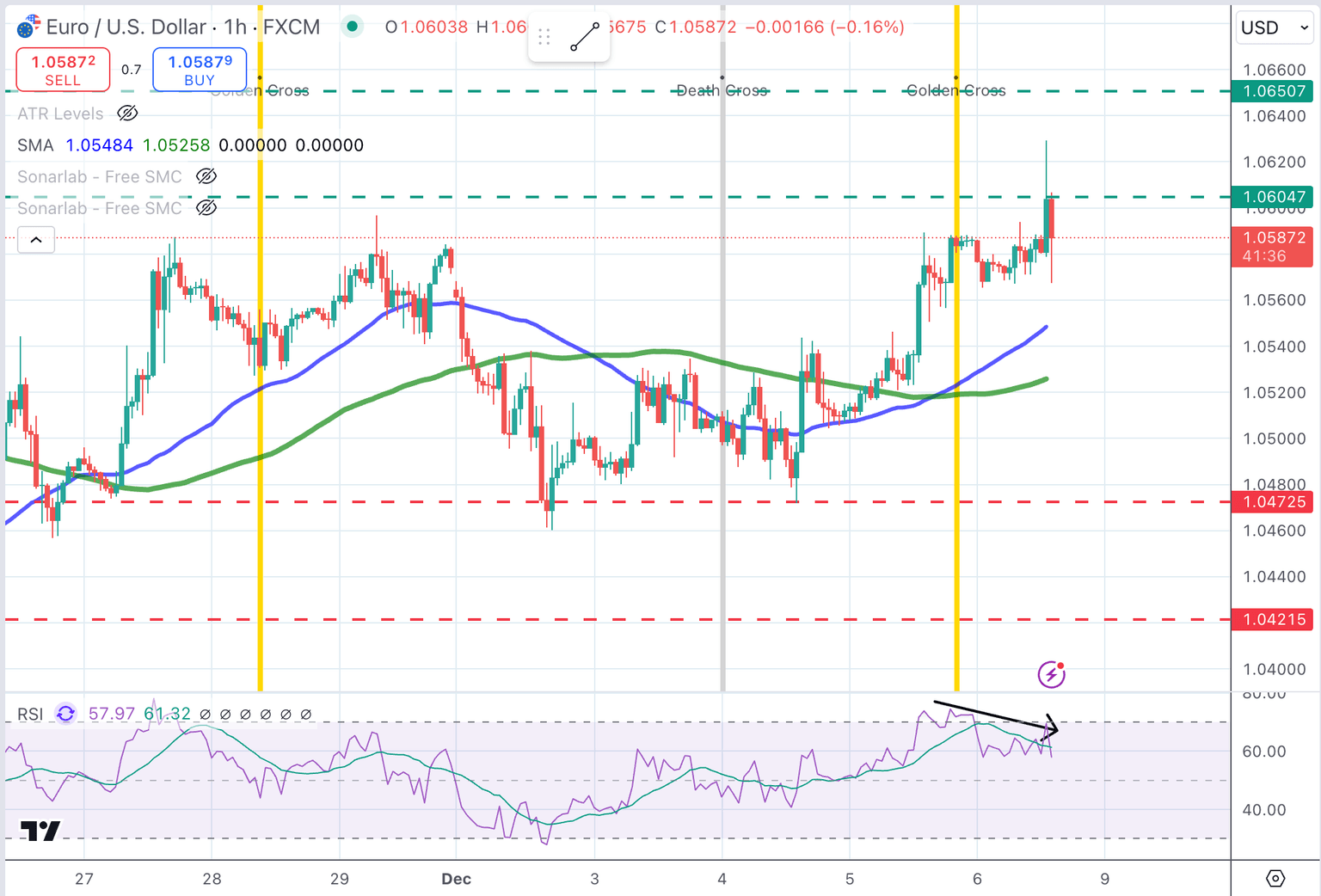

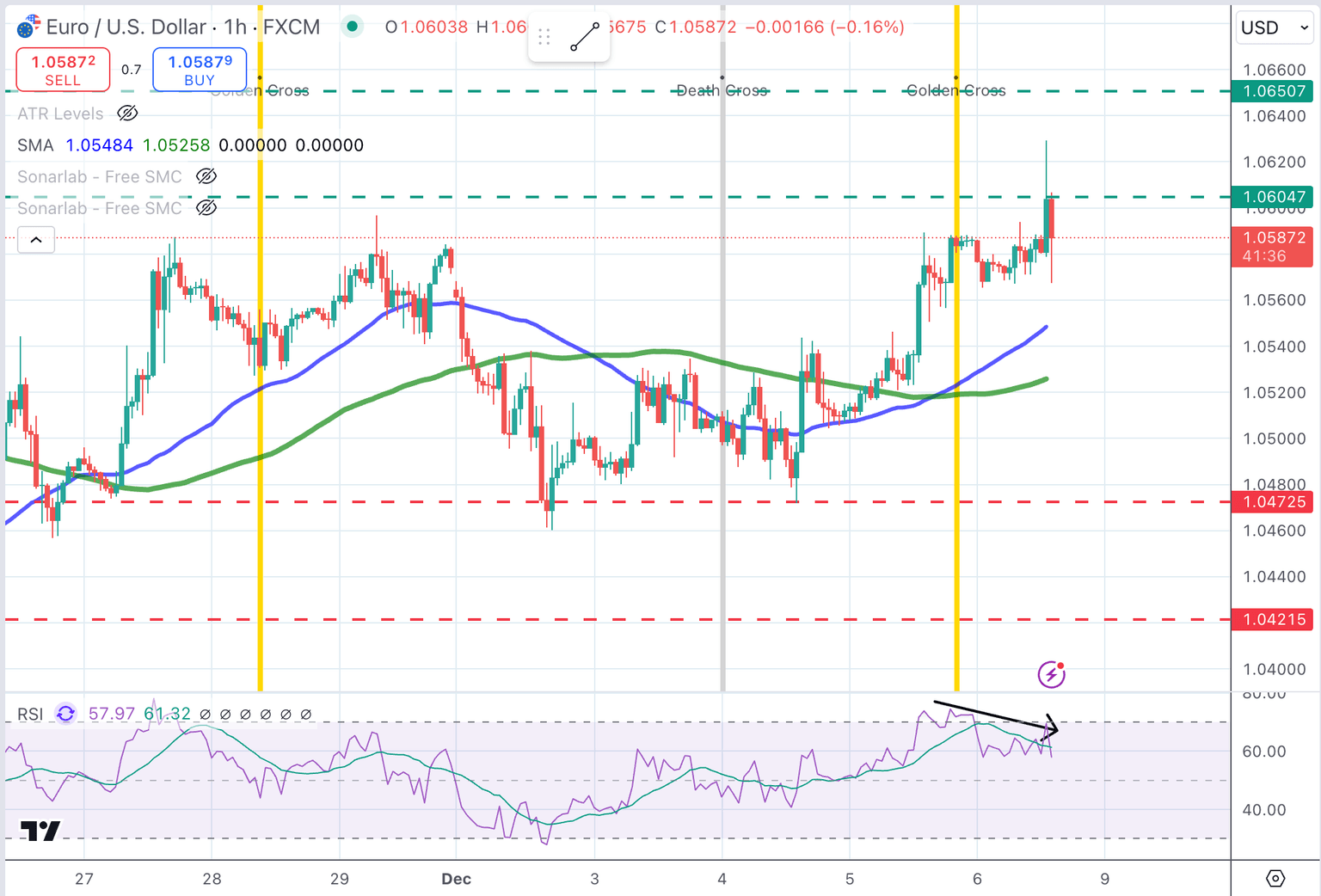

Technical analysis: EUR/USD faces resistance at 1.0600

The EUR/USD failed to find acceptance above the 1.0600 resistance area and has returned to the previous levels. The intraday bias is positive, although the hourly chart is showing some bearish divergence, suggesting that the upside attempt is lacking momentum.

Above 1.0600 the next target is the November 13 high at 1.0650. On the downside, supports are at the December 2 and 4 lows 1.0475 ahead of the November 26 low, at 1.0420.

EUR/USD 1-hour Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.