EUR/USD under pressure as yield climb weighs and Fed risk dominates

- EUR/USD slips 0.05% as stronger US Dollar and rising Treasury yields weigh ahead of Wednesday’s Fed decision.

- US inflation remains near 3% and consumer surveys show worsening sentiment, keeping traders cautious on outlook.

- ECB’s Schnabel signals comfort with rate-hike bets, while Germany’s industrial production and Sentix confidence improve.

EUR/USD slides 0.05% as the week begins, courtesy of broad US Dollar strength, amid choppy trading as traders brace for the Federal Reserve monetary policy decision. At the time of writing, the pair trades at 1.1637 after hitting a daily high of 1.1672.

Euro softens despite mixed US sentiment data, ECB hawks offer support

Traders seem to keep their powder dry as Fed Chair Jerome Powell and Co. most likely cut rates 25 basis points on Wednesday, a move already priced in by the financial markets. Meanwhile, US Treasury yields advance, as investors seem to price in a higher neutral fed funds rate, following last Friday’s data that revealed US inflation stalled but it remains closer to 3%.

The US economic docket featured the New York Fed Survey of Consumers expectations, with households turning pessimistic on current and future financial conditions.

Nevertheless, the Euro shrugged off those factors as European Central Bank (ECB) member Isabel Schnabel, said that she’s comfortable on bets that the next move is a hike. On the data front, Industrial Production in Germany improved in October, along with the Sentix Investor Confidence for December.

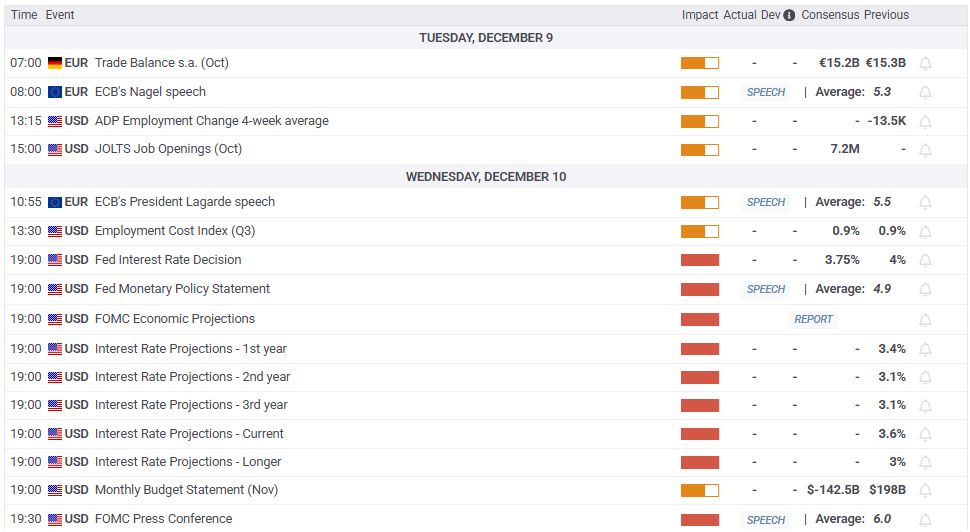

On Tuesday, the US economic docket will feature the ADP Employment Change 4-week average and the JOLTS Job Openings for October. In the Eurozone, traders would eye the German’s Trade Balance for December and ECB’s Joachim Nagel speech.

Daily market movers: Euro’s underpinned by Schnabel comments

- The NY Fed Survey of Consumer Expectations for November revealed that inflation is seen steady at all horizons while households turned pessimistic about their financial situations. Median inflation for one-year is at 3.2% steady above 3% at the three to five-year horizon.

- Consumers added that the financial situation has “deteriorated notably,” adding that “Perceptions of credit access compared to a year ago deteriorated.”

- German’s Industrial Production at 1.8% MoM up from 1.1% exceeding forecasts of a contraction of -0.4%. The Sentix Investor Confidence in December improved from -6.2 vs -7.4 in November.

- ECB’s Isabel Schnabel commented that she agrees with the swaps market and asked that if she is ready to succeed President Lagarde if she is asked to. Schnabel added that the Euro economy could grow above its potential despite the headwinds. Regarding inflation, it is in good place at 2%, yet volatile energy prices and base effects could exert upward pressure on headline inflation.

- ECB’s Rehm said that they must be aware of upside and downside inflation risks.

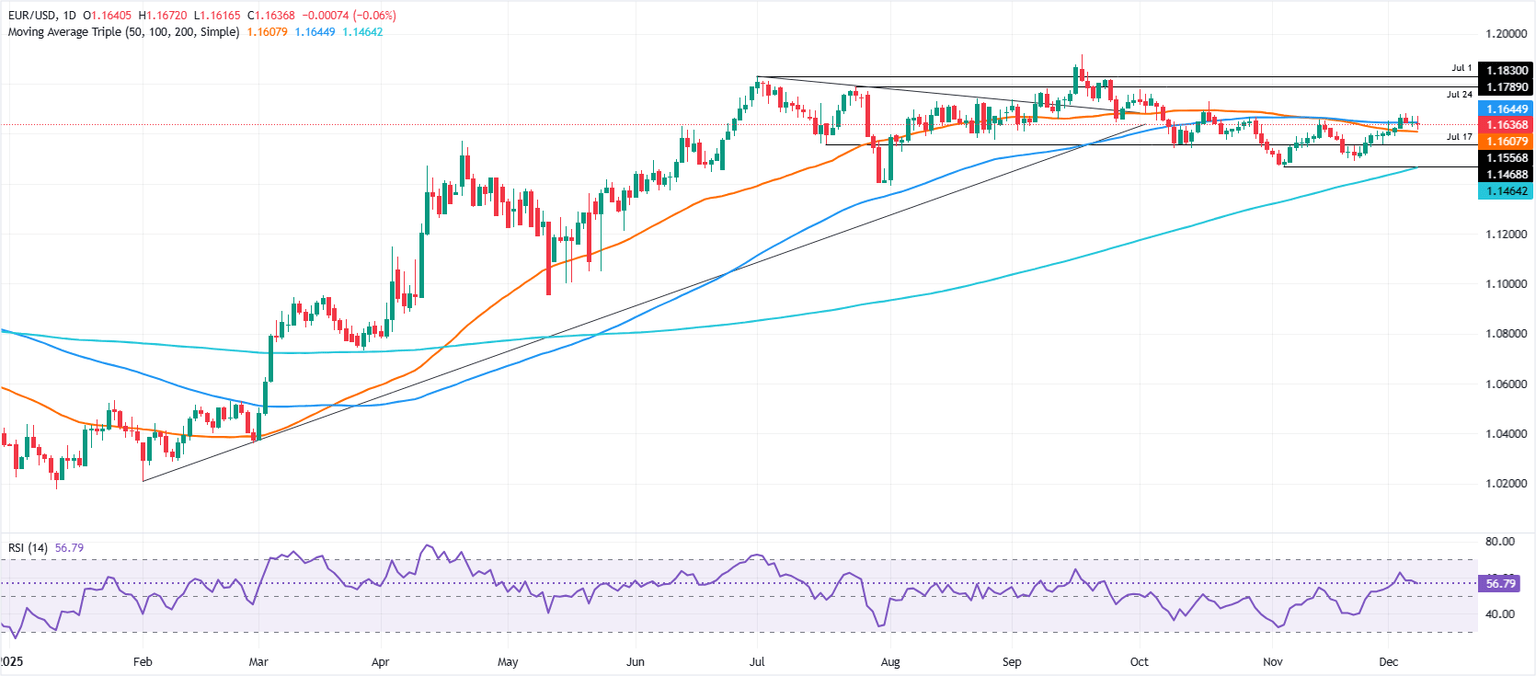

Technical analysis: EUR/USD dips below 1.1650, eyes on 1.1600

EUR/USD to holds belpw1.1650 for a fifth straight session, carving out a tight consolidation range between this level and 1.1600. Buyers’ inability to claim 1.1700 allowed bearish momentum to build, as suggested by the flattening Relative Strength Index (RSI), putting at risk a potential retest of 1.1800 and the year-to-date high at 1.1918.

The Euro’s first support below 1.1650 would be the 50-day Simple Moving Average (SMA) near 1.1605. A break beneath this region would then bring the 20-day SMA at 1.1596 into play, followed by the 1.1500 psychological level.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.