EUR/USD Technical Analysis: Upper bound of consolidation awaits near 1.1475

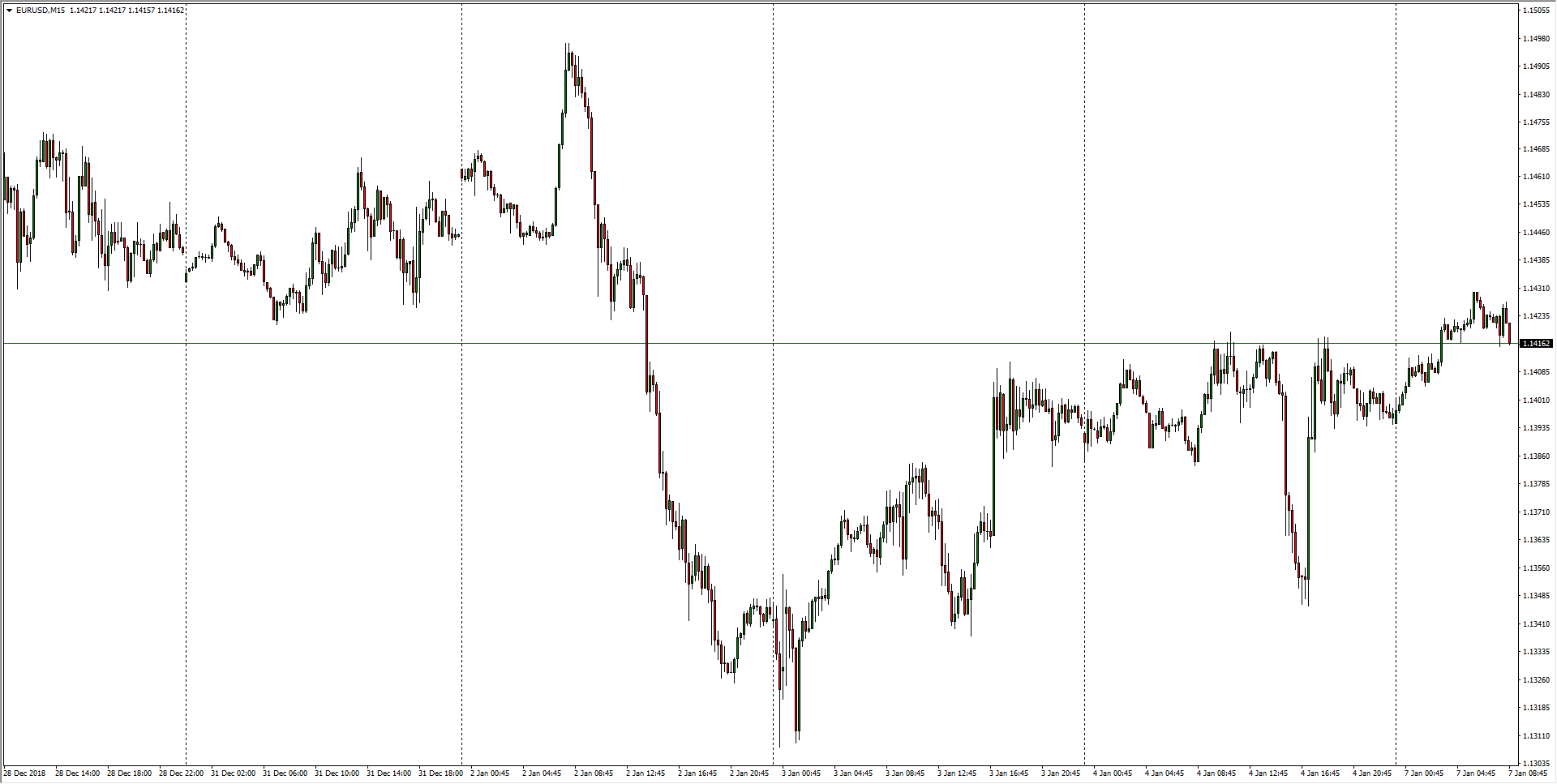

- Intraday action for EUR/USD heading into 2019 sees the pair lifting from near-term lows from 1.1300- 1.1350, testing back into a familiar resistance zone from 1.1425, though Euro bidders are adamantly

EUR/USD, 15-Minute

- Hourly candles show the Fiber's sideways spiral as the major pairing continues to struggle to separate itself from the 1.1400 major handle.

EUR/USD, 1-Hour

- EUR/USD looks set for one more pass at the upper bound of rough consolidation near 1.1475, and the pair's two-month-plus ranging period looks set to continue into the new year.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1424

Today Daily change: 21 pips

Today Daily change %: 0.184%

Today Daily Open: 1.1403

Trends:

Previous Daily SMA20: 1.1388

Previous Daily SMA50: 1.1372

Previous Daily SMA100: 1.148

Previous Daily SMA200: 1.1647

Levels:

Previous Daily High: 1.142

Previous Daily Low: 1.1345

Previous Weekly High: 1.1586

Previous Weekly Low: 1.1309

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Previous Daily Fibonacci 38.2%: 1.1391

Previous Daily Fibonacci 61.8%: 1.1374

Previous Daily Pivot Point S1: 1.1359

Previous Daily Pivot Point S2: 1.1315

Previous Daily Pivot Point S3: 1.1285

Previous Daily Pivot Point R1: 1.1433

Previous Daily Pivot Point R2: 1.1463

Previous Daily Pivot Point R3: 1.1507

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.