EUR/USD Technical Analysis: Remaining upright from the 1.1300 zone

- The Euro heads into Wednesday's market session towards the low end, and intraday barriers sit on either side of EUR/USD at yesterday's low of 1.1306, with intraday resistance sitting at the 38.2% Fibo retracement level of 1.1342.

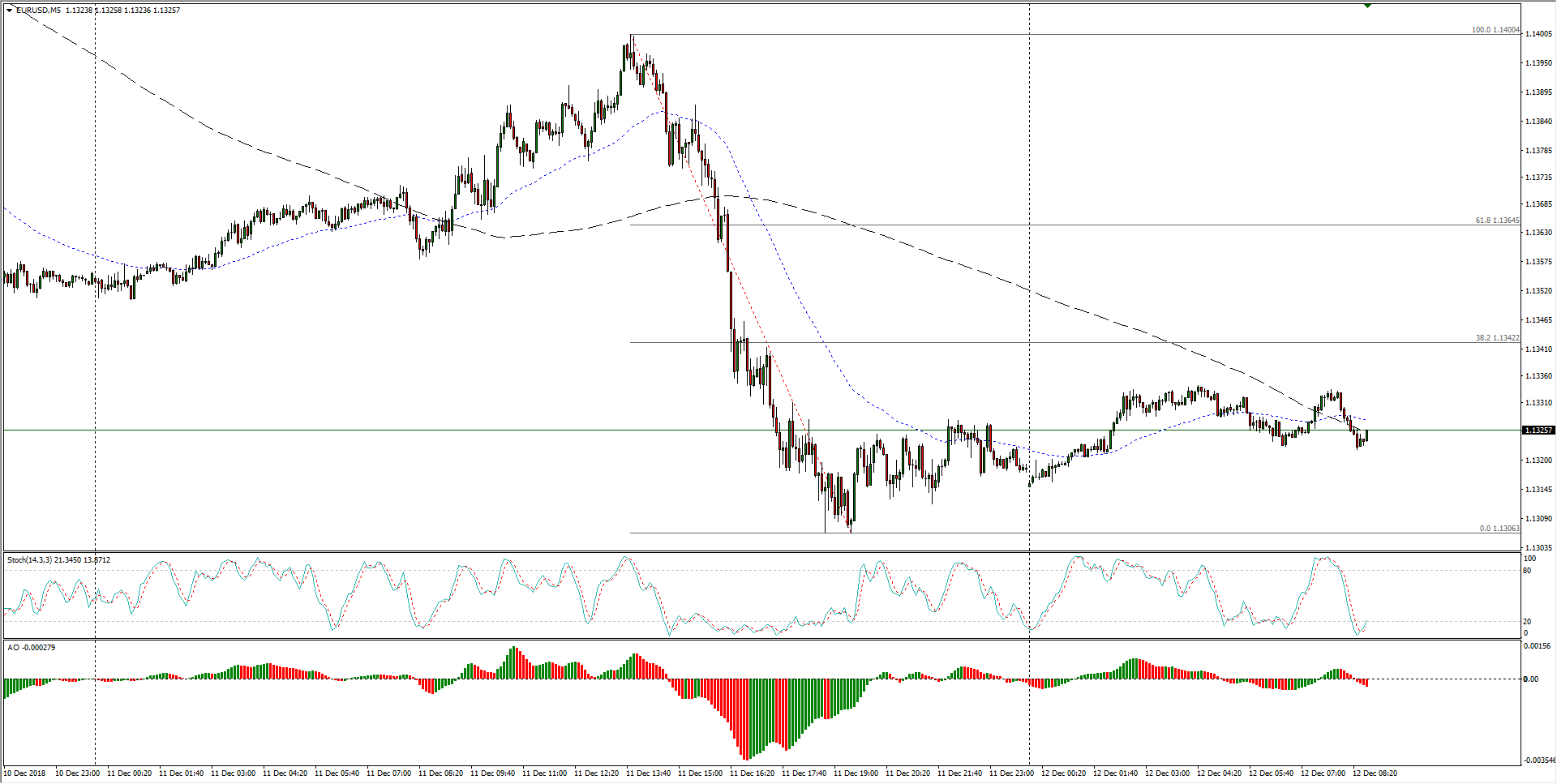

EUR/USD, 5-Minute

- The near-term sees the EUR/USD pair testing support at the 1.1300 major handle, and the pair routinely undergoes rapid rises and falls, largely owing to USD flows from the early US trading window.

EUR/USD, 30-Minute

- Looking further out, the EUR/USD pairing sees a constraining pattern forming on 4-hour candlesticks, and swing traders will be looking for a break-and-retest of either boundary before loading into further positions, and the Fiber is likely to remain middling heading into the Christmas season.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1323

Today Daily change: -5.0 pips

Today Daily change %: -0.0441%

Today Daily Open: 1.1328

Trends:

Previous Daily SMA20: 1.1361

Previous Daily SMA50: 1.1409

Previous Daily SMA100: 1.1508

Previous Daily SMA200: 1.1733

Levels:

Previous Daily High: 1.14

Previous Daily Low: 1.1306

Previous Weekly High: 1.1424

Previous Weekly Low: 1.1311

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1342

Previous Daily Fibonacci 61.8%: 1.1365

Previous Daily Pivot Point S1: 1.1289

Previous Daily Pivot Point S2: 1.1251

Previous Daily Pivot Point S3: 1.1195

Previous Daily Pivot Point R1: 1.1383

Previous Daily Pivot Point R2: 1.1439

Previous Daily Pivot Point R3: 1.1477

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.