EUR/USD Technical Analysis: Near-term rising support to face refreshed downside pressure from 1.1400

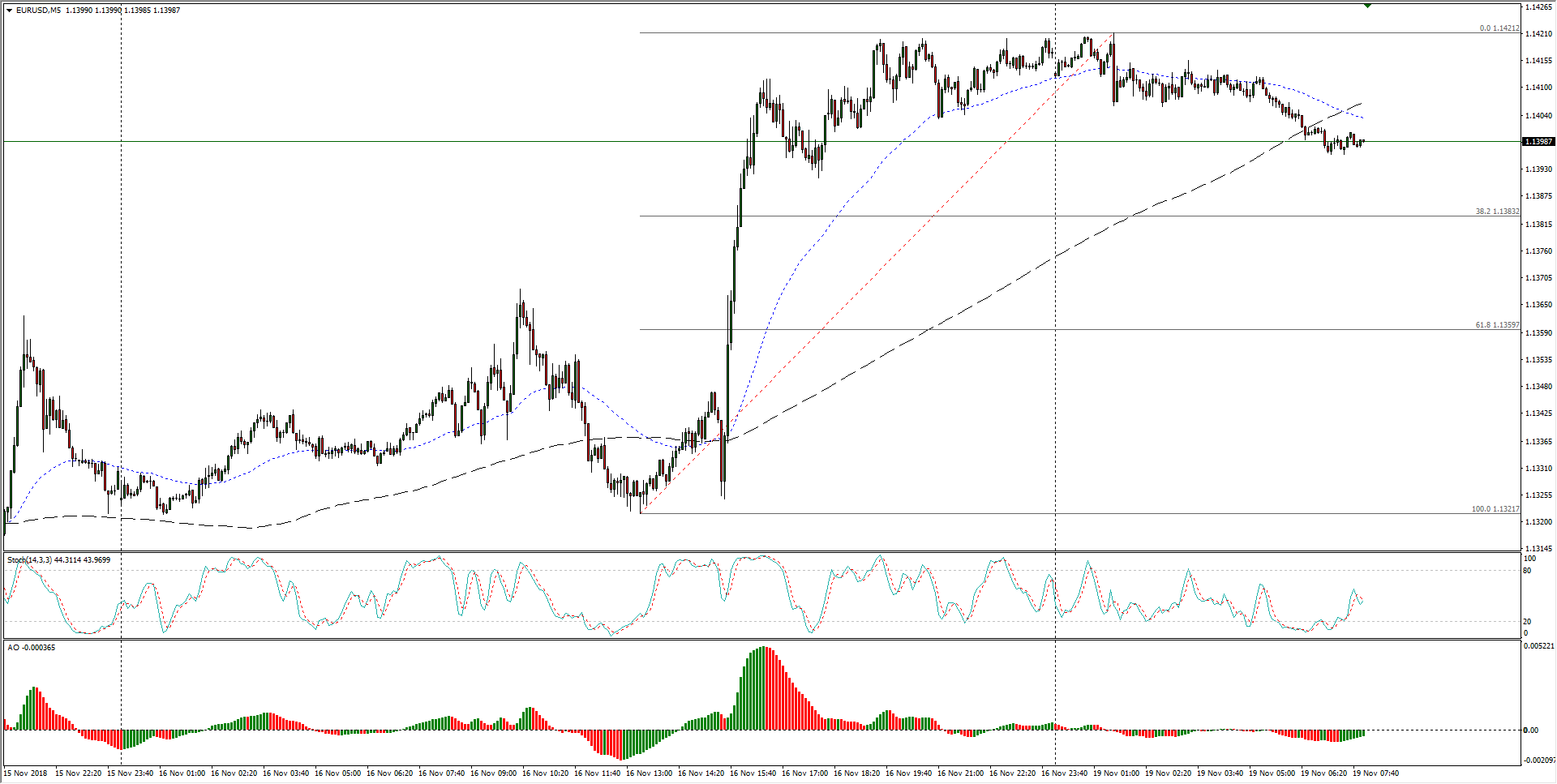

- EUR/USD trades towards the downside after Friday's spike above the 1.1400 handle, but the Fiber is struggling to maintain recent bullish gains and looks set to withdraw back to intraday support zones from the 38.2% Fibo retracement level.

- EUR/USD Forecast: Descending trend-channel caps additional gains ahead of a crucial week for Italian budget

EUR/USD Chart, 5-Minute

- The past two weeks have seen the EUR/USD drive higher in bullish recovery mode, boosted by a near-term rising trendline, but gains are likely capped at the last swing high that failed to capture the 1.1500 handle in early November.

EUR/USD Chart, 30-Minute

- The near-term rising trendline is also due to face stiff resistance from a medium-term declining trendline over the past two months, and the 200-period moving average currently perched at 1.1435, is acting as firm resistance ever since the Fiber declined below the critical indicator in late September.

EUR/USD Chart, 4-Hour

EUR/USD

Overview:

Last Price: 1.1398

Daily change: -18 pips

Daily change: -0.158%

Daily Open: 1.1416

Trends:

Daily SMA20: 1.1374

Daily SMA50: 1.1512

Daily SMA100: 1.1563

Daily SMA200: 1.1815

Levels:

Daily High: 1.142

Daily Low: 1.132

Weekly High: 1.142

Weekly Low: 1.1216

Monthly High: 1.1625

Monthly Low: 1.1302

Daily Fibonacci 38.2%: 1.1382

Daily Fibonacci 61.8%: 1.1358

Daily Pivot Point S1: 1.135

Daily Pivot Point S2: 1.1284

Daily Pivot Point S3: 1.1249

Daily Pivot Point R1: 1.1451

Daily Pivot Point R2: 1.1486

Daily Pivot Point R3: 1.1552

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.