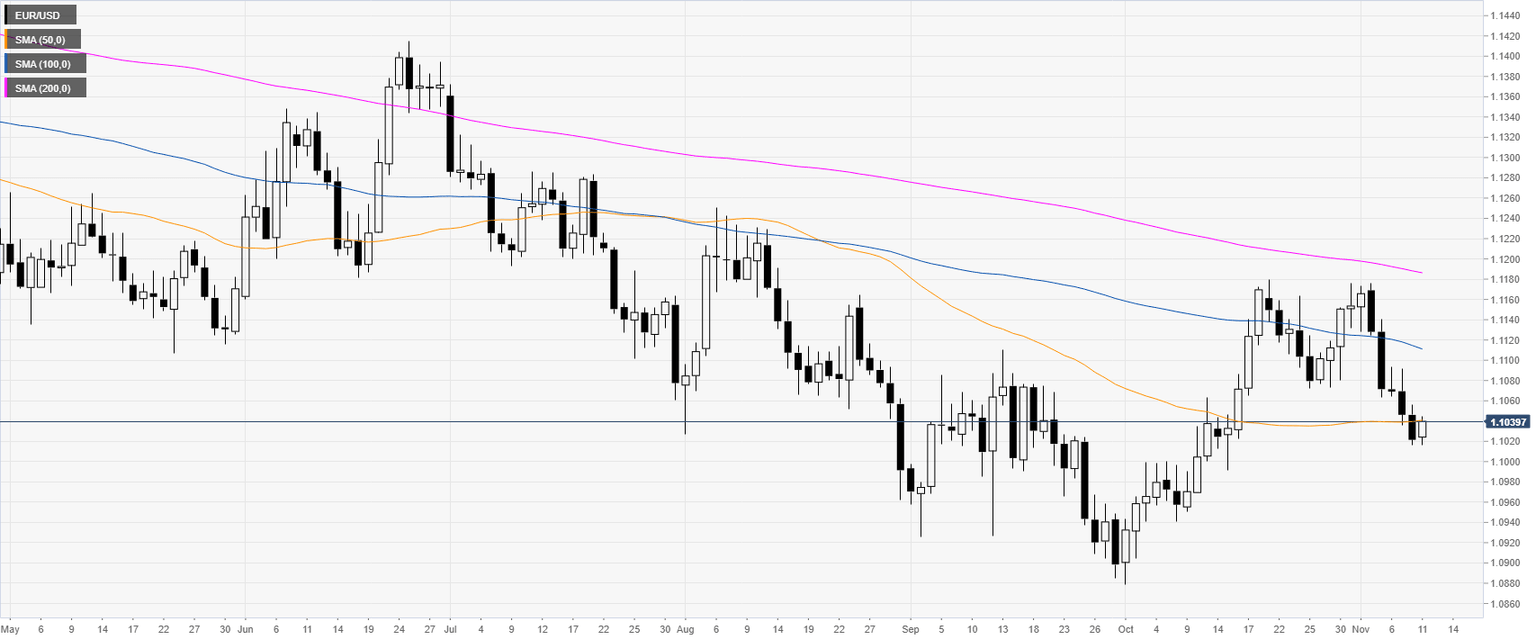

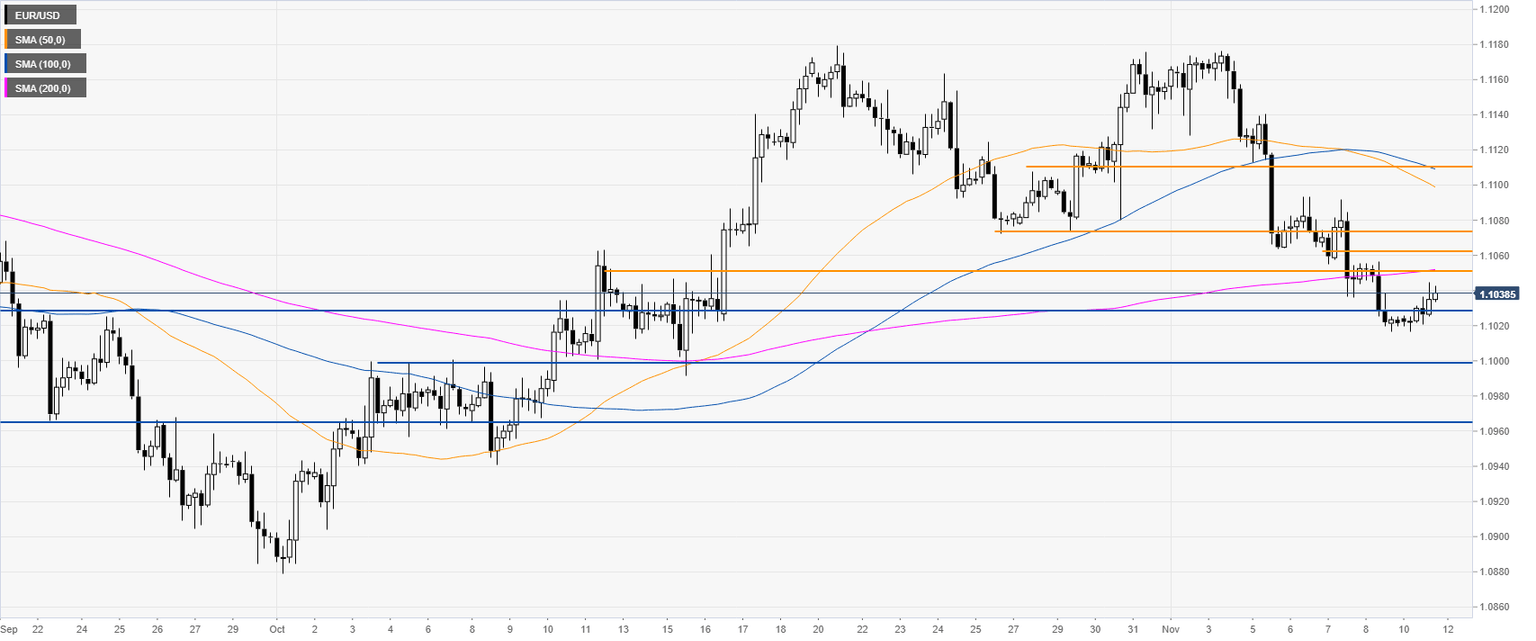

EUR/USD technical analysis: Euro off last week’s low, trading near 1.1040 level

- EUR/USD is starting the week quietly retracing up slightly after last week’s decline.

- The level to beat for bears is the 1.1028 support level.

- Bank holidays in the US and Canada is keeping volatility low.

EUR/USD daily chart

EUR/USD four-hour chart

EUR/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst