EUR/USD Technical Analysis: Early Monday bullish action could face near-term challenges

- EUR/USD faces early risk-on action following Monday market open, but the upside remains limited as the pair remains far off of Friday's peaks.

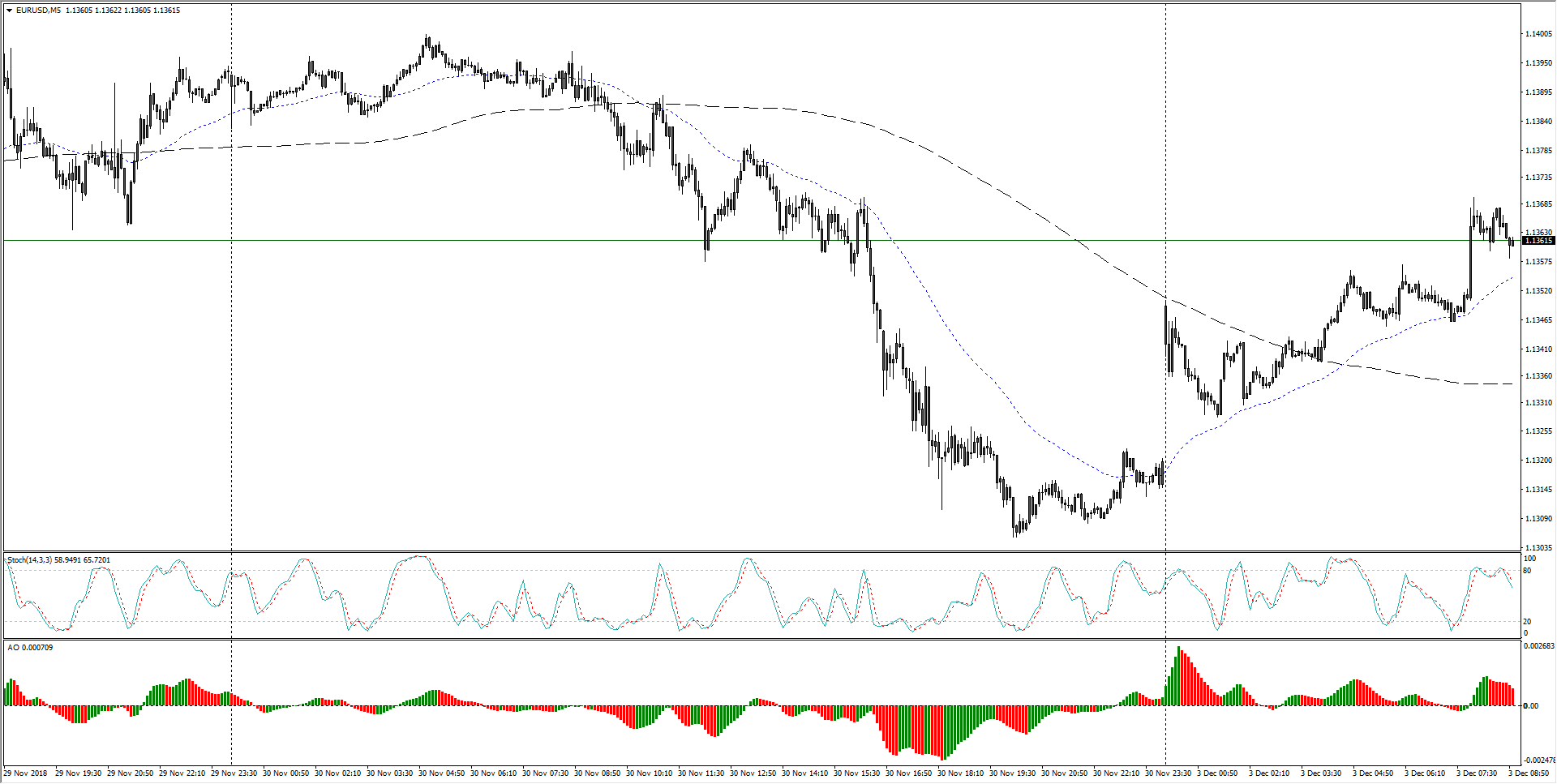

EUR/USD, 5-Minute

- Although the pair looks set to continue the current push off of a higher low, technical indicators are set for a return to the mean, and the EUR continues to struggle at major levels.

EUR/USD, 30-Minute

- On 4-Hour candles, EUR/USD continues to face rejection from the 200-period moving average currently sitting at 1.1390, and near-term swing lows are coiling the pair into a breaking pattern, but the overall trend remains biased towards the downside.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1364

Today Daily change: 42 pips

Today Daily change %: 0.371%

Today Daily Open: 1.1322

Trends:

Previous Daily SMA20: 1.136

Previous Daily SMA50: 1.1451

Previous Daily SMA100: 1.153

Previous Daily SMA200: 1.1765

Levels:

Previous Daily High: 1.1402

Previous Daily Low: 1.1305

Previous Weekly High: 1.1402

Previous Weekly Low: 1.1267

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1342

Previous Daily Fibonacci 61.8%: 1.1365

Previous Daily Pivot Point S1: 1.1284

Previous Daily Pivot Point S2: 1.1247

Previous Daily Pivot Point S3: 1.1188

Previous Daily Pivot Point R1: 1.138

Previous Daily Pivot Point R2: 1.1439

Previous Daily Pivot Point R3: 1.1477

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.