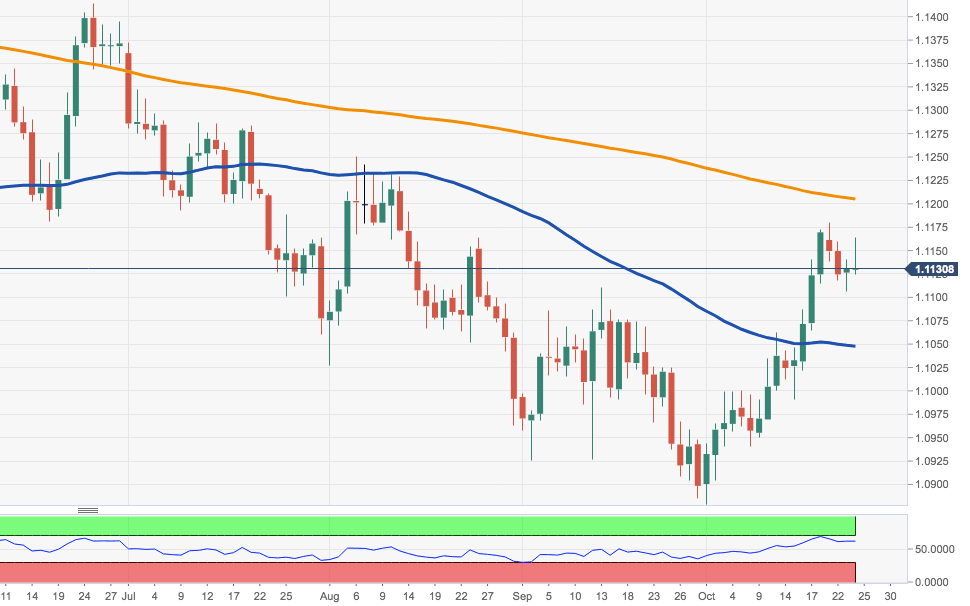

EUR/USD Technical Analysis: A test of the 55-day SMA around 1.1050 stays on the table

- EUR/USD has managed to rebound from recent lows near 1.1100 the figure and advanced to the 1.1160/65 band earlier today, where it lost some vigour.

- The expected dovish tone from the ECB event later today carries the potential to spark another challenge of the 1.1100 neighbourhood.

- If the selling impetus gathers further traction, then the critical 55-day SMA in the mid-1.10s would become the next target of relevance.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.