EUR/USD finds temporary support, downside bias stays afloat

- EUR/USD rebounds to near 1.0550 while investors look for fresh cues for Fed-ECB likely interest rate action in December.

- Fed’s Powell emphasized that there is no need to rush for rate cuts.

- Fears of a US-Eurozone trade war have escalated among investors.

EUR/USD bounces back from the psychological support of 1.0500 at the start of the week. The major currency pair rebounds as the US Dollar’s (USD) rally stalls after posting a fresh annual high. The US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, looks for fresh triggers to extend its upside above the key resistance of 107.00.

According to analysts at Capital Economics, "While a period of consolidation looks likely in the near term, we have revised up our forecasts for the US Dollar and now project a further 5% appreciation by the end of 2025." Economists added, "That is based primarily on a view that President-elected Donald Trump will push ahead with the core tariff policies he proposed on the campaign trail and that the United States (US) economy will continue to outperform its major peers."

Investors are looking for fresh cues to know how Trump’s policies will guide the monetary policy action for the December meeting and 2025. Meanwhile, Federal Reserve (Fed) officials refrain from projecting the likely consequences of Trump’s policies on the economy and the interest rate policy. In the event at Federal Bank of Dallas on Thursday, Fed Chair Jerome Powell said, "I think it's too early to reach judgments here." Powell added, "We don't really know what policies will be put in place."

On the interest rate outlook, Jerome Powell said that the economy is not sending any signals that might force us to ramp up rate cuts, however, he reiterated that inflation is on a sustainable path towards the bank’s target of 2% that allows them to head towards the neutral rate.

This week, investors will focus on the preliminary S&P Global Purchasing Managers Index (PMI) data for November, which will be published on Friday. The PMI data will show the current status of private business activity and the impact of Trump’s victory on business optimism.

Daily digest market movers: EUR/USD gauges interim support despite downbeat Eurozone's economic outlook

- EUR/USD recovers ahead of European Central Bank (ECB) President Christine Lagarde’s speech at an event in Paris scheduled at 18:30 GMT. Investors would like to know how much Trump’s protectionist policies will impact the Eurozone economy. Also, market participants would look for cues about the likely interest rate cut size in the December meeting.

- Fears of a trade war between the Eurozone and the United States have deepened after the commentary of Stephen Moore, a senior economist advisor to Donald Trump, who said at BBC radio over the weekend that the US would be less interested in a free trade deal with Britain if the government put its economic relations with the European Union (EU) ahead of those with the US, Reuters reported.

- ECB Vice President Luis de Guindos said on Monday, "The balance of risks has shifted from concerns about high inflation to fears over economic growth." The spark of a trade war between the Eurozone and the US arose when Trump mentioned, in his election campaign, that the euro bloc would "pay a big price" for not buying enough American exports.

- According to analysts at ING, the ECB is expected to cut interest rates again in December, but a 50 basis points (bps) cut is far from certain.

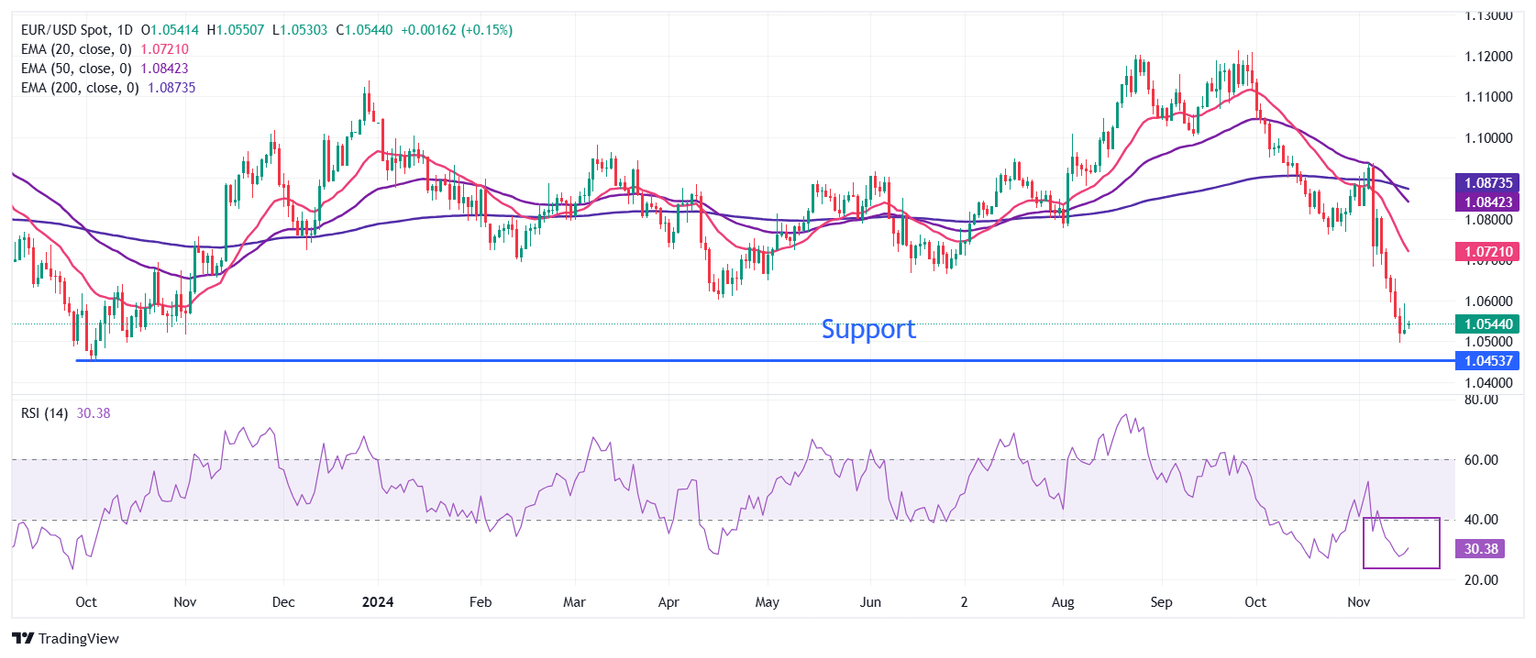

Technical Analysis: EUR/USD strives to gain ground near 1.0500

EUR/USD wobbles above the immediate support of 1.0500 in North American trading hours on Monday. The outlook of the major currency pair remains bearish as all short- to long-term Exponential Moving Averages (EMAs) are declining.

The 14-day Relative Strength Index (RSI) oscillates in the bearish range of 20.00-40.00, adding to evidence of more weakness in the near term.

Looking down, the pair is expected to find a cushion near the October 2023 low at around 1.0450. On the flip side, the round-level resistance of 1.0600 will be the key barrier for the Euro bulls.

(This story was corrected on November 18 at 08:08 GMT to say that US S&P Global PMI data for November will be published on Friday, not Thursday.)

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.