EUR/USD steadies as shutdown fears weigh on Dollar

- Dollar pressured as Senate fails to secure votes to avert looming October 1 government shutdown.

- US job openings steady, while confidence survey highlights growing household pessimism on labor and business outlook.

- Fed officials split on policy path, balancing downside risks to jobs against persistent inflationary pressures.

EUR/USD holds firm on Tuesday during the North American session, although the Dollar weakens due to fears of a possible government shutdown that could disrupt the release of crucial jobs data for Fed officials. At the time of writing, the pair trades at 1.1735 up a modest 0.05%.

Pair holds above 1.1730 despite mixed US data and cautious Fed rhetoric

The financial markets narrative remains focused on the US government being able to doge a shutdown that will begin in October 1. Recently, a US Democratic bill to avoid the shutdown, failed to garner sufficient votes to pass in Senate as the voting continues.

Data-wise, job openings in the US, ticked up but revealed the “no hiring, no firing” environment, highlighted by Fed officials. At the same time, the Conference Board latest Consumer Confidence poll revealed that households turned pessimistic on business and labor market conditions.

Additionally, to this, Federal Reserve officials are grabbing the headlines. Chicago Fed Austan Goolsbee said that tariffs are halting business decisions regarding prices or hiring personnel. Boston Fed Susan Collins said that further cuts may be appropriate, but officials need to be wary about inflation.

The Fed Vice Chair Philip Jeffersons revealed that “I see the risks to employment as tilted to the downside and risks to inflation to the upside.”

Across the pond, German Retail Sales data for August, improved but disappointed investors falling below the mark monthly; while on a yearly basis, showed that consumer spending is slowing.

Daily market movers: EUR/USD consolidates amid mixed US economic data

- Job openings in the US showed the labor market is slowing, yet vacancies rose from 7.21 million to 7.23 million in August. Digging into the data, the hiring rate edged down to 3.2%, the lowest level since June 2024, while layoffs remained at a low level.

- The Conference Board (CB) Consumer Confidence in September missed estimates of 96.0, dipped from 97.6 in August to 94.2 this month. “Consumer confidence weakened in September, declining to the lowest level since April 2025,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.

- The US Bureau of Labor Statistics (BLS) revealed on Monday that a shutdown would delay the announcement of jobs data.

- Fed funds rate futures point to an 95% probability of a 25-basis-point cut in October, with just an 5% chance for keeping rates unchanged, according to Prime Market Terminal’s rate probability tool.

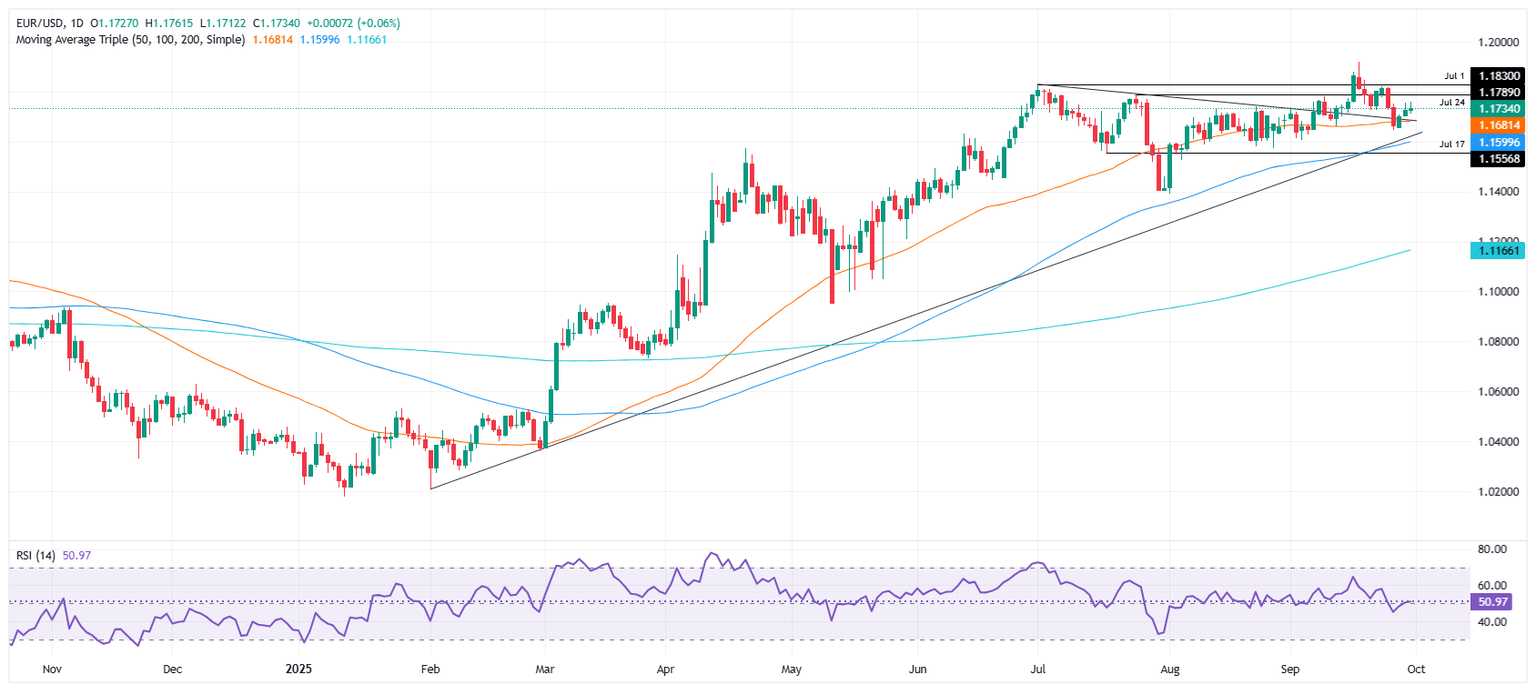

Technical outlook: EUR/USD steadies at around 1.1730 awaiting a fresh catalyst

EUR/USD holds steady above the 1.1700 figure during the last three trading days, yet it has failed to edge above the 1.1750 mark, which could open the door for further gains. The Relative Strength Index (RSI) shows signs of being flattish near the 50 neutral level.

That said, If EUR/USD clears 1.1740, the next resistance would be 1.1800 ahead of the yearly high of 1.1918. Conversely, a drop below 1.1700 will expose 1.1650, before challenging the 100-day SMA At 1.1605.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.